Picture supply: Ocado Group plc

The FTSE 100 doesn’t have many high-profile tech shares. One of many few is Ocado (LSE: OCDO). Is it a progress inventory? Evaluating the 70% fall within the Ocado share worth over the previous 5 years to a US progress inventory like Nvidia (up 2,903% in the identical interval), it doesn’t appear like the form of progress inventory most traders get enthusiastic about!

Nonetheless, Ocado has a sizeable, rising enterprise and is well-regarded within the retail business. The corporate introduced right now (8 July) that it’s set to construct a 3rd fulfilment centre in Japan for native retail big Aeon.

So, has the Ocado share worth fallen too far, presenting me with a shopping for alternative? Or may issues get even worse from right here?

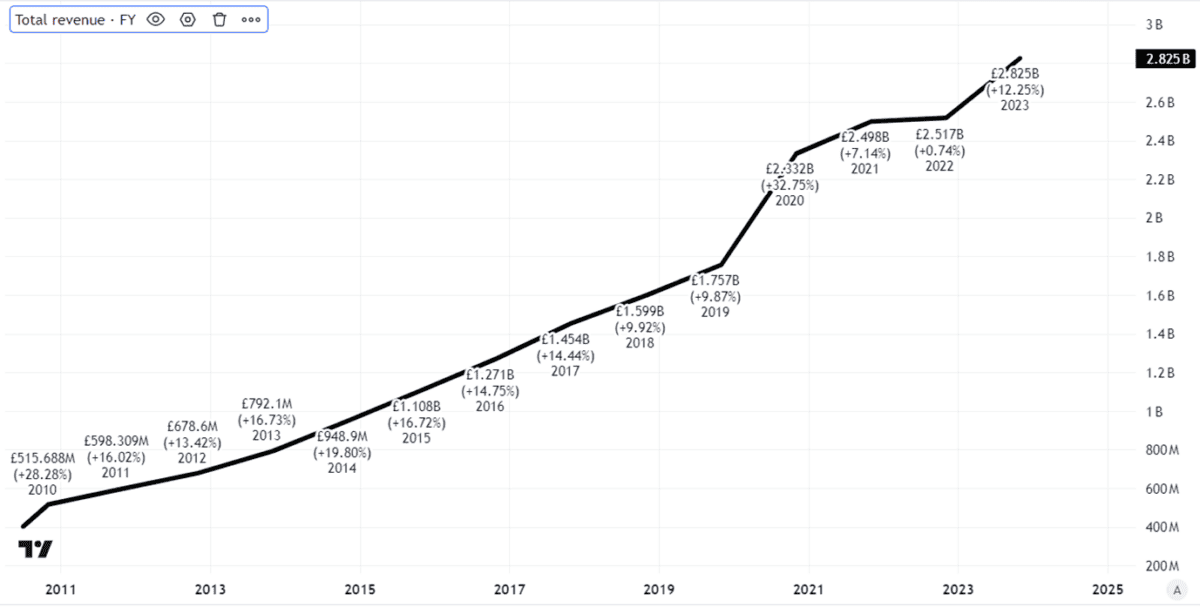

Stable income progress

Ocado is a enterprise with rising revenues. The Aeon deal is simply the newest in a sequence of agreements it has made with retailers worldwide because it expands the dimensions of the service it gives to assist handle their on-line fulfilment operations.

Created utilizing TradingView

However whereas a rising gross sales pattern might be seen as constructive signal an organization has recognized a probably profitable market, it isn’t at all times a very good factor.

Why?

Income is one factor. An organization can typically increase income simply by reducing costs and attaining greater gross sales volumes, for instance. However on the finish of the day, what issues to long-term traders is whether or not an organization could make earnings.

