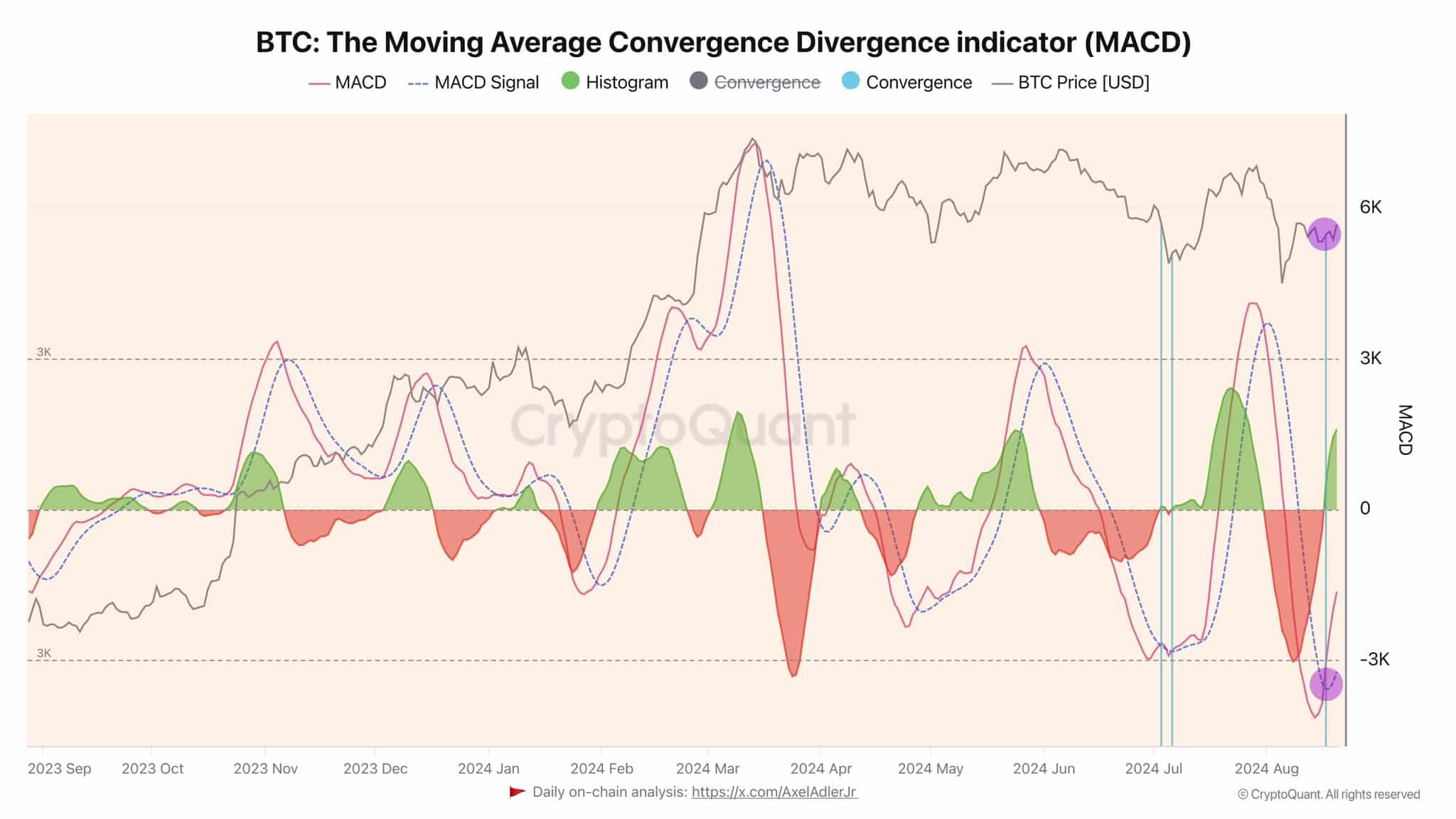

- Michael Saylor’s assertion was consistent with what the Bitcoin MACD indicator confirmed.

