Picture supply: Getty Photos

It’s at all times a bit surreal when an organization in your Shares and Shares ISA begins trending big-time the world over. That’s what occurred to me not too long ago with cybersecurity agency CrowdStrike (NASDAQ: CRWD).

That is the kind of firm that I would like working behind the scenes, holding its prospects secure from cyber threats with its cloud-native Falcon platform. If its identify is out of the blue on everybody’s lips, then I’d assume a large cyberattack has taken place.

As we all know although, that’s not what occurred a couple of days in the past. A defective software program replace crashed 8.5m Microsoft Home windows computer systems, disrupting flights, banks, TV channels, and hospitals around the globe. It was the largest IT outage in historical past.

Following this, the CrowdStrike share value has dropped 23%. Is that this an opportunity for me to purchase extra shares?

A family identify (for the flawed motive)

The very first thing to notice is that there’ll clearly be significant claims from this epic failure. Delta Air Traces, for instance, has needed to cancel greater than 4,000 flights.

This occasion even brought about volatility among the many largest cyber underwriters throughout the first and reinsurance markets. Barclays stated: “At present, due to the short duration of the accident and the non-malicious nature of it, we would expect [insurance] industry impact of $1bn or less.”

As disruptive as this was, and positively embarrassing for CrowdStrike, a large-scale cyberattack would have been worse. That will have destroyed belief within the firm’s defensive capabilities.

Then once more, there’s nonetheless the unquantifiable reputational harm. That may take time to measure.

What we do know is that Elon Musk has stated that Tesla has already deleted CrowdStrike from its techniques. Others might but comply with and that may clearly influence the corporate’s progress prospects.

An essential platform

Stepping again although, the widespread influence of this occasion highlights how essential the corporate’s endpoint safety platform has change into. It now serves 538 of the Fortune 1000 corporations, whereas its synthetic intelligence (AI) expertise will get smarter because it consumes extra information.

Between FY19 and FY24 (which resulted in January), income grew by greater than 10 instances.

In Q1 FY25, the corporate generated report free money movement of $322m, up from $227m a yr in the past. That was 35% of its $921m in income, which grew 33%.

It’s been rolling out extra AI options, with 28% of its prospects adopting seven or extra of its 28 cloud modules, up from 23% a yr earlier.

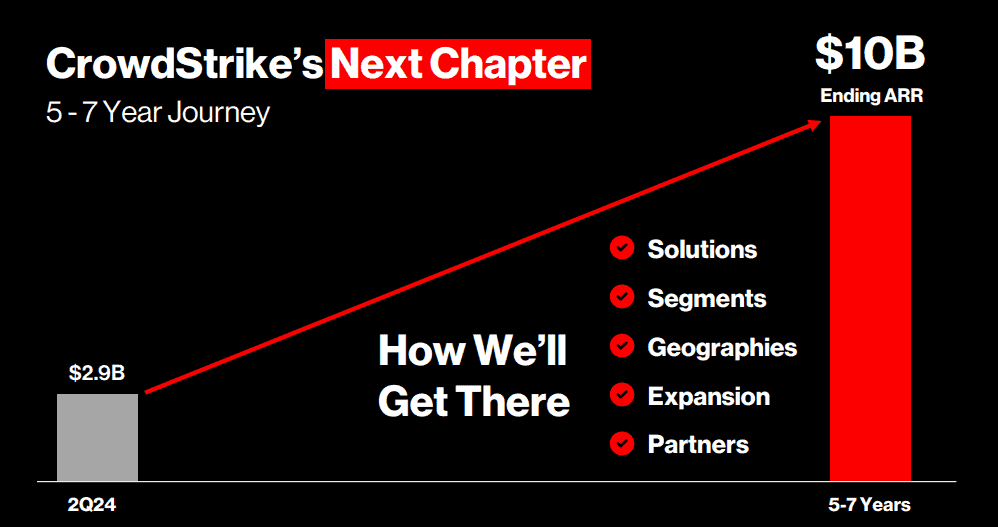

Trying forward, the agency is concentrating on $10bn in annual recurring income (ARR) over the subsequent 5 to seven years. On the finish of Q1, ARR stood at $3.65bn.

After all, this goal was made earlier than the software program replace debacle.

My transfer

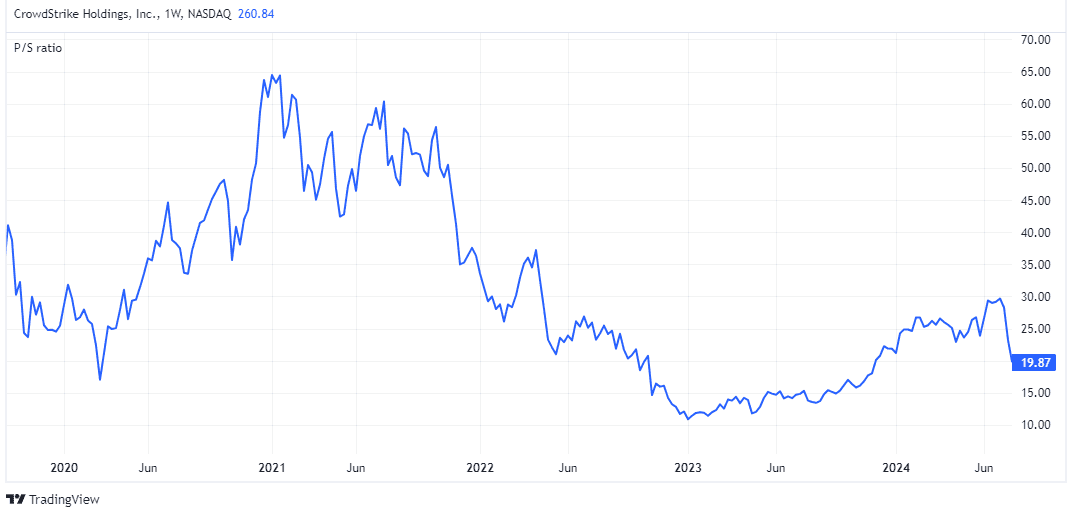

CrowdStrike is buying and selling at round 20 instances gross sales, even after the 23% drop. So this stays a really costly inventory — one priced for perfection.

Nonetheless, issues aren’t excellent. Development charges may drop off if there are points with renewals and attracting new prospects. In the meantime, the agency might have to supply some value concessions or redesign how its software program interacts with units, placing strain on near-term profitability.

Nonetheless, this stays a best-in-breed cybersecurity inventory. If it retains on falling, I’ll contemplate investing more cash. However I’d desire to attend for Q2 in August to listen to administration converse.