- Bitcoin investments have been value $1.97 billion whereas ETH accounted for $69 million.

- Brief-term holders are unconvinced a few Bitcoin’s worth improve.

$2 billion! That was the worth of the overall investments put into crypto merchandise final week, CoinShares revealed. In accordance with the report, Bitcoin [BTC] investments have been value about $1.97 billion.

Ethereum [ETH] additionally added to the capital, with a $69 million enter. This was the very best influx the altcoin had registered because the peak in March.

BTC is just not totally again

For these unfamiliar, CoinShares releases the report each week. The publication goals to cowl funding referencing digital property together with cryptocurrencies.

In the course of the earlier week, Bitcoin, in addition to ETH, was within the highlight. With the dominance once more, it appeared that buyers have been assured within the brief and long run potential of the coin.

Supply: CoinShares

Nonetheless, James Butterfill, CoinShares’ Head of Analysis, revealed a number of causes for the give attention to Bitcoin. In accordance with Butterfill, the optimistic macro knowledge introduced final week performed a major half. He wrote that,

“We believe this turn around in sentiment is a direct response to weaker than expected macro data in the US, bringing forward monetary policy rate cut expectations. Positive price action saw total assets under management (AuM) rise above the US$100bn mark for the first time since March this year.”

Regardless of the advance, BTC traded sideways for many of the final seven days. At press time, Bitcoin’s worth was $69,373.

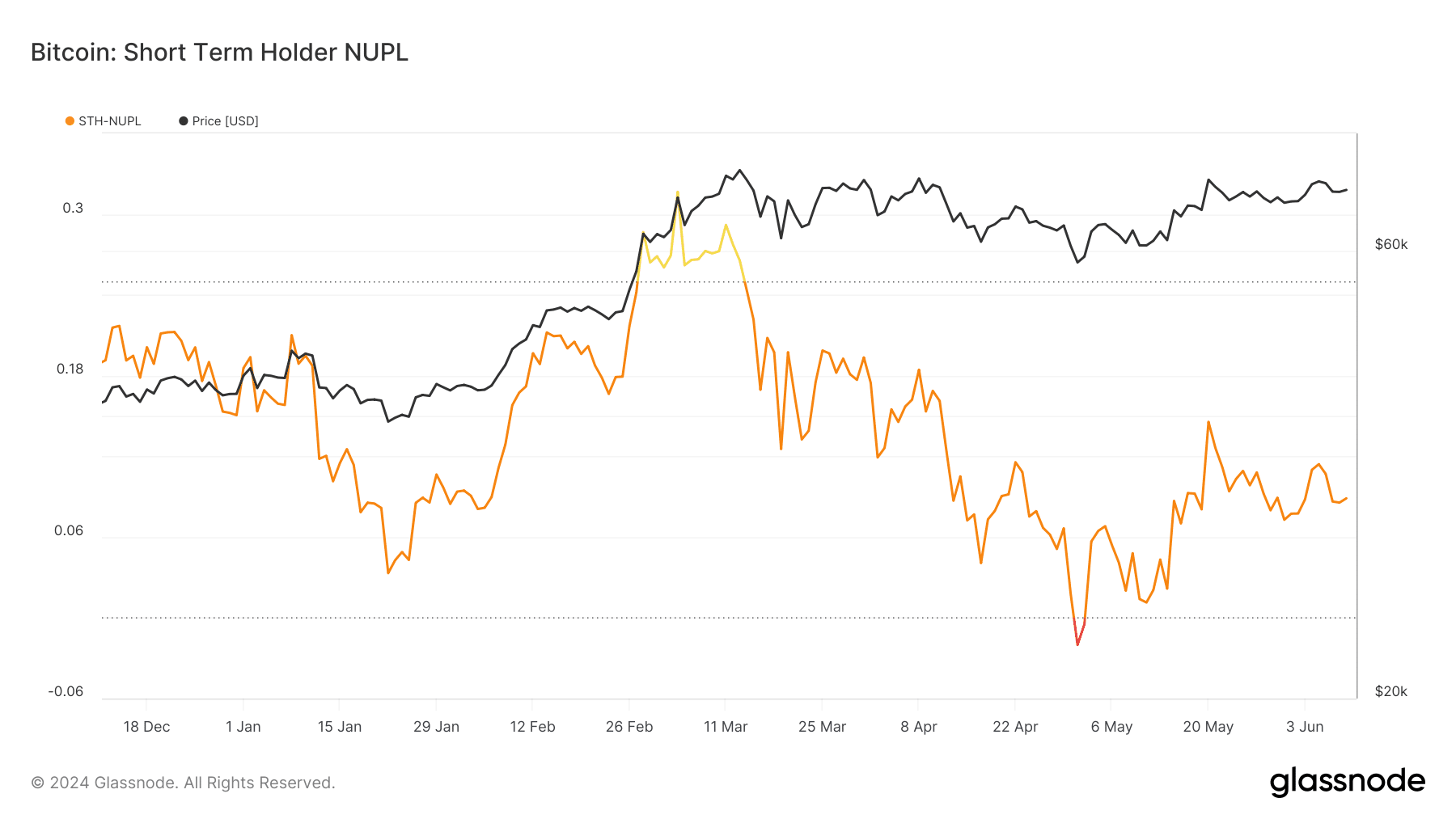

AMBCrypto seemed on the STH-NUPL to evaluate the habits of short-term buyers. STH-NUPL stands for Brief Time period Holder- Web Unrealized Revenue/Loss.