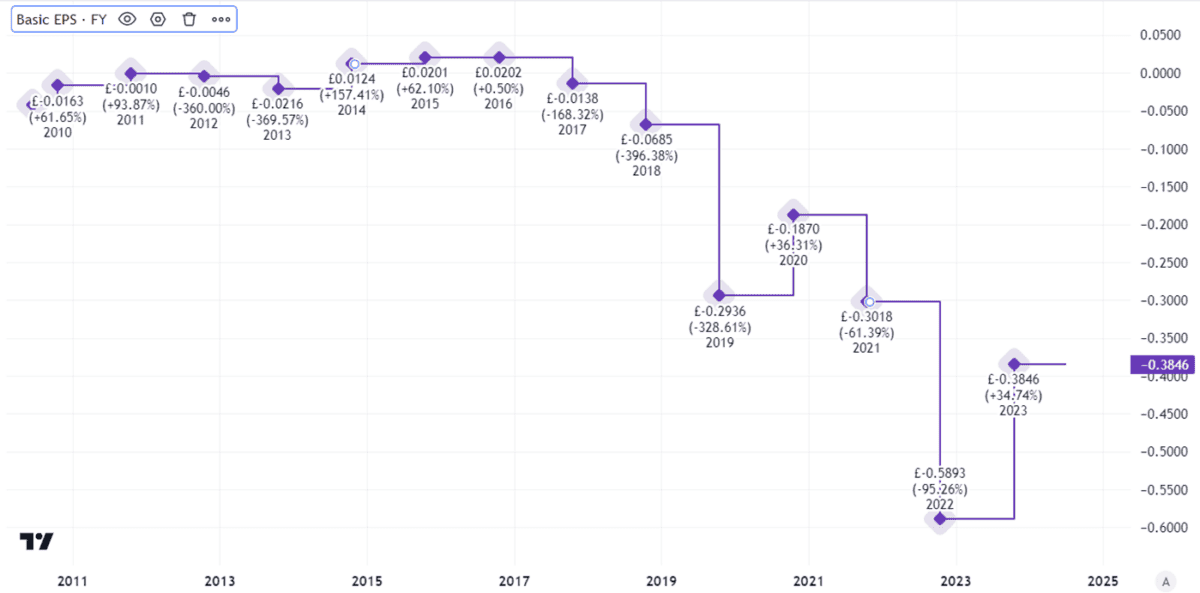

Purple ink in abundance

That is the place I believe the funding case for Ocado appears weaker.

Sure, it has a rising buyer base and spectacular proprietary know-how. However on the finish of the day, whereas the Ocado outsourcing enterprise depends on tech (that has been costly to construct) it’s also closely depending on the corporate constructing and working plenty of distribution centres. Once more, that’s costly.

Add into the combo the truth that it wants to try this in numerous areas worldwide and it turn into obvious why the corporate has been spilling plenty of crimson ink up to now few years.

The story is fairly clear from the agency’s primary earnings (or losses) per share.

Created utilizing TradingView

To assist counter the prices, the corporate has issued extra shares, diluting present shareholders to lift funds. I see that as a danger for future too.

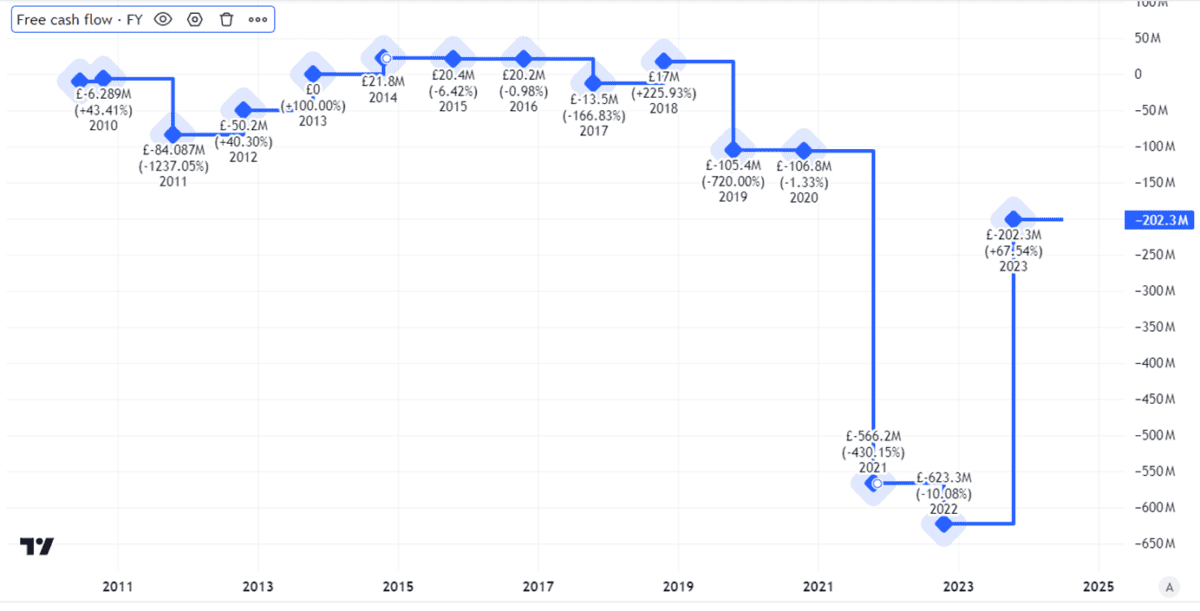

However regardless of the influx of money from that, the general free money stream has nonetheless been closely destructive of late.

Created utilizing TradingView

Tons nonetheless to show

That funding in infrastructure may repay because it permits Ocado to ship on decades-long buyer contracts.

If free money flows enhance markedly and the enterprise can show its mannequin is ready to generate earnings constantly, I reckon right now’s Ocado share worth may develop into a cut price.

That has not but been confirmed, although.

The funding case stays closely tied to purchasing into Ocado’s concept of what it needs to do, relatively than the present monetary efficiency.

Not solely does that specify right now’s Ocado share worth, it may additionally imply that if the thought can’t be convincingly confirmed to be a cash spinner, the share could also be overvalued even at its present stage.

I’ve no plans to purchase.