- Analyst Ki Younger helps shopping for Bitcoin at $100K anticipating a $145K worth.

- A number of metrics pointed $100K as the extent to propel BTC to $160K.

As Bitcoin [BTC] continued to indicate power, CryptoQuant analyst Ki Younger posed a well timed query on X – Do you have to purchase Bitcoin at $100K?

Ki Younger’s first key consideration within the guidelines was if potential consumers questioned whether or not they would remorse not buying if Bitcoin climbed to $145K.

Additionally the readiness of potential consumers for a attainable bear market and the power to face up to corrections of over 30% with out panic promoting.

He added that the long-term dedication was additionally essential, suggesting a minimal holding interval of 1 12 months.

Why $100K degree is vital

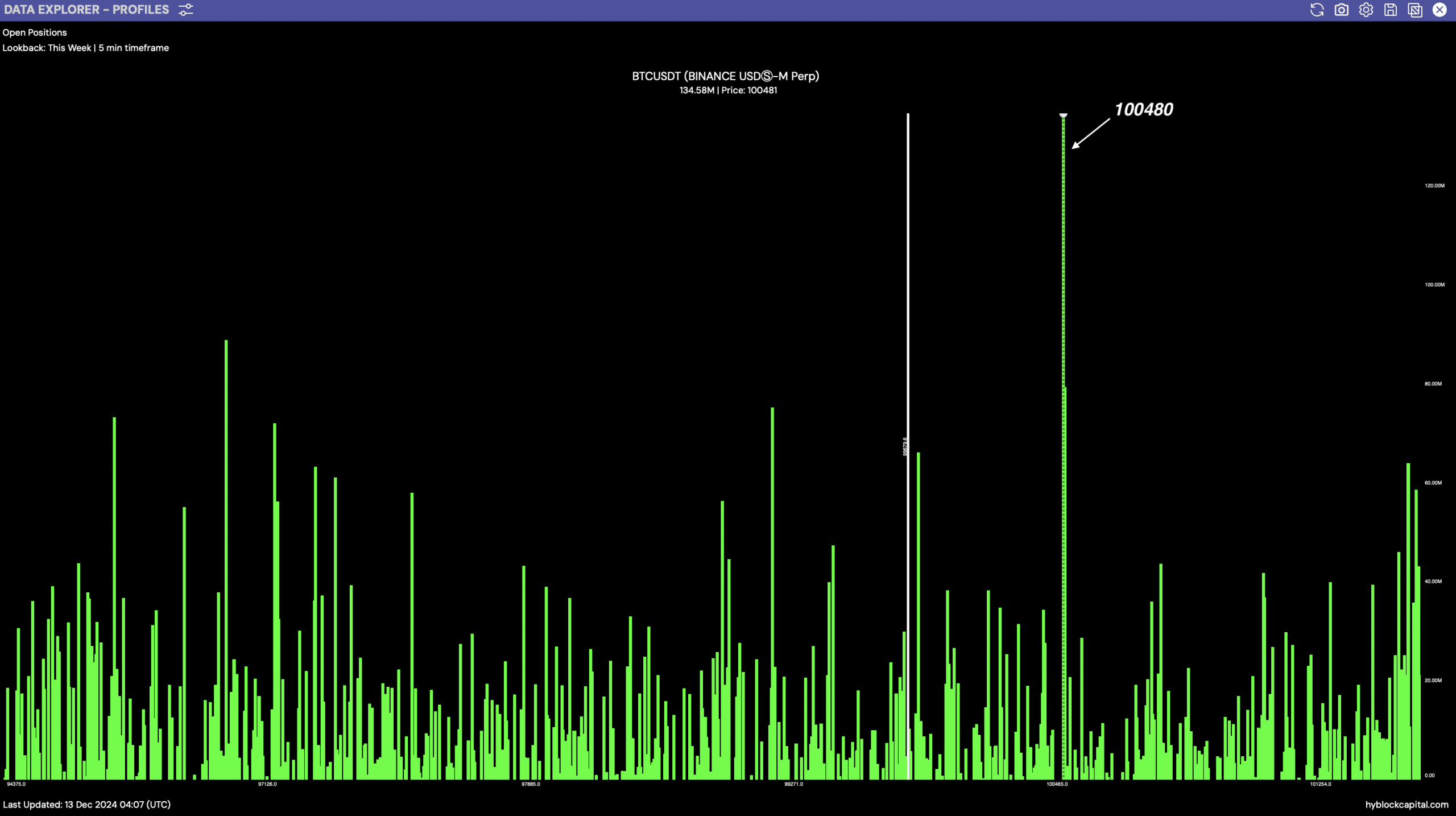

Evaluation of Bitcoin’s open positions over the previous week confirmed focus on the $100,480 worth degree.

This particular level registered the height variety of open contracts and could possibly be essential for Bitcoin’s worth motion. The emphasis on this degree prompt it as a key space for merchants, indicating sturdy curiosity and attainable rivalry between consumers and sellers.

Supply: Hyblock Capital

There have been various actions throughout different worth ranges, however none matched the depth seen at $100,480.

