- Excessive-risk DeFi loans surged as market sentiment drove demand for leverage.

- DeFi tokens energetic addresses hitting new all-time highs.

Excessive danger loans surged as Bitcoin [BTC] hit new ATH driving demand for leverage. DeFi lending platforms Aave and Moonwell confirmed a major uptrend within the worth of high-risk loans as per IntoTheBlock, the place the collateral was inside 5% of being liquidated.

The upward development instructed an elevated urge for food for leverage throughout the crypto market as members search increased returns, particularly throughout bullish phases.

Notably, the rise in high-risk loans instructed that related behaviors had been prevalent throughout different DeFi lending platforms. This meant that broader market sentiment was inclined in the direction of aggressive funding methods.

Supply: IntoTheBlock

Nevertheless, the current conclusion of the U.S. elections launched potential volatility that would have an effect on these leveraged positions adversely.

Massive-scale political occasions typically result in unpredictable market actions, rising the danger of liquidations for these high-stake loans.

The state of affairs illustrated the precarious steadiness DeFi members navigate between looking for excessive returns and managing important dangers in an ever-volatile market surroundings.

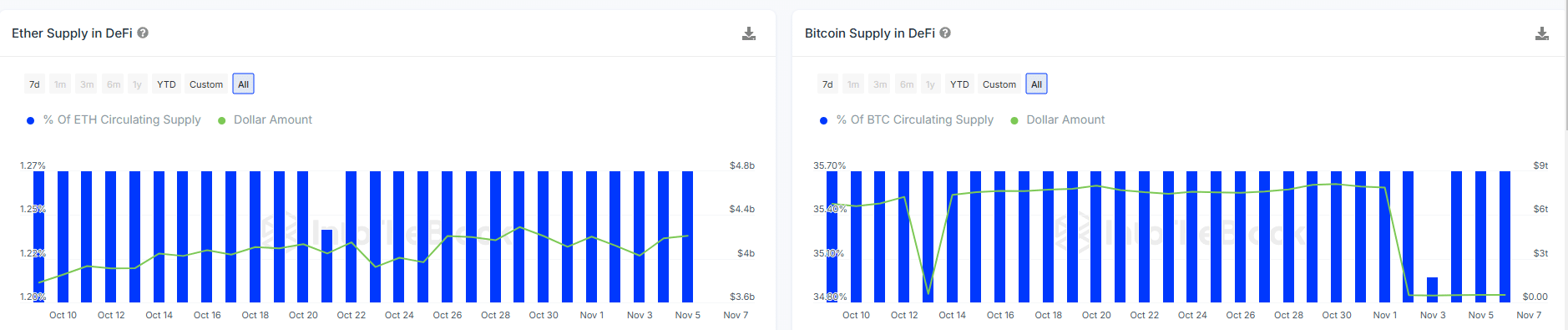

Distinction in provide of ETH and BTC in DeFi

Regardless of slight lower in whole greenback worth of Bitcoin in DeFi, it remained considerably increased than that of Ethereum. This instructed a deeper market penetration and better stake by members leveraging Bitcoin in DeFi platforms.

This indicated that Bitcoin might be extra vulnerable to the impacts of high-risk loans, particularly as market sentiment pushes demand for leverage.

Supply: IntoTheBlock

With Bitcoin’s bigger presence in DeFi, any important market corrections or volatility may result in extra pronounced results on Bitcoin’s worth and stability in comparison with Ether.

Thus, stakeholders in Bitcoin ought to keep notably vigilant about potential market actions that these high-risk monetary actions within the DeFi house might drive.

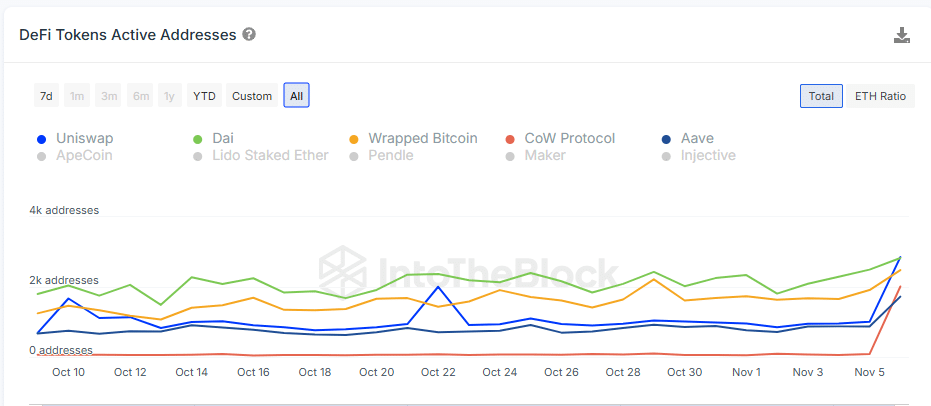

DeFi tokens energetic addresses at ATH

The chart confirmed an enormous rise in energetic addresses for a number of DeFi tokens, seemingly on account of extra customers speculating and looking for high-leverage alternatives in DeFi.

The notable improve in exercise, particularly with Wrapped Bitcoin (WBTC), highlighted the market’s rising use of leverage and concern of lacking out, which may inflate asset costs.

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Traditionally, elevated exercise typically got here earlier than market peaks. A sudden consciousness of overpricing or an enormous financial occasion may shortly drive down BTC costs.

Buyers and merchants should be cautious. The present rise in energetic addresses and leveraging reveals increased volatility danger. This might have an effect on Bitcoin’s actions quickly and should result in a neighborhood prime that would ignite a correction.