- ETH has risen 6% because the halving day.

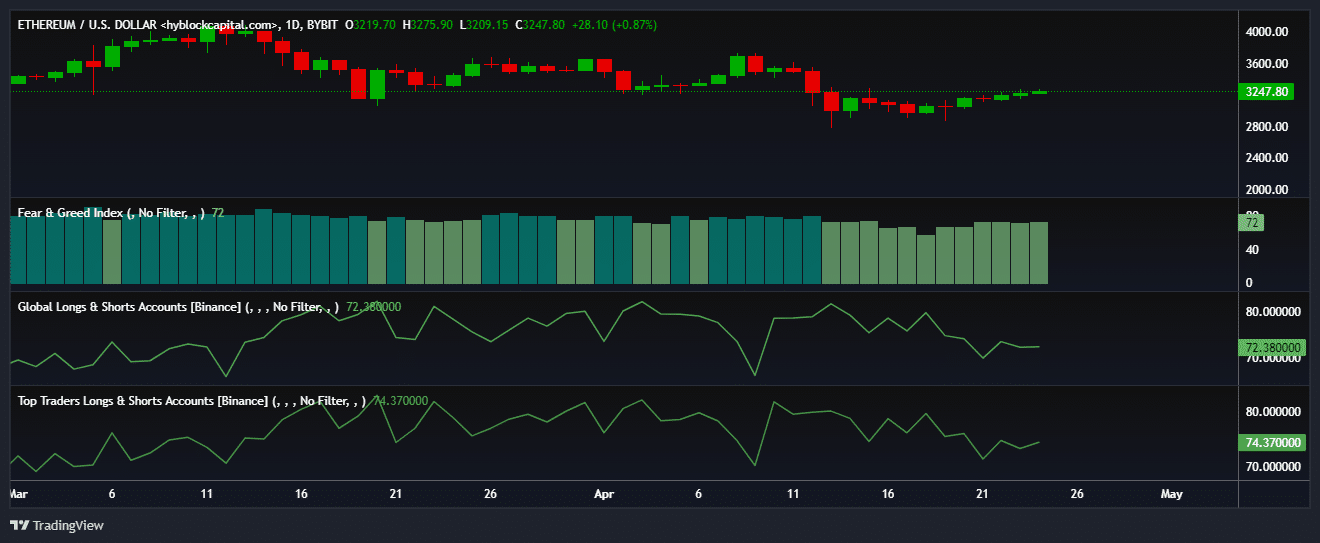

- The full variety of accounts longing ETH on Binance rose since halving.

Bitcoin [BTC] halving appeared to have exerted vital upward strain on Ethereum [ETH].

The second-largest cryptocurrency rose 6% because the halving day, exchanging arms at $3,250 on the time of writing, information from CoinMarketCap confirmed.

