- Curiosity in Bitcoin ETFs grew considerably as inflows surged.

- Worth motion remained impartial, holders stayed worthwhile.

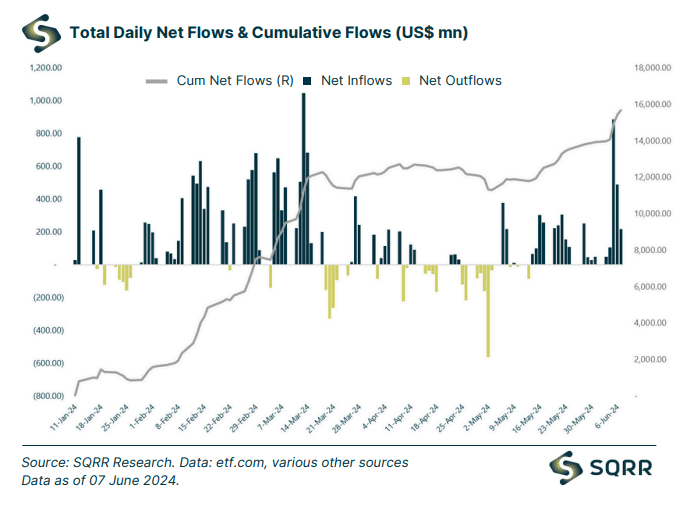

Bitcoin [BTC] ETF volumes grew materially over the previous month, indicating rising curiosity in BTC from the standard monetary sector.

Will Bitcoin rise?

Bitcoin ETFs surged in June, marking a record-breaking begin to the month.

This robust efficiency was evident throughout a number of key metrics, together with fund flows, asset underneath administration (AUM), buying and selling volumes, and particular person fund AUM reaching new highs.

Supply: SQRR

Fueled by investor enthusiasm, all Bitcoin ETFs witnessed a internet influx of roughly $1.75 billion through the week.

IBIT and FBTC had been the foremost drivers, collectively bringing in a staggering $1.63 billion in internet inflows. Notably, GBTC was the one fund to expertise internet outflows for the week, at -$0.12 billion.

It’s essential to keep in mind that this comes amidst a record-breaking 18 consecutive days of general internet inflows for all funds, reaching a complete of $15.66 billion.

Supply: SQRR

The overall belongings underneath administration (AUM) for Bitcoin ETFs additionally surpassed a major milestone, reaching $62.33 billion by the week’s finish, a transparent indication of rising investor confidence on this asset class.

