- Ethereum witnessed a extra extreme correction final week than Bitcoin.

- Metrics urged that promoting strain was excessive on BTC and ETH, however ETH had an edge.

Bitcoin [BTC] remained within the limelight during the last week because it approached $70k, however later plummeted close to $66k. Ethereum [ETH] had a more durable week because it witnessed a relatively extra correction.

Nonetheless, the newest replace revealed that buyers ought to contemplate accumulating ETH, as its volatility has barely picked up.

Weekly efficiency

CoinmarketCap’s information revealed that after getting rejected from the $70k zone, BTC’s value dropped. On the time of writing, it was buying and selling at $66,491 with a market capitalization of over $1.31 trillion.

However, ETH witnessed a 3% value correction final week. At press time, ETH had a worth of $3,325 with a market capitalization of over $399 billion.

As per QCB Broadcast’s insights, BTC’s value began to say no after the US equities opened. One more reason was the U.S. authorities’s sell-off of BTC price $2 billion.

The perception additionally talked about that buyers may contemplate accumulating Ethereum because it has already gained slight volatility and may witness fluctuations within the coming week.

Ethereum may achieve energy quickly, because the market is perhaps turning into proof against headline outflow figures as a result of rotation from dearer ETHE to the cheaper ETFs.

Ethereum vs Bitcoin

AMBCrypto then deliberate to verify and examine these two cryptos, to search out out whether or not Ethereum can outshine BTC this week.

As per our evaluation of Santiment’s information, BTC’s Social Dominance remained comparatively increased than that of ETH. Each cryptos witnessed a rise of their Provide on Exchanges as nicely.

This urged that buyers have been contemplating promoting BTC and ETH.

Additionally, BTC’s Worth Volatility 1w elevated sharply, whereas ETH’s Worth Volatility dropped. Although this may look unfavourable for Ethereum, the truth is perhaps totally different.

The drop in 1-week value volatility may point out an finish to the token’s bearish value motion, in flip hinting at a bullish pattern reversal.