Value could proceed to maneuver sideways

This metric considers the sentiment BTC holders who’ve held the coin for lower than 155 days have. At press time, the studying of the metric was 0.085, and within the hope (orange) zone.

This situation meant that the majority short-term holders weren’t assured that Bitcoin’s worth would improve within the brief time period. Subsequently, demand for the coin won’t be intense, suggesting that the worth would possibly proceed to maneuver sideways.

Supply: Glassnode

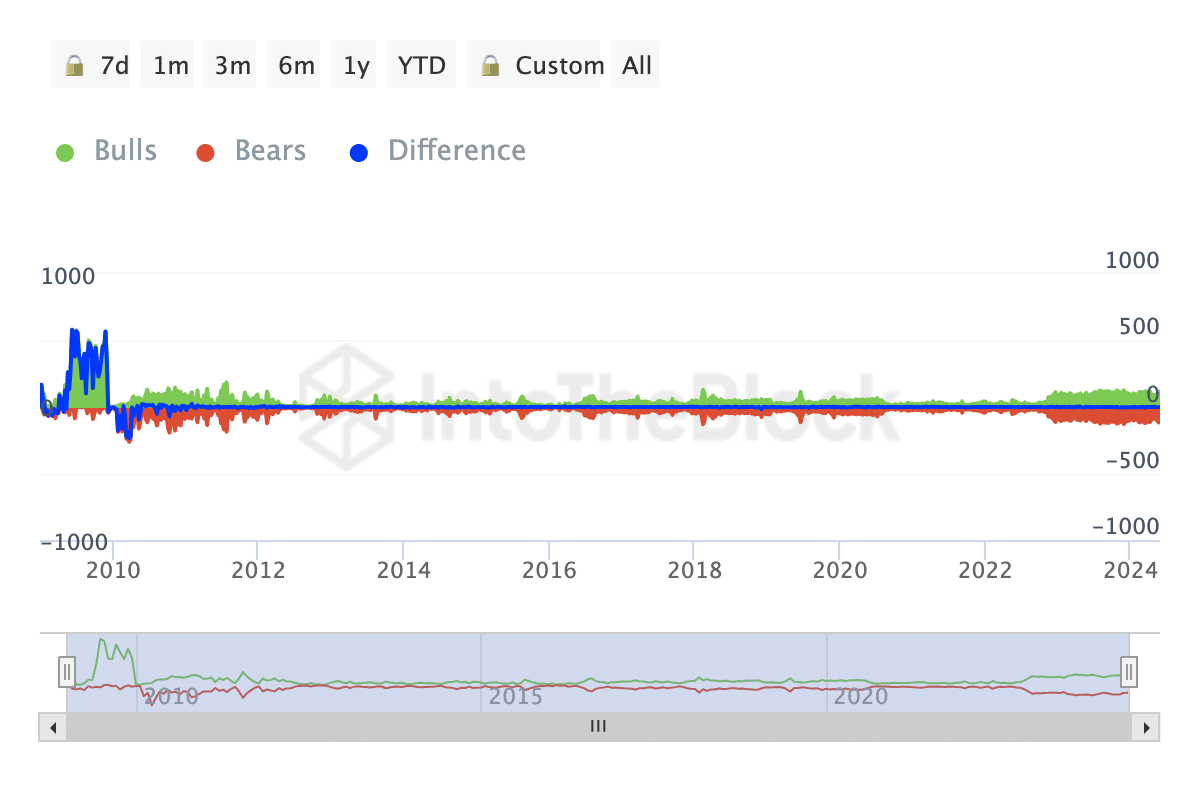

When it comes to the worth, AMBCrypto analyzed the Bulls and Bears indicator offered by IntoTheBlock. This metric tracks the exercise of addresses that purchased or bought 1% of the buying and selling quantity within the final 24 hours.

If the studying is in favor of bulls, it signifies that many of the quantity have been purchase orders. Then again, a bearish dominance signifies a rise in promoting stress.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

For Bitcoin, the Bulls and Bears indicator was zero as of this writing. Subsequently, this neutrality might trigger BTC to maintain buying and selling in a good vary within the meantime.

Supply: IntoTheBlock

By the look of factor, a bearish market situation might ship BTC to $68,000. Nonetheless, if issues get higher available in the market, the coin might soar to $71,000 once more.