- Brief-term holders started to build up giant quantities of BTC.

- Whale accumulation of BTC slowed down.

Bitcoin [BTC] witnessed a large bump in worth over the previous couple of days, inflicting a surge in optimism amongst merchants. Nevertheless it wasn’t simply merchants that have been displaying optimism round BTC.

Brief time period holders transfer in

In the previous couple of days, the Brief Time period Holders (STH) provide noticed a web improve of over 20,000 Bitcoin.

U.S. ETFs collected 11,000 Bitcoin throughout the identical interval, even when contemplating outflows from the Hong Kong ETFs. This instructed vital demand from different sources, as mirrored within the worth motion.

This elevated demand from STHs creates a optimistic suggestions loop. As extra folks purchase in, the value goes up, attracting much more consumers. This will speed up worth will increase.

Nevertheless, it’s essential to keep in mind that STHs are usually extra more likely to promote rapidly on worth dips, probably resulting in larger volatility.

So, whereas STH accumulation is a optimistic signal for Bitcoin’s short-term momentum, it may have an effect on BTC’s long run progress.

Supply: glassnode

What are holders as much as?

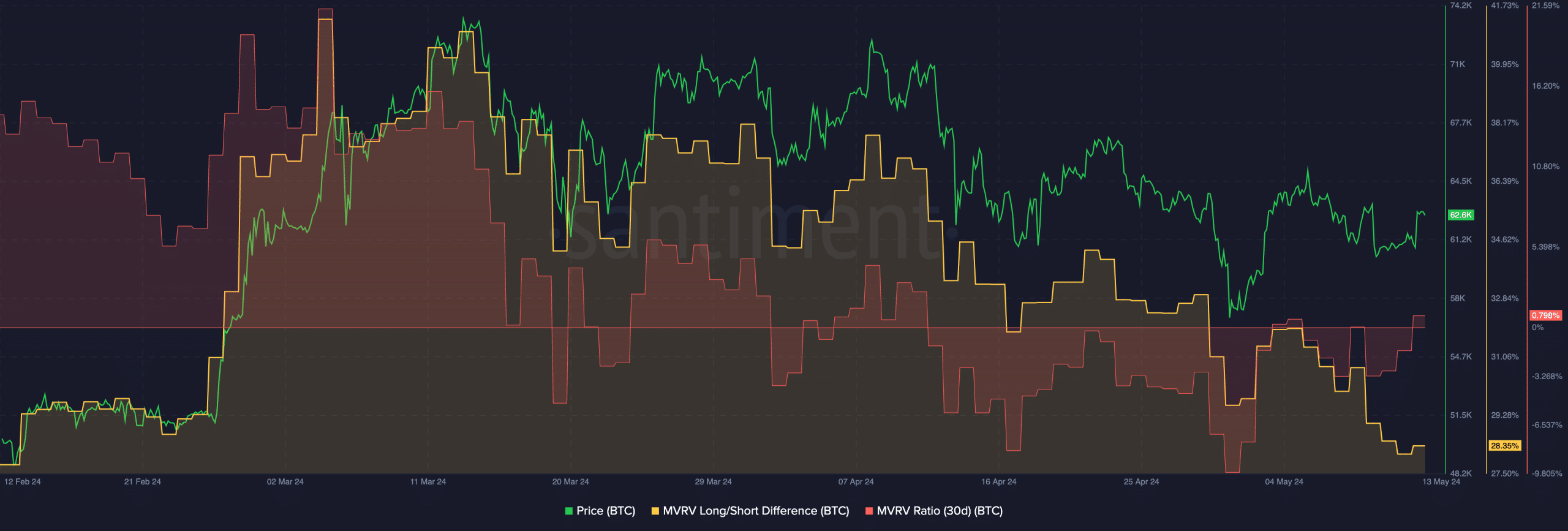

One other indicator of the rising variety of Brief Time period Holders could be the declining Lengthy/Brief ratio. A falling lengthy/quick ratio instructed that the variety of long-term holders accumulating BTC have been declining.

These long-term holders usually tend to preserve their holdings throughout violent worth fluctuations, which may additionally impression BTC negatively in the long term.

The MVRV ratio for BTC had surged in the previous couple of days, indicating that a lot of addresses holding BTC had turned worthwhile.

This might add promoting stress on BTC, as STHs could also be incentivized to promote their holdings for revenue.

Supply: Santiment

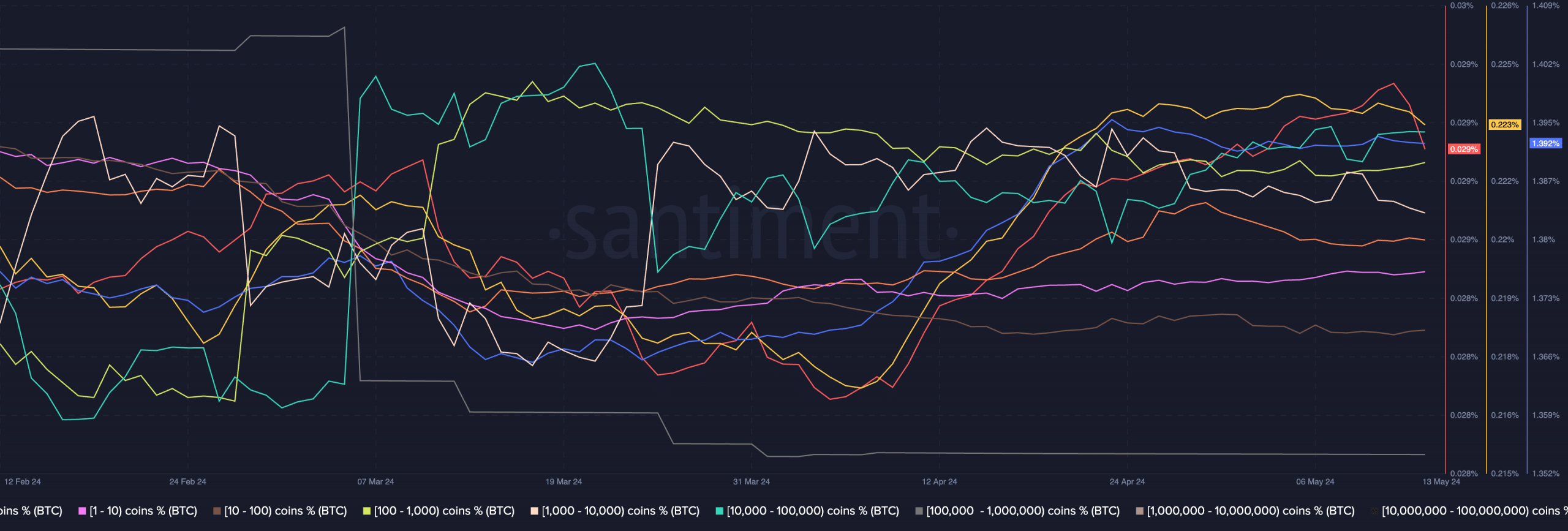

Whale conduct would additionally play an important position in figuring out the value of BTC sooner or later. In the previous couple of days, whales have been stagnant by way of accumulation of BTC.

They haven’t bought any of their holdings, however have proven no real interest in accumulating BTC at this worth stage.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Retail merchants, however, have been noticed to purchasing Bitcoin en masse, which can have additionally contributed to the current surge in BTC’s worth.

On the time of writing, BTC was buying and selling at $67,110.39 and its worth had grown by 1.17% within the final 24 hours.

Supply: Santiment