Supply: Santiment

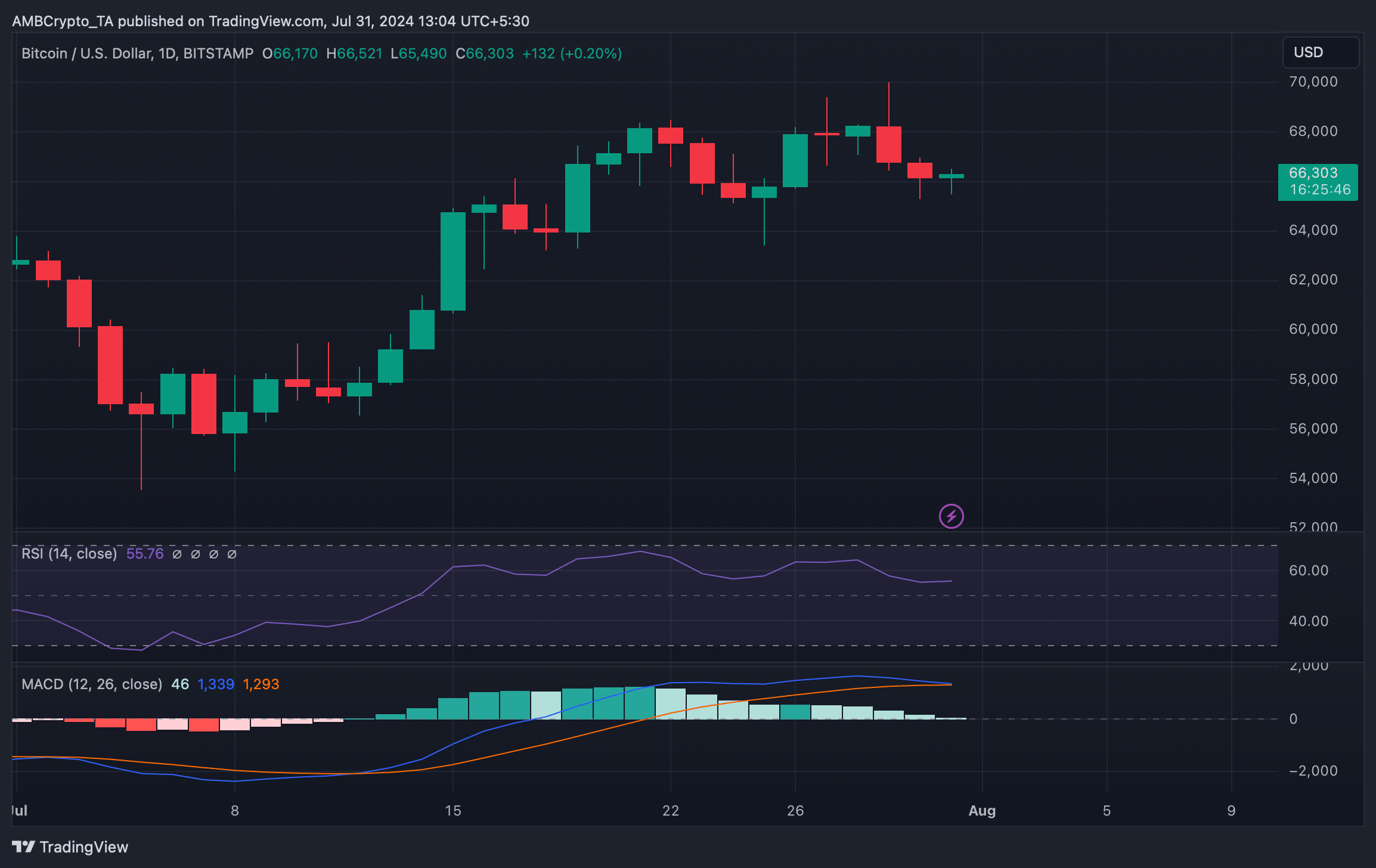

We then checked Bitcoin and Ethereum’s day by day charts to raised perceive which method they have been headed. We discovered that BTC’s MACD displayed a bearish crossover.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Moreover, its Relative Energy Index (RSI) registered a downtick after which moved sideways. These indicators urged that the possibilities of correction or much less risky value motion have been excessive.

Supply: TradingView

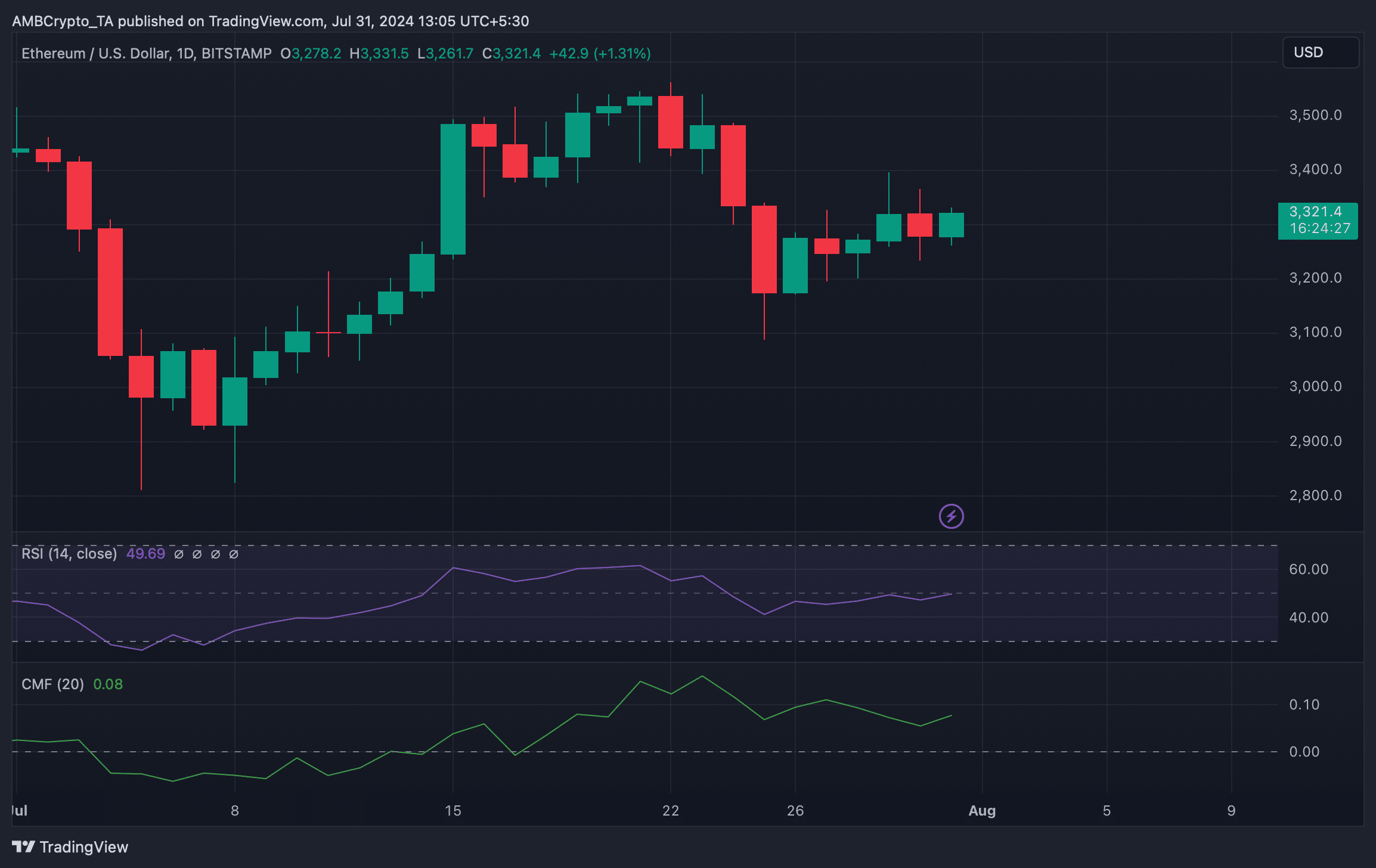

Quite the opposite, Ethereum’s Relative Energy Index (RSI) gained bullish momentum. Its Chaikin Cash Circulation (CMF) additionally adopted an identical pattern, hinting that ETH may achieve bullish momentum earlier than Bitcoin.

Supply: TradingView