Amid the excitement and anticipation, Customary Chartered, a British cross-border financial institution, has projected that Ethereum spot ETFs will doubtless be permitted by the US Securities and Alternate Fee (SEC) this week.

In response to the financial institution, the approval of those spot ETFs may catalyze important market inflows, with estimates starting from $15 billion to $45 billion within the first yr alone.

Moreover, this anticipated inflow of capital is anticipated to considerably increase Ethereum’s market dynamics, doubtlessly driving its value towards the $8,000 mark by the top of 2024.

Implications Of Ethereum ETFs Approval:

Notably, the bullish outlook from Customary Chartered is supported by the approaching deadlines for the primary spherical of spot Ethereum ETFs, with VanEck’s deadline on Could 23 and Ark Make investments/21Shares’ on Could 24.

Geoff Kendrick, Head of FX Analysis and {Digital} Belongings Analysis at Customary Chartered Financial institution, expressed excessive confidence in approving these ETFs, estimating an “80% to 90%” chance. Kendrick notably famous:

After approval, we estimate that spot ETFs will drive inflows of two.39-9.15 million ether within the first 12 months after approval. In U.S. greenback phrases, that equates to roughly $15 billion to $45 billion. As a proportion of market cap, it’s much like our estimates of inflows to bitcoin ETFs, that are proving correct.

Kendrick elaborated that if the spot ETH ETFs obtain approval as anticipated, Ethereum may keep its present value ratio with Bitcoin, which is projected to succeed in $150,000 by the top of 2024. This projection locations Ethereum at an $8,000 valuation by the top of the yr.

Furthermore, with Customary Chartered’s forecast of Bitcoin reaching $200,000 by the top of 2025, Ethereum may additionally see its value rise to $14,000 over the identical interval, reaffirming the financial institution’s earlier value goal in March.

Bullish Market Sentiment Amid Rising ETF Approval Odds

Following the elevated chance of Ethereum ETF approvals, the value of Ethereum has surged, crossing the $3,600 degree for the primary time since April 19.

This represents a greater than 20% improve previously 24 hours, pushing Ethereum’s market capitalization above $450 billion.

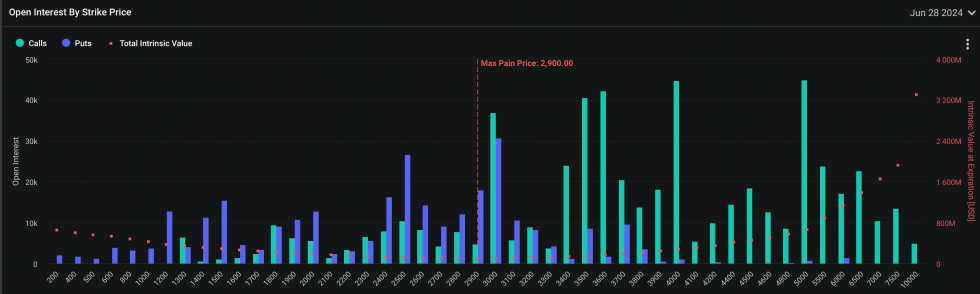

The market’s response to those developments has been overwhelmingly optimistic, with spinoff markets like Deribit exhibiting concentrated bets on Ethereum calls surpassing the $4,000 value mark. Probably the most favored strike value amongst these choices merchants is an formidable $5,000, indicating robust bullish sentiment.

Notably, Bloomberg analysts heightened optimism concerning the approval of spot ETH ETFs by unexpectedly growing the approval odds to 75%, a major soar from the sooner 25% estimation.

This reassessment adopted stories that the SEC is quickly altering its stance, with exchanges being urged to replace their 19b-4 filings swiftly.

Replace: @JSeyff and I are growing our odds of spot Ether ETF approval to 75% (up from 25%), listening to chatter this afternoon that SEC might be doing a 180 on this (more and more political difficulty), so now everybody scrambling (like us everybody else assumed they’d be denied). See… https://t.co/gcxgYHz3om

— Eric Balchunas (@EricBalchunas) Could 20, 2024

In response to Eric Balchunas, approval may come this Wednesday, signaling a serious shift within the regulatory panorama and doubtlessly setting the stage for additional positive factors in ETH’s value.

Featured picture created with DALL·E, Chart from TradingView