- Bitcoin whales offloaded 30,000 BTC value $1.83 billion

- Regardless of a 23% dip in massive transactions, 80% of holders had been nonetheless in revenue at press time

Bitcoin’s worth has develop into extremely unstable over the previous couple of days. As anticipated, this volatility precipitated some attention-grabbing behaviour from most of the market’s holders.

Think about this – A preferred analyst lately revealed that numerous whales reportedly bought or redistributed round 30,000 BTC value $1.83 billion, within the final 72 hours alone.

In gentle of the dimensions of such motion, there may be sure to be hypothesis about Bitcoin’s subsequent transfer. Therefore, the query – Will BTC proceed to fall or is that this merely a fake-out earlier than the crypto rallies for actual?

Whales make waves, however revenue saves

So far as the market’s consideration is anxious, whale actions all the time take heart stage. And, this week is not any exception to that rule.

The sale or redistribution of 30,000 BTC inside simply 72 hours has despatched ripples all through the market. As anticipated, many are actually speculating that this might result in additional draw back stress.

A major $1.83 billion value of Bitcoin modified palms, and market individuals are attempting to determine if that is half of a bigger technique.

Supply: Santiment

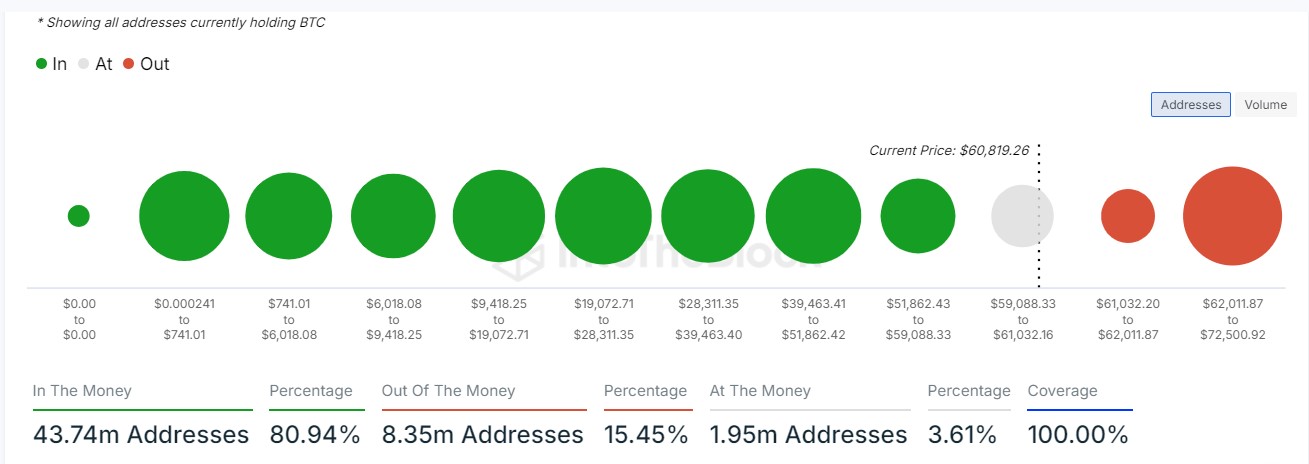

Nonetheless, it is very important observe that this large redistribution got here at a time when 80% of Bitcoin holders had been nonetheless in revenue.

This merely signifies that regardless of the sell-off, many buyers acquired BTC at decrease costs. Consequently, this offers them much less incentive to promote in panic.