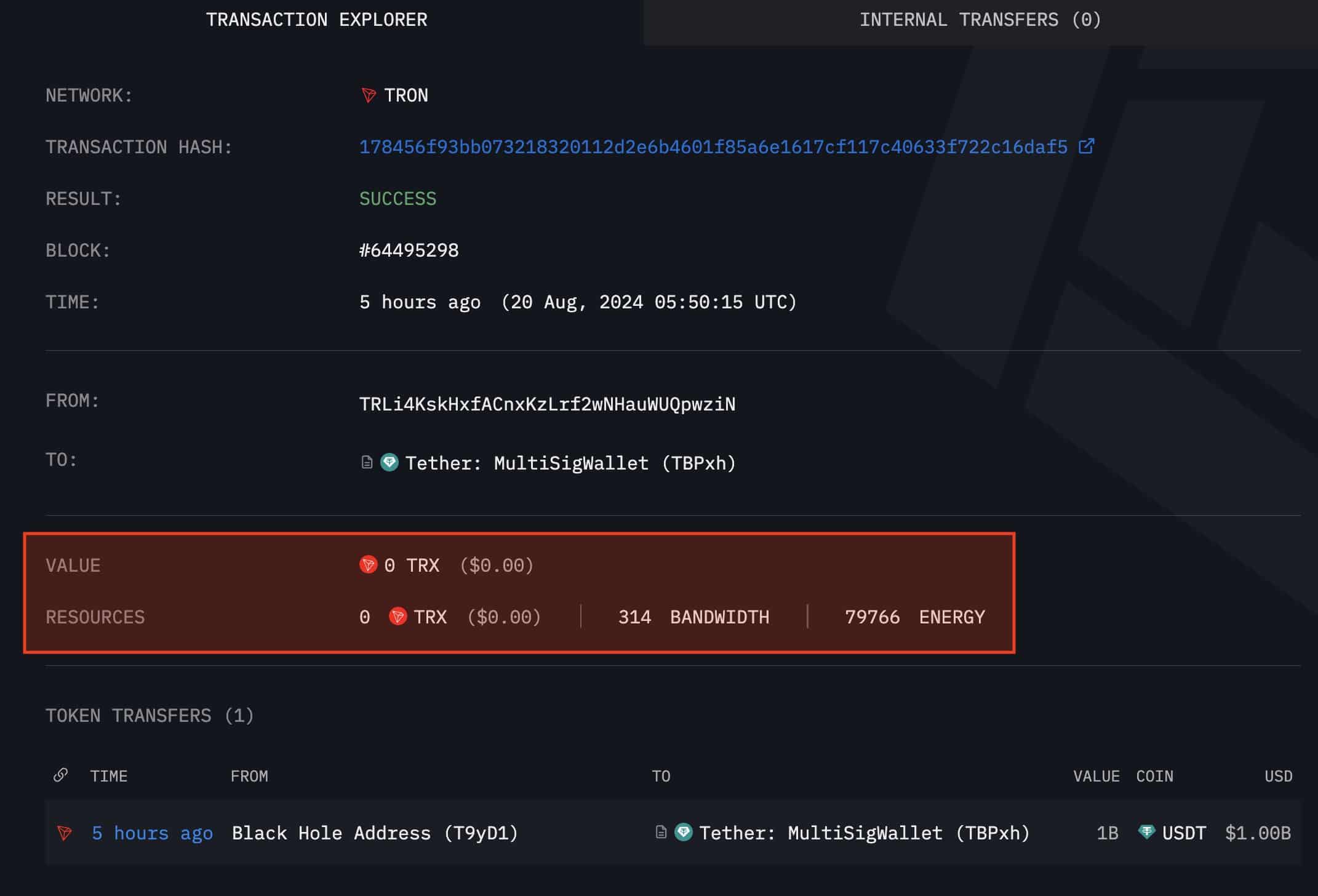

- Tether treasury mints $1B USDT with zero charges.

The founder and former Microstrategy CEO, Michael Saylor’s tweet, “By my calculations, Bitcoin [BTC] is going up forever,” resonated strongly with the crypto neighborhood, fueling anticipation for a 2024 bull run.

Saylor’s feedback coincided with 60% of high US hedge funds gaining Bitcoin publicity within the first half of 2024. This surge in institutional curiosity has pushed up Bitcoin ETF costs and Bitcoin itself.

On the charts, Bitcoin has proven intention to go increased after wicking above the 4-hour resistance whereas the 3-day chart reveals a bullish double backside with a big engulfing candle, indicating a robust upward momentum.

Supply: Tardigrade/TradingView

Furthermore, Bitcoin MACD indicator on the each day time-frame started forming a bullish sample 5 days in the past and has now totally flipped bullish.

The market has steadily moved in direction of a bullish convergence on the MACD, signaling potential upward momentum.

This shift within the MACD suggests a strengthening development that might result in additional good points, as extra merchants are beginning to discover this bullish sign.

Supply: CryptoQuant

Tether treasury mints one other $1B USDT

Tether, which operates just like the Federal Reserve of crypto, influencing market tendencies every time new USDT is minted. Tether Treasury minted $1 billion USDT on TRON with zero charges.

In the course of the newest Bitcoin correction, Tether’s printers had been extremely lively as Whale Alert famous on X with the whole minted USDT distributed as $85 million transferred to Bitfinex and $50 million to an unknown pockets.

Supply: Arkham

The continued minting of USDT is anticipated to drive Bitcoin costs increased within the upcoming bull market.

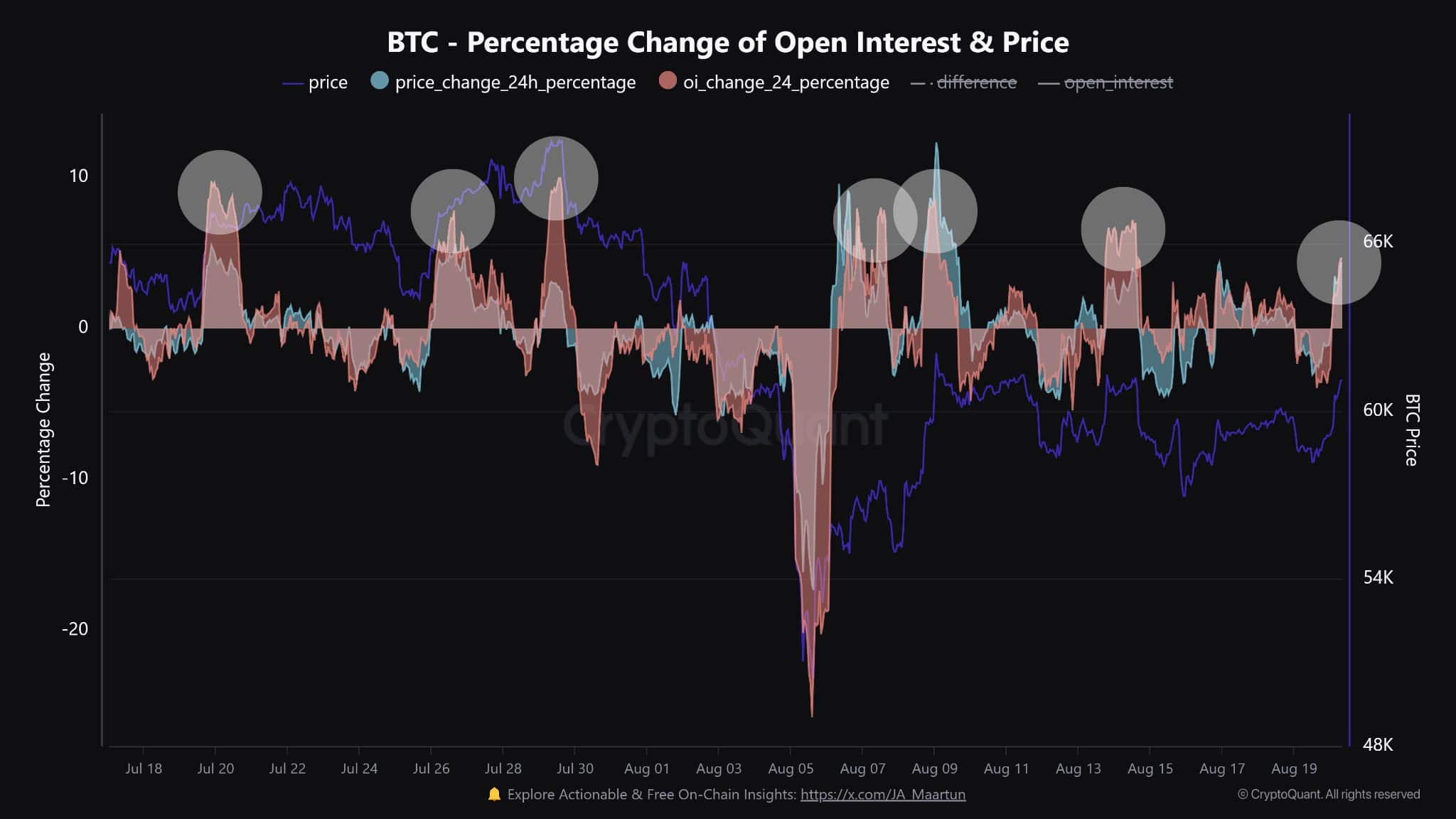

Sturdy accumulation as open curiosity rises

Bitcoin is in a robust accumulation part, with Metaplanet buying 500 million Yen ($3.4 million) price of Bitcoin, elevating its holdings to 360.368 BTC as Karan Singh famous on X.

This transfer, alongside rising institutional confidence, has pushed Metaplanet shares up by 13%. Moreover, Glassnode reviews that the Bitcoin accumulation index has peaked at 1.0, indicating a surge in shopping for exercise.

Supply: Glassnode

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Buyers are more and more accumulating extra positions following BTC’s open curiosity improve by 5%, pushed by leverage.

Supply: CryptoQuant

Traditionally, leverage-fueled pumps have usually led to cost reversals, although there’s no certainty it’s going to occur once more.