Picture supply: Getty Pictures

Few buyers prefer it when an organization cuts its dividend. However it’s at all times a threat for any earnings share. However whereas FTSE 100 dividend cuts might generate headlines, some FTSE 250 shares slash their payouts with out attracting the identical kind of consideration.

But a lower is a lower – and may be painful relating to the passive earnings streams one earns from a portfolio.

That explains why I diversify my portfolio throughout a variety of various shares. However as an investor, additionally it is vital to know among the attainable indicators {that a} dividend lower is perhaps coming.

Unusually excessive yield

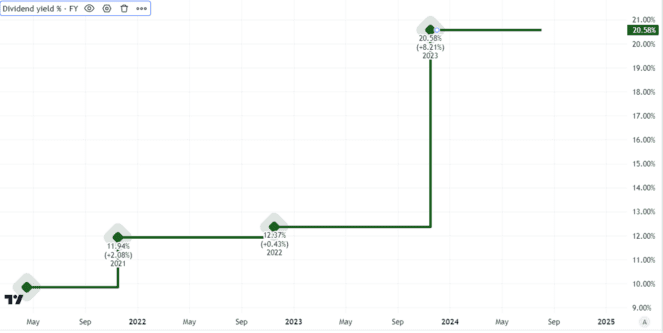

Take a look at this chart. Can we discover something uncommon?

Created utilizing TradingView

It reveals a dividend yield that stood at round 12% three years in the past. However that then elevated to virtually 20%. In different phrases, for each pound I invested on this share, I might have gotten again 20p per 12 months – if the dividend was maintained at that stage.

Some shares have excessive yields and preserve or improve their payouts. However an unusually excessive yield – and 20% is certainly that for a FTSE 250 share – is a crimson flag for me. I might wish to know why the yield was so excessive and choose what the long run appeared like for the dividend.

Typically a yield is excessive as a result of a enterprise had a very good 12 months.

In different circumstances, it displays the share value transferring down as investor nervousness grows in regards to the sustainability of a dividend.

That’s precisely the case right here. The yield chart above pertains to Diversified Vitality (LSE: DEC). The FTSE 250 share has fallen 62% in 5 years.

Rising debt

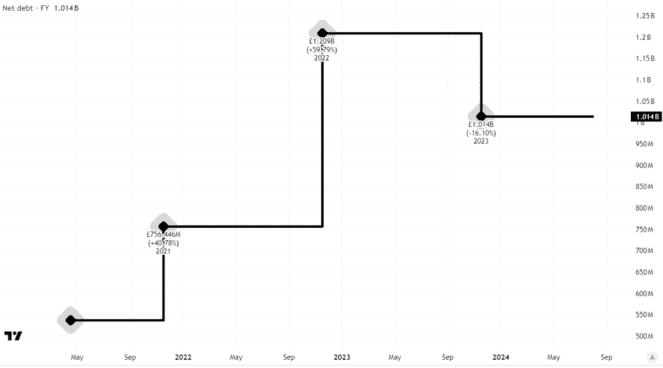

Diversified Vitality introduced a dividend lower in March, which didn’t shock me in any respect. Partly that lack of shock was due to the corporate’s stability sheet – one thing else I pay shut consideration to as an investor.

At $1.3bn, it had barely much less internet debt on the finish of final 12 months than 12 months earlier than.

Created utilizing TradingView

Nonetheless, for an organization that has a market capitalisation of round £440m (roughly $527m) in the intervening time, that’s an uncomfortably excessive debt for my part.

Debt issues relating to dividends as a result of the upper an organization’s debt, the much less monetary flexibility an organization usually has. Even when it generates giant money flows, it could want to make use of them to service debt, to not pay massive dividends.

That’s true of a FTSE 100 agency too — however a FTSE 250 firm can discover accessing finance extra pricey than a far bigger firm in the principle index.

Searching for nice firms not simply excessive dividends

There are a number of different indicators I take a look at when contemplating what would possibly occur to a share’s dividends in future. These are solely two of them.

Briefly, as an alternative of specializing in yield, I ask myself what an organization’s long-term industrial prospects appear like and what which may imply for shareholder payouts.