- BTC is seeing a worth decline.

- The decline has not deterred whales from accumulating.

Crypto whale accumulation of Bitcoin [BTC] has picked up considerably within the final month.

Information indicated that these massive holders have gathered a considerable quantity of BTC, which has led to a rise within the worth of their holdings.

This pattern advised that high-net-worth traders are displaying renewed confidence in Bitcoin, presumably anticipating future worth will increase.

Crypto whale benefit from worth drops

In line with knowledge from Lookonchain, a specific crypto whale handle intensified its Bitcoin accumulation simply because the earlier month was ending.

In two days, this whale gathered a complete of 5,800 Bitcoin, valued at almost $400 million.

Particularly, the handle withdrew 1,300 BTC on the thirty first of July, following a withdrawal of 4,500 BTC the day gone by. This accumulation occurred throughout a interval when Bitcoin’s worth skilled consecutive declines.

From the twenty ninth to the thirty first of July, the BTC worth chart confirmed a downward pattern. Regardless of this decline, the whale’s vital accumulation signifies a bullish stance by large-scale traders.

Worth of crypto whale holdings enhance

In line with knowledge from IntoTheBlock, July noticed a big enhance in Bitcoin holdings by crypto whales, marking a notable accumulation interval.

Particularly, addresses that personal at the very least 0.1% of BTC’s circulating provide added over 84,000 BTC to their holdings.

This accumulation represents the most important single-month tally in BTC phrases since October 2014, highlighting a considerable enhance in whale exercise.

Supply: IntoTheBlock

Additional evaluation revealed that accounts holding over $10 million value of BTC have additionally seen a rise within the worth of their holdings over latest months.

The rise culminated in a big uptick on the finish of the final month.

In consequence, the holdings of those addresses have now reached almost $800 billion.

This determine accounts for over half of Bitcoin’s present market capitalization, underscoring the substantial affect that these massive holders have in the marketplace.

This pattern of accumulation by whales can point out bullish sentiment amongst key market individuals, as they might anticipate greater costs sooner or later or see present ranges as undervalued.

Whales maintain a 1% benefit

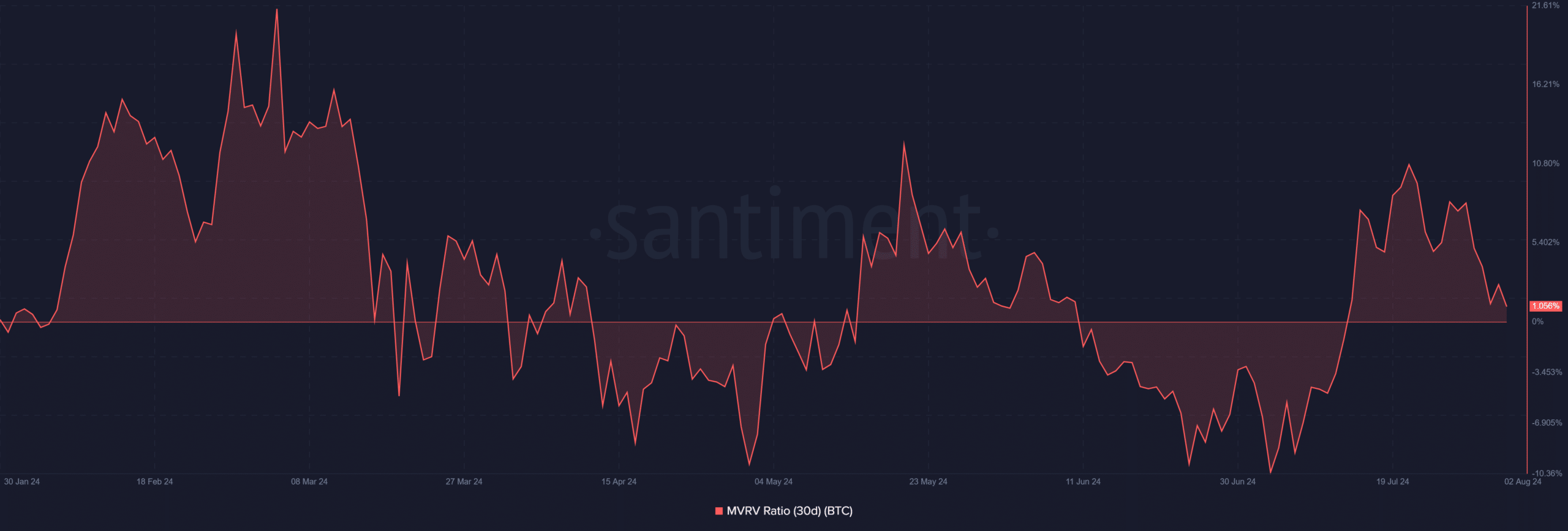

The evaluation of the Bitcoin Market Worth to Realized Worth (MVRV) ratio revealed a slight enhance to only over 1% at current.

A latest deep dive into the info indicated that though the MVRV ratio had seen a stronger determine, it skilled a decline not too long ago.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nonetheless, it’s noteworthy that the ratio began the month under 1% and subsequently rose, reaching a peak of 10.75% at its highest level this month earlier than experiencing a decline.

Supply: Santiment

Because the MVRV ratio was above 1% at press time, it indicated that, on common, crypto whales that gathered Bitcoin not too long ago nonetheless held their investments with a revenue margin of over 1%.