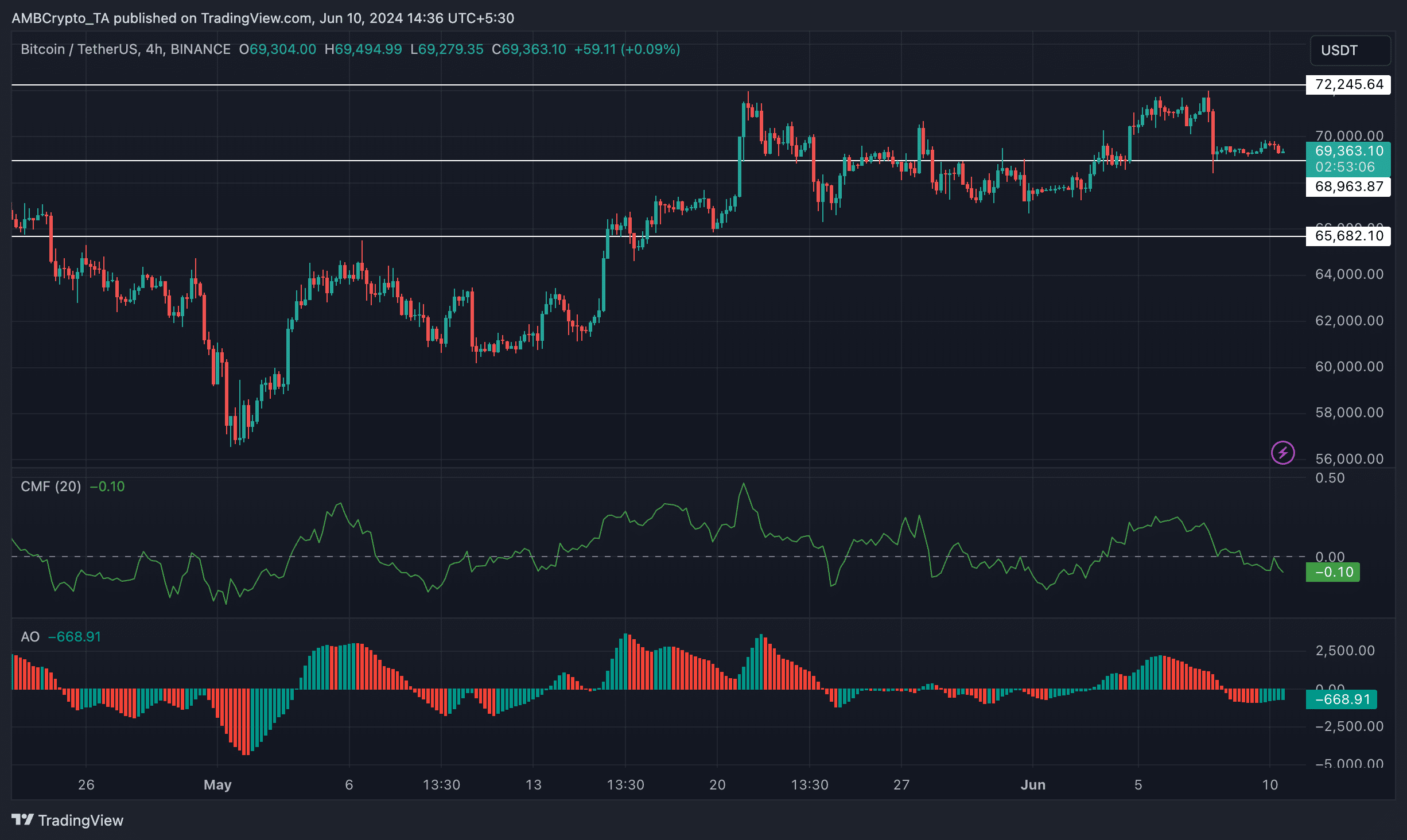

Regardless of the surge in worth, BTC hasn’t been capable of push previous the $70,000 mark over the previous few days. On the time of writing BTC was buying and selling at $69,388.69 within the final 24 hours, it had seen a minimal surge of 0.06%.

Because the twenty first of Could, after testing the $72,245.64 mark, Bitcoin had been transferring sideways. Although the value motion of BTC was largely impartial, the CMF (Chaikin Cash Circulation) for the king coin declined.

This meant that the cash flowing into BTC had lowered.

Furthermore, the Superior Oscillator(AO) had turned unfavorable. This indicator measures momentum by evaluating latest worth actions to historic knowledge.

A decline suggests the latest BTC worth will increase may be dropping power, probably indicating a shift in the direction of a bearish sentiment with extra sellers or much less shopping for stress.

Supply: Buying and selling View

What ought to holders do?

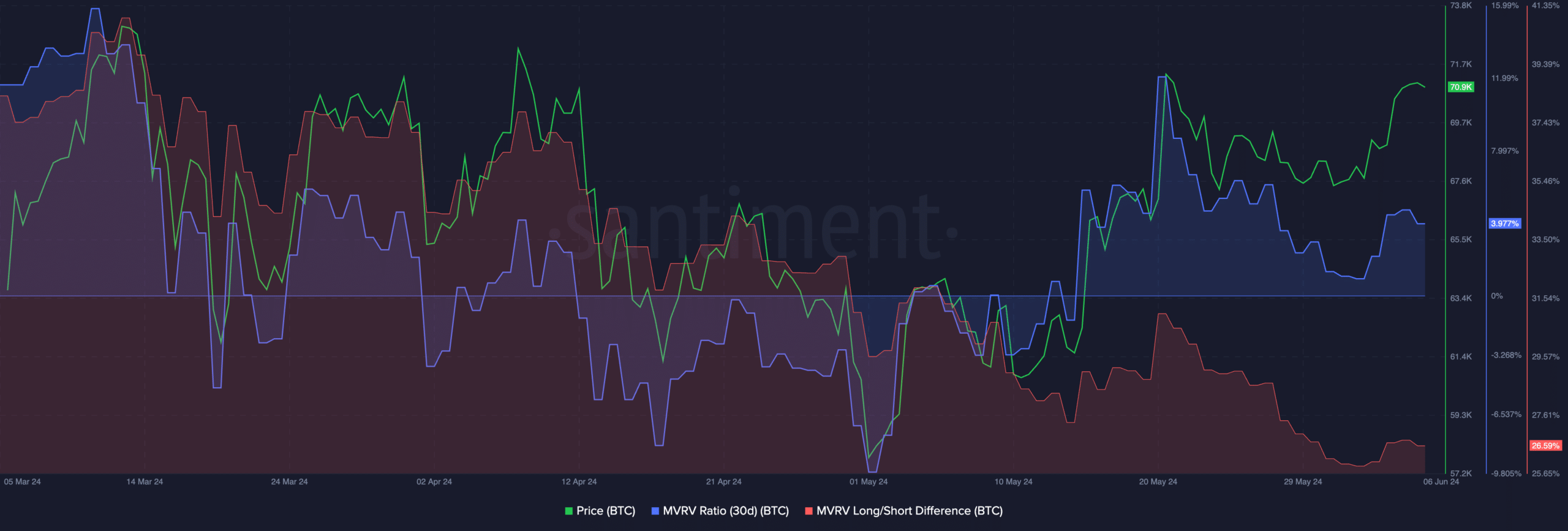

Most BTC holders remained worthwhile on the time of writing. This was indicated by the MVRV ratio for BTC remained excessive.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The Lengthy/Brief distinction for BTC had declined considerably as nicely, indicating that the variety of short-term holders accumulating BTC had declined.

The temperament of those short-term holders and their willingness to promote or hold their holdings will play an enormous function in figuring out BTC’s worth.

Supply: Santiment