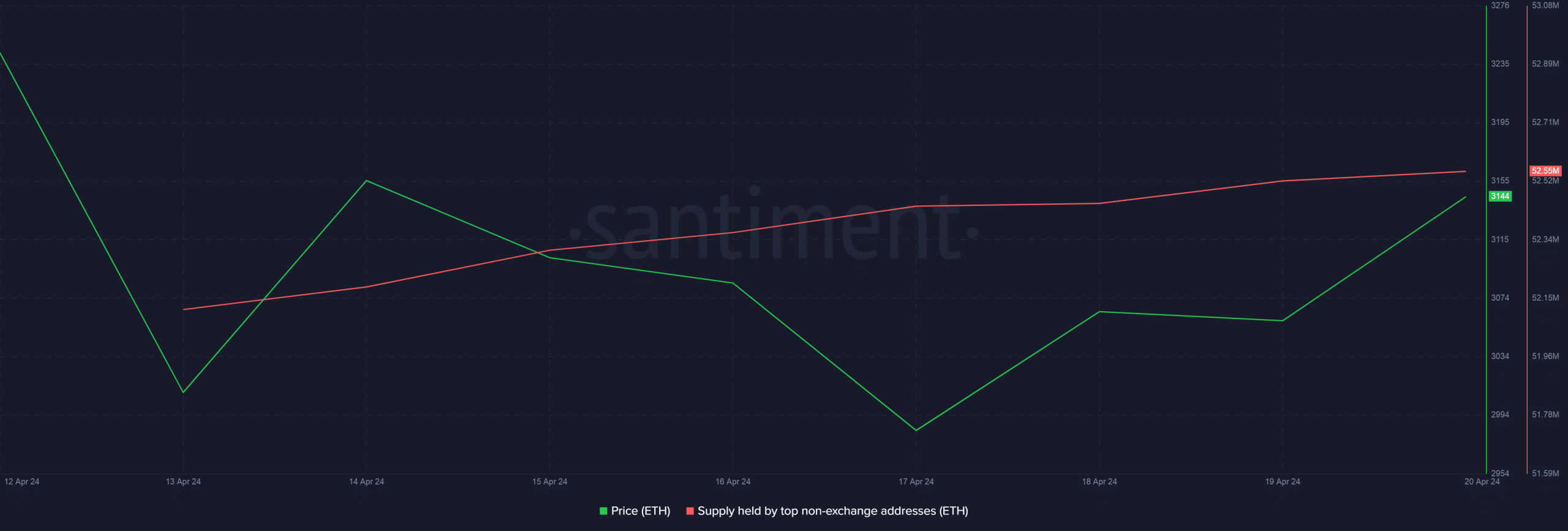

Utilizing Santiment, AMBCrypto famous a slight improve within the complete stability of high non-exchange addresses since halving. This recommended that accumulation by influential traders supported the value rise.

Supply: Santiment

Will the momentum maintain?

In line with outstanding crypto market analyst Ali Martinez, $3,170 until $3.270 has acted as a robust resistance for ETH, with as many as 1.63 million addresses buying 4.45 million cash on this vary.

Whereas ETH clearly broke the primary barrier, a break above $3.270 would help the thought of a rally all the best way to $3,650, Martinez predicted.

Futures merchants wager on ETH’s rise

The value rally additionally galvanized ETH’s futures market. For the reason that twentieth of April, the full variety of accounts longing ETH on Binance have risen steadily, AMBCrypto seen utilizing Hyblock Capital’s information.

Moreover, the share of whale accounts taking bullish bets for ETH elevated from 71% to 74% since halving. This type of justified the buildup idea outlined earlier.

Supply: Hyblock Capital

The market sentiment additionally tilted in direction of greed, which might improve shopping for strain within the coming days.

What do the technical indicators say?

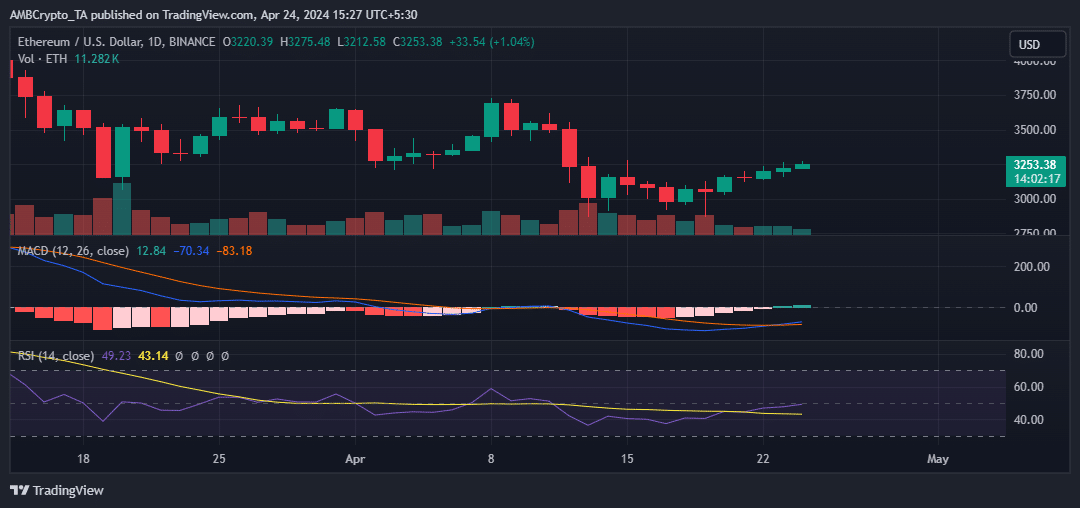

AMBCrypto examined ETH’s each day chart and its key technical indicators to gauge the subsequent actions.

The Relative Energy Index (RSI) hit the impartial 50 degree as of this writing, indicating a pivot in direction of the bullish facet. Usually, the 40-50 zone acts as a superb help throughout a bull market.

Therefore, a pointy transfer above this space might help a sustained rally.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

The Shifting Common Convergence Divergence (MACD) crossed above the sign line, indicating the opportunity of a worth improve.

Nevertheless, to strengthen the bullish narrative, the MACD ought to cross above 0 within the days to come back.

Supply: Buying and selling View