- Indicators confirmed Ethereum maintained its longer-term uptrend

- The wrestle to interrupt the $4k resistance may proceed for extra days

Ethereum [ETH] was pressured to fall by 5.7% previously 40 hours of buying and selling. Throughout the identical time, Bitcoin [BTC] set a brand new all-time excessive above $108k and fell to the $103.4k stage. Regardless of the pullback and vary formation, Ethereum bulls have a superb probability of preserving the rally going.

Ethereum bulls proceed to scuffle with out success round $4k

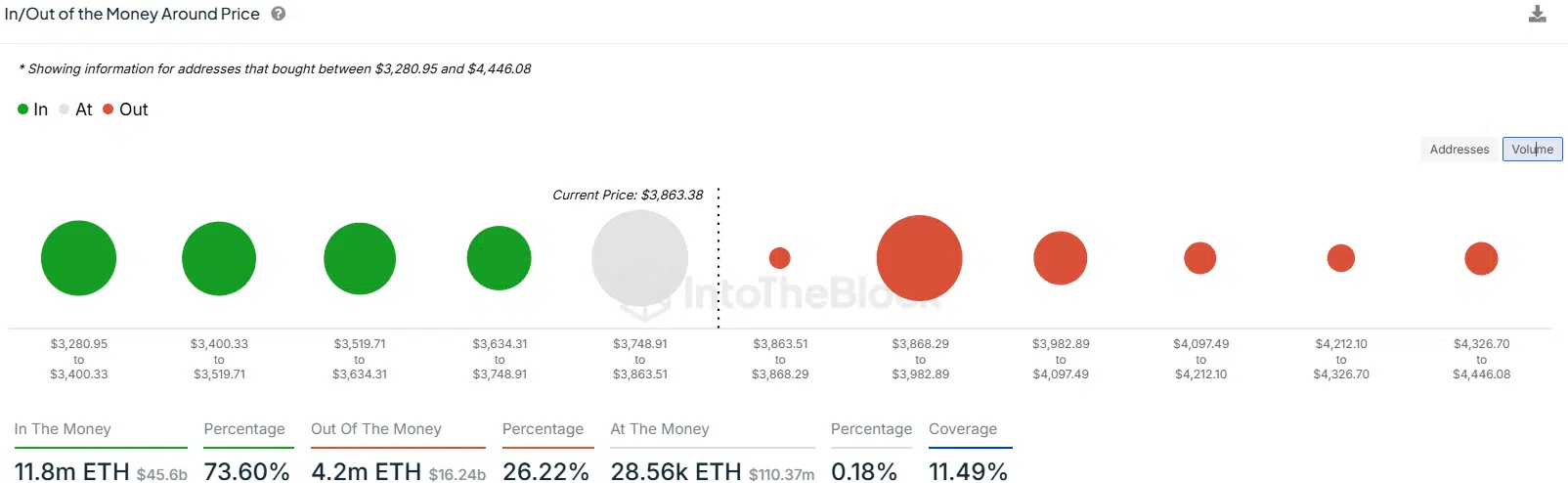

Supply: IntoTheBlock

Whereas Ethereum has a better timeframe bullish bias, the lack to keep up costs above $4k was a priority. Up to now two weeks, ETH has examined the $4.1k resistance stage twice and been rebuffed each instances.

AMBCrypto appeared on the information from IntoTheBlock. The In/Out of the cash across the worth identifies the typical buy worth of Ethereum and the amount purchased by addresses inside a sure vary across the market worth.

The excessive quantity of purchases on the $3,868-$3,982 zone meant {that a} transfer past this zone might be powerful. Patrons in that worth vary had been out of the cash because of the current dip and will promote their holdings if costs bounced, opposing additional features.

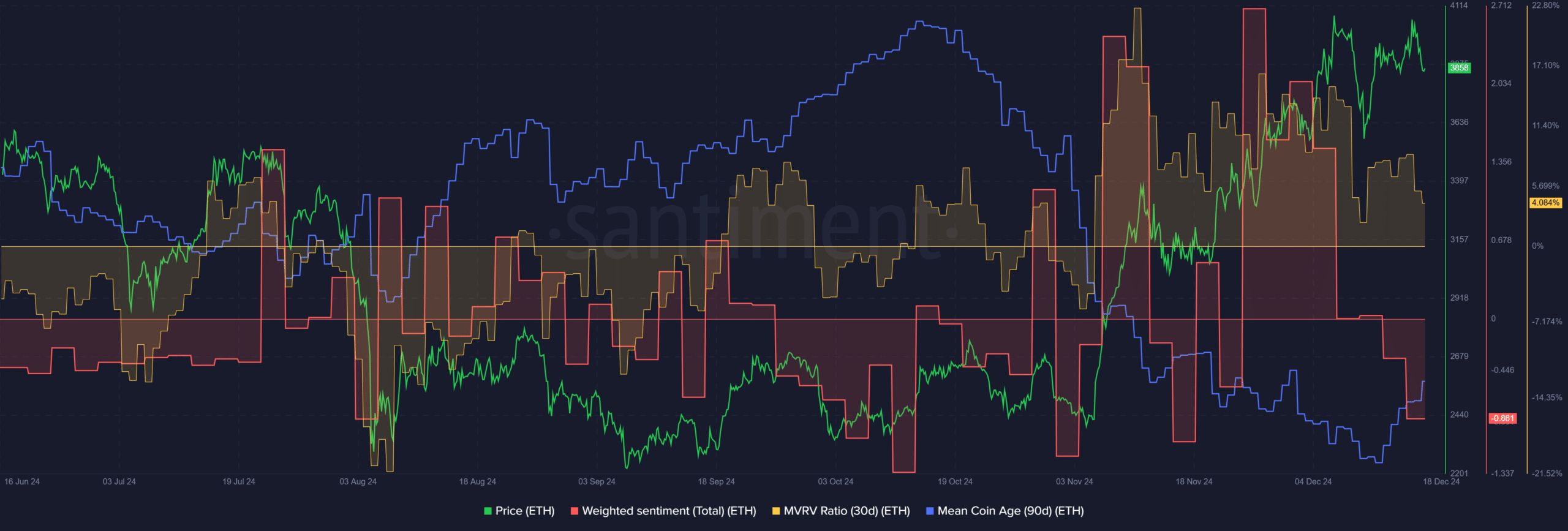

Supply: Santiment

The info from Santiment outlined a shift in sentiment in current days. The weighted sentiment flipped bearishly to point bearish on-line engagement. The 30-day MVRV was additionally excessive, exhibiting short-term holders had been worthwhile.

Some profit-taking and promote stress is predicted and will delay makes an attempt at restoration. In the meantime, the imply coin age, which had been in a powerful downtrend since mid-October, has begun to recuperate.

Ethereum bulls would need to see this accumulation proceed over the approaching weeks.

Potential vary formation forward

Supply: ETH/USDT on TradingView

In December, ETH has ranged between $3.6k and $4k for essentially the most half. The mid-range stage at $3.8k has acted as assist, and Ethereum was buying and selling above this stage at press time.

Learn Ethereum’s [ETH] Value Prediction 2024-25

The DMI confirmed a powerful uptrend nonetheless in progress on the each day timeframe, because the +DI (inexperienced) and ADX (yellow) had been each above 20. The OBV has climbed larger since October, reinforcing the thought of regular demand and sustainable features.