- Promoting strain on Bitcoin and Ethereum elevated.

- SOL and DOGE additionally witnessed over 4% worth declines prior to now 24 hours.

After fairly a couple of days of promising upticks, the crypto market witnessed main corrections as a number of high cash tumbled.

Due to this fact, AMBCrypto deliberate to take a better take a look at the states of high cryptos like Bitcoin [BTC], Ethereum [ETH], Solana [SOL], and Dogecoin [DOGE] to learn how the crypto week forward may seem like.

Bitcoin’s week forward

Firstly, AMBCrypto examined