- Ethereum ETFs confronted $38M outflows, reflecting shifting market sentiment after weeks of regular inflows.

- Regardless of this, ETH’s worth remained comparatively secure.

Ethereum [ETH] ETF encountered a major shift in investor conduct, with $38 million in outflows recorded final week.

This marked the primary week of internet outflows following 5 consecutive weeks of inflows, signaling a possible change in market sentiment towards Ethereum-based funds.

A more in-depth have a look at ETH ETF outflows

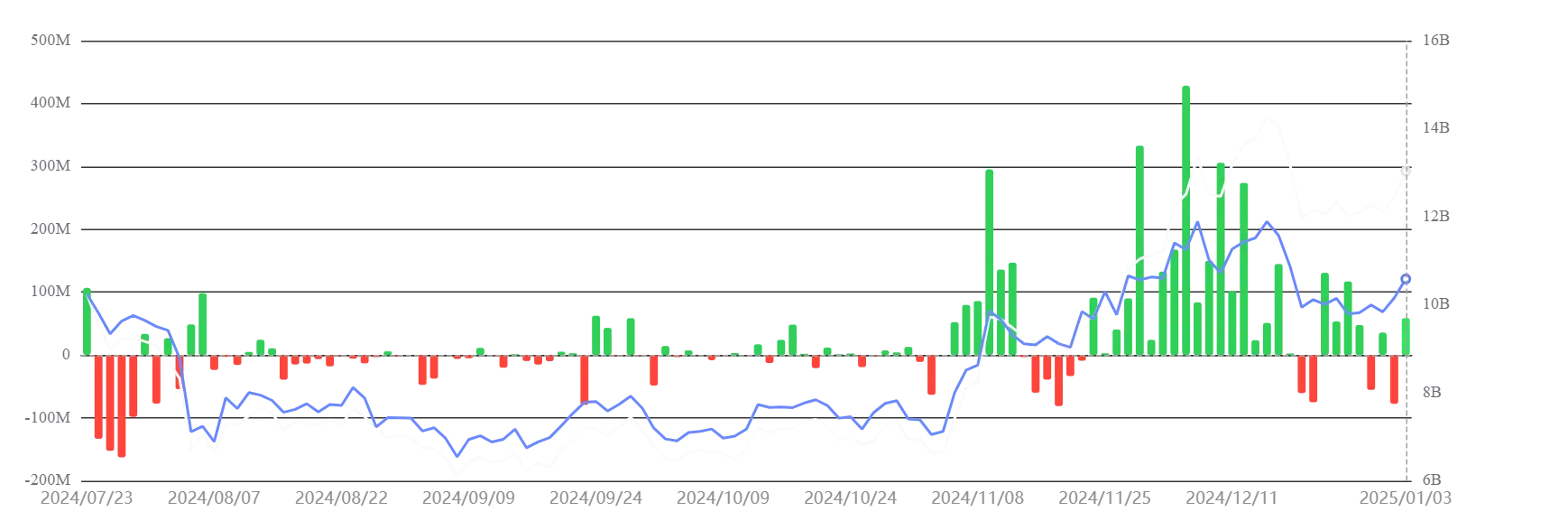

The weekly circulate chart indicated a stark distinction from earlier weeks, which noticed substantial inflows, peaking in December 2024. The netflow surged to over $800 million throughout this era for 2 consecutive weeks.

Regardless of the current outflows, Ethereum ETFs have amassed a cumulative complete internet influx of $2.68 billion over the previous a number of months, reflecting regular demand throughout earlier durations.

Supply: Soso Worth

The every day ETF circulate chart additional emphasizes the gradual shift in momentum, with a notable purple bar marking a major single-day outflow.

ETH ETFs at the moment handle complete internet property of $13.03 billion, which accounts for about 3% of Ethereum’s complete market capitalization.

Regardless of the short-term setback, these figures underline the rising significance of ETFs within the broader Ethereum funding panorama.

Supply: Soso Worth

Ethereum worth evaluation

Ethereum’s worth remained comparatively secure at press time, buying and selling at $3,649.55. Technical indicators just like the Cash Move Index (MFI) stood at 65.12, signaling ongoing accumulation regardless of ETF outflows.

The golden cross noticed on the chart—the place the 50-day transferring common crossed above the 200-day transferring common—indicated a long-term bullish development.

Nevertheless, the outflows counsel short-term warning amongst institutional traders.

Supply: TradingView

Quantity knowledge highlighted a gentle buying and selling exercise of 21.12K ETH, which can assist Ethereum preserve its present worth ranges whilst ETFs face lowered curiosity.

What’s driving the outflows?

The $38 million outflows might be attributed to a number of components, together with profit-taking after weeks of inflows and a powerful worth restoration.

Broader market volatility could have additionally triggered a shift in sentiment, resulting in lowered publicity to Ethereum funds.

The reversal in ETH ETF flows underscores the fragility of market sentiment. Whereas Ethereum’s worth has proven resilience, the outflows could sign an early warning for potential corrections.

Learn Ethereum’s [ETH] Value Prediction 2025-26

Nevertheless, with a cumulative internet influx of $2.68 billion and complete internet property of $13.03 billion, Ethereum ETFs stay a crucial participant within the evolving crypto funding panorama.

This setback may show short-term, with inflows more likely to resume as market circumstances stabilize.