Supply: IntoTheBlock

Massive transactions decline, whereas Bitcoin holders keep sturdy

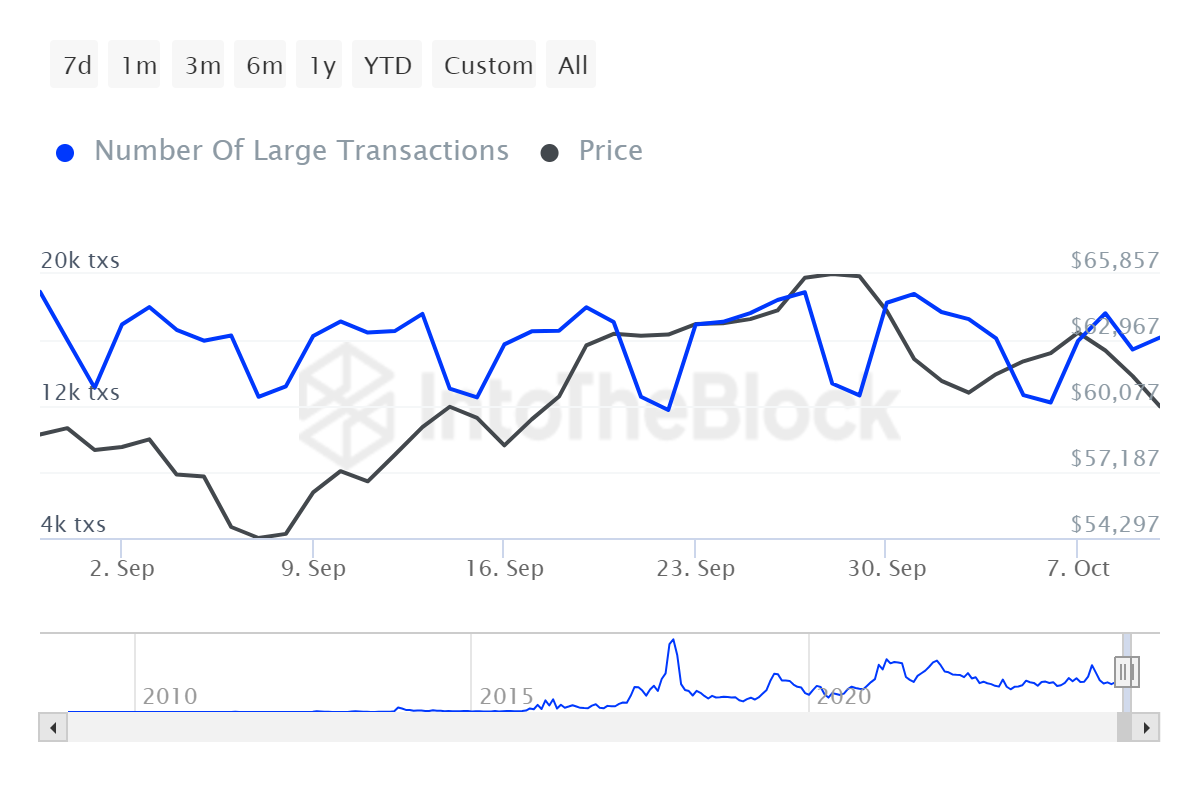

AMBCrypto additional analysed IntoTheBlock’s massive transaction knowledge to trace the whale dynamics on this significant market section. The info indicated a 23% dip in massive Bitcoin transactions, which generally means lowered market exercise amongst institutional gamers and high-net-worth people.

Regardless of this, nonetheless, a majority of Bitcoin holders stay in revenue. This may be interpreted as an indication of holders’ reluctance to promote on this market atmosphere.

Now, whereas massive transactions might need slowed down, there isn’t any signal of main panic among the many broader holder base.

Supply: IntoTheBlock

Inflation provides gasoline to hypothesis

Complicating issues additional, U.S. inflation recorded the next fee than anticipated at 2.4%. As a rule of thumb, when stronger inflation happens, buyers often flock to safe-haven property like Bitcoin.

This might offset the near-term promoting stress by whales and gasoline hypothesis that this current dip could also be a short lived blip earlier than the broader rally.

Will Bitcoin dip additional?

The confluence of whale exercise and higher-than-expected U.S. inflation paints uncertainty within the Bitcoin market.

Whereas some analysts argue that whales are attempting to set off a faux dip earlier than a significant rally, others consider the promoting stress may result in additional worth declines within the quick time period.