- The Ethereum ETF approval coincided with a shift in investor sentiment, as Bitcoin ETFs skilled outflows after weeks of constant inflows.

- Trade web flows and lengthy/brief ratios indicated market uncertainty.

The cryptocurrency market has witnessed a big shift just lately. After weeks of constant inflows, Bitcoin [BTC] ETFs have skilled their first outflows.

This transformation comes on the heels of the Ethereum [ETH] ETF approval, suggesting a attainable correlation between the 2 occasions.

Ethereum steals the highlight

The approval of Ethereum ETFs has seemingly diverted investor consideration from Bitcoin. It has additionally sparked a renewed curiosity in Ethereum, probably on the expense of Bitcoin’s current momentum.

The timing of those occasions has led to elevated hypothesis a few attainable rotation of funds between the 2 main cash.

Knowledge from CryptoQuant indicated a pattern in change web flows. Bitcoin has seen constructive web flows of 2675.13 BTC. Which means that extra cash have been coming into exchanges, relatively than leaving.

Supply: CryptoQuant

On the opposite facet, Ethereum skilled unfavorable web flows of -24752.72 ETH, suggesting the next quantity of withdrawals from exchanges.

Including to this, Ali Martinez tweeted that BTC was displaying indicators of a breakout, probably heading in direction of $67,000.

The RSI had already damaged its descending trendline at press time, and now it wanted to surpass $66,450 to substantiate the bullish breakout.

Supply: X

BTC drops hints about market sentiment

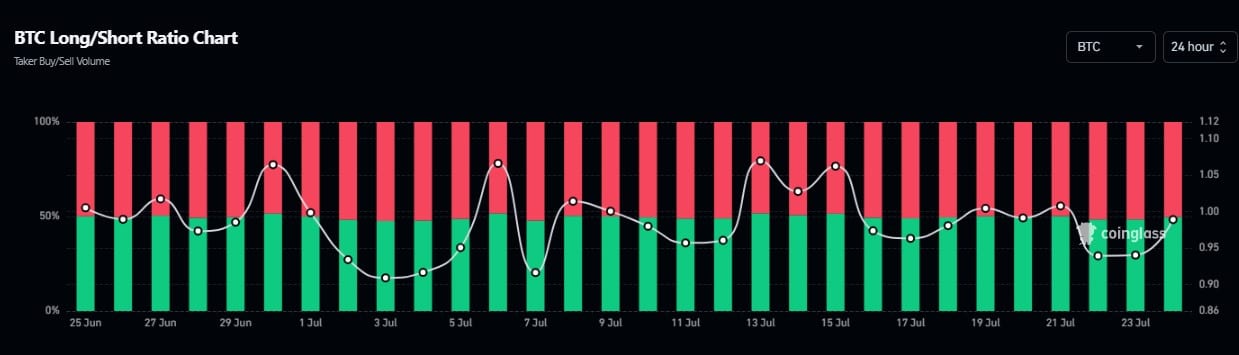

AMBCrypto’s evaluation of BTC’s Lengthy/Brief Ratio Chart through Coinglass supplied additional perception into market sentiment.

Over the previous 24 hours, the ratio has witnessed fluctuations, with current information displaying a slight improve in lengthy positions. This advised that regardless of the ETF outflows, traders remained optimistic about Bitcoin’s prospects.

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Is volatility on the horizon?

The mixture of ETF outflows, shifting change web flows, and fluctuating Lengthy/Brief Ratios painted an image of market uncertainty.

These elements might probably result in elevated volatility within the coming weeks as traders reassess their positions in gentle of the Ethereum ETF approval.