This focus of open positions might function both help or resistance, influencing Bitcoin’s worth motion if examined. The patterns typically signaled key psychological and strategic market thresholds, the place future worth actions might pivot.

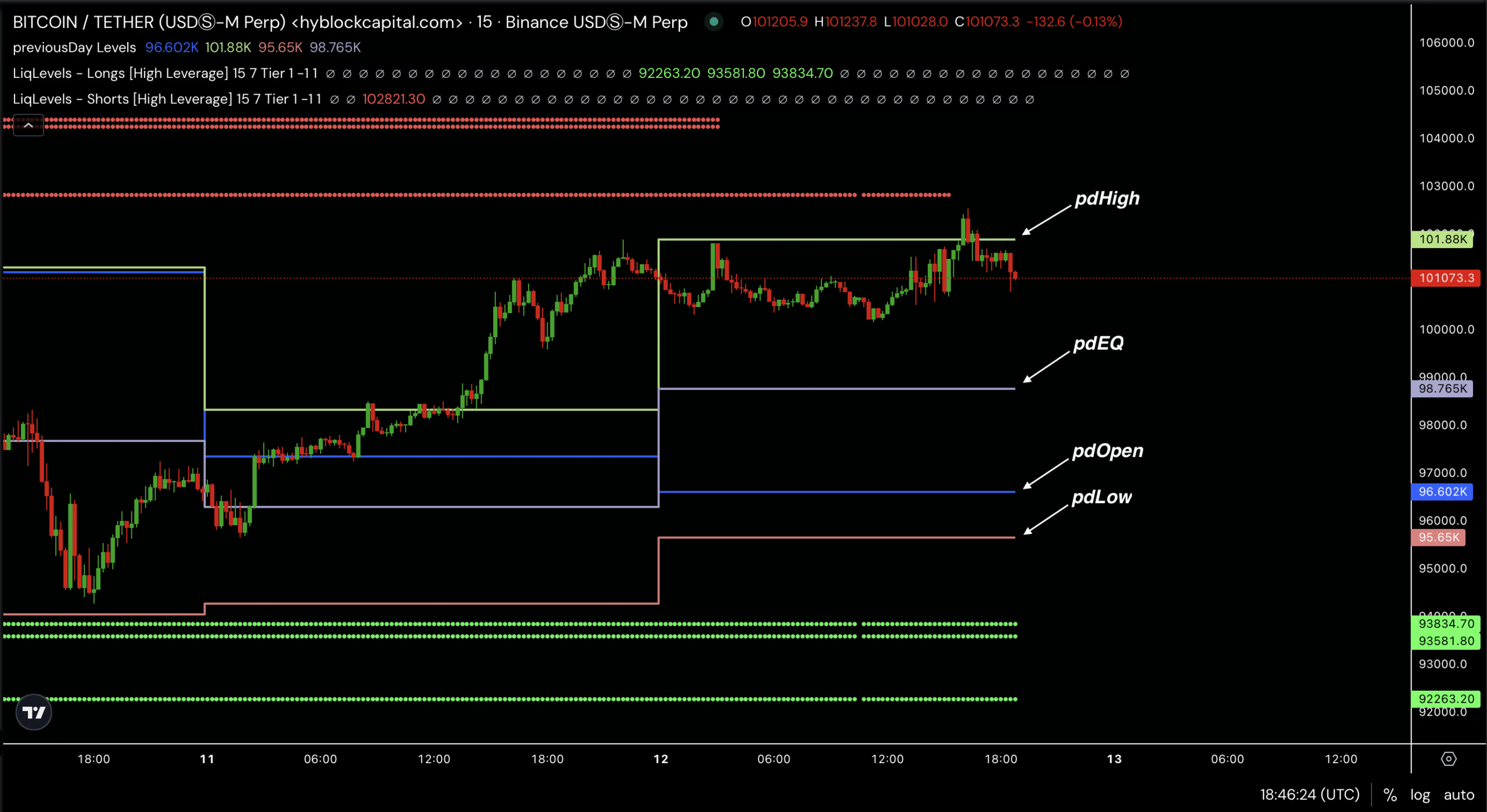

Additional evaluation confirmed that the value remained beneath the day prior to this’s excessive at $101,888.

This degree, alongside the high-leverage brief liquidity ranges, fashioned a resistance space which BTC briefly approached earlier than retracing, indicating a wrestle to interrupt increased.

Supply: Hyblock Capital

The liquidity ranges prompt that $100K was a pivotal degree offering merchants with insights for potential excessive reward-to-risk entry factors.

BTC worth prediction

Bitcoin consolidated for a interval of eight months, embarking on a considerable ascent. This part served as a buildup earlier than BTC skilled a breakout.

Traditionally, such patterns prompt potential additional features. Subsequently, analysts speculated that Bitcoin might climb in the direction of $145K and even perhaps attain as excessive as $160K on this cycle.

Supply: Buying and selling View

BTC might surge if it sustains momentum past the breakout part, coupled with elevated market participation and favorable macroeconomic situations.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

The steep uptrend bolstered the sentiment that Bitcoin’s earlier long-term consolidation was a prelude to extra vital features.

Bitcoin might both check resistance ranges or set up new help zones, pivotal for its pathway to probably attain $160,000.