- BlackRock’s Bitcoin ETF achieved a report $4.1 billion buying and selling quantity.

- BTC ranked because the ninth-largest asset globally.

Bitcoin [BTC] exchange-traded funds (ETFs) had a tough begin in November. Nevertheless, after three consecutive days of outflows, the ETFs lastly recorded huge inflows.

In line with information from Farside Buyers, day by day complete web inflows on the sixth of November soared to $621.9 million, successfully breaking the prior streak of outflows.

This surge coincided with Donald Trump’s return to the presidency for a second time period.

Trump had promised regulatory reform and agency assist for the crypto business, which may very well be another excuse for this surge.

IBIT sees outflows

Surprisingly, IBIT didn’t lead the current surge of inflows this time.

As an alternative, it posted a day by day web outflow of $69.1 million, following an outflow of $44.2 million the day past.

IBIT was joined by BRRR, which noticed a day by day outflow of $2.6 million.

Supply: Farside Buyers

However, ETFs comparable to GBTC, FBTC, ARKB, BITB, BTC, and HODL recorded constructive inflows, whereas the remaining funds skilled no inflows in any respect.

BlackRock’s Bitcoin ETF makes historical past once more

Regardless of the dip, Eric Balchunas, senior ETF analyst at Bloomberg, highlighted on X (previously Twitter) that IBIT achieved an unprecedented buying and selling quantity of $1 billion inside the first 20 minutes of market opening.

This surge, which equaled a typical full-day quantity, contributed to IBIT’s record-breaking day with $4.1 billion traded. He remarked,

“It was also up 10%, its second best day since launching”

Balchunas elaborated that the collective group of Bitcoin ETFs recorded $6 billion in buying and selling quantity.

As well as, most ETFs doubled their common quantity. The analyst described it as,

“An all-around banger day for an infant category that never ceases to amaze.”

At press time, IBIT held 433,644 BTC price over $30 billion, solidifying its place because the main Bitcoin ETF at present listed within the U.S.

BTC’s efficiency post-election

Within the wake of Trump’s re-election, IBIT wasn’t the one one setting new highs.

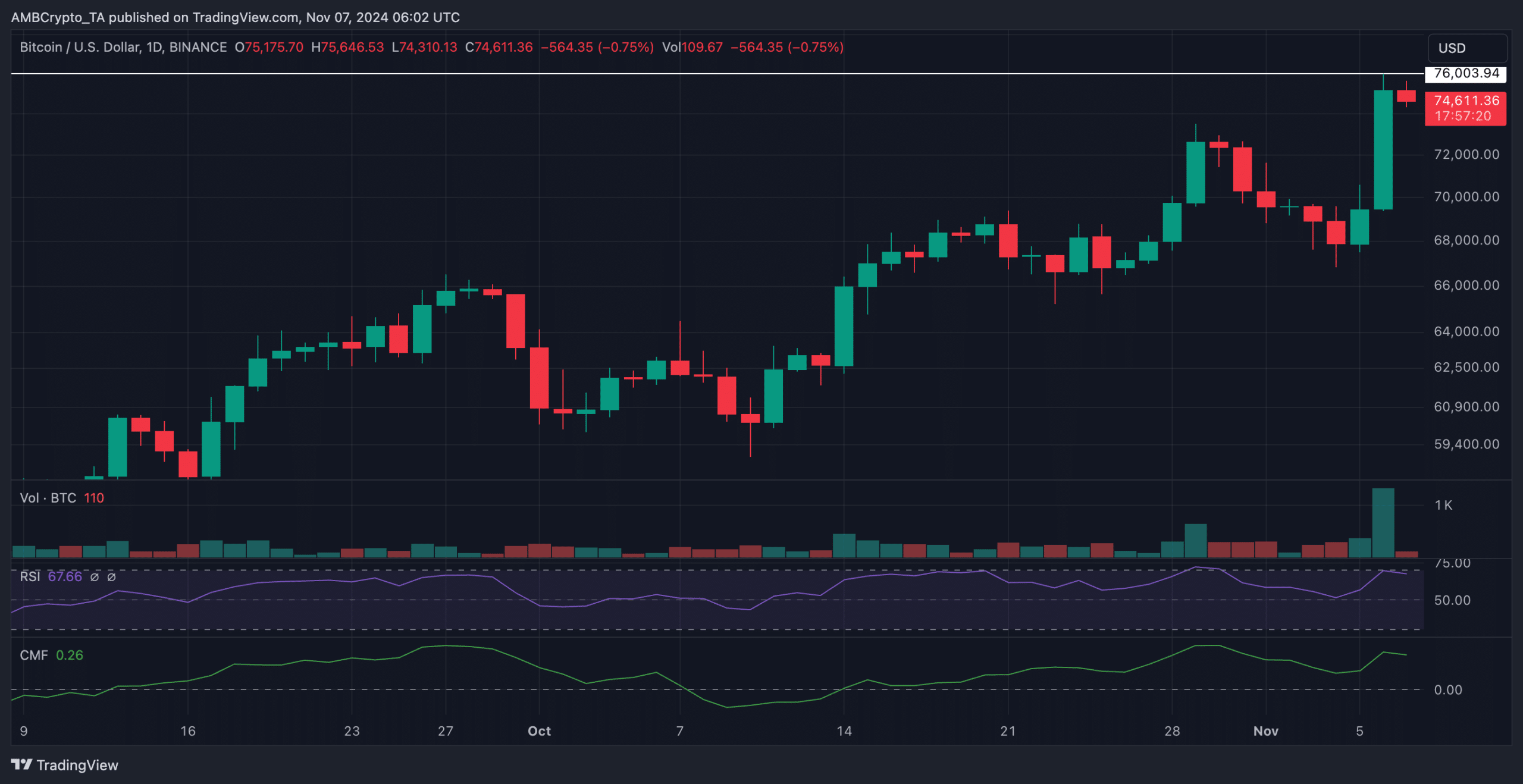

Bitcoin additionally skilled a major surge, setting a brand new all-time excessive at over $76,000. This got here shortly after BTC hit a report peak of $75,000 earlier than the election outcomes.

On the time of writing, BTC’s worth had retreated to $74,611, reflecting a 1.83% lower from its peak.

Over the previous 24 hours, it witnessed a minor dip of 0.32%, in response to CoinMarketCap.

In the meantime, on the day by day chart, the RSI was recorded at 67.66, signifying sturdy bullish momentum.

This studying indicated that whereas BTC stays beneath the overbought threshold, there was nonetheless potential for extra upward motion if shopping for strain persists.

Supply: TradingView

Moreover, the CMF indicator was at 0.26. This signaled a powerful influx of capital into BTC and bolstered the general constructive development.

BTC overtakes Meta

Notably, the worth rally pushed BTC’s market cap to a powerful $1.48 trillion, at press time. This allowed it to surpass Meta, which has a market cap of $1.44 trillion.

Because of this, the king coin secured its place because the ninth largest asset on the planet, as per CompaniesMarketCap.

Supply: CompaniesMarketCap

The IBIT and the worth milestone underscored BTC’s rising recognition as a key participant within the international monetary panorama.

This marked a historic second for the cryptocurrency market, because it continues to problem conventional belongings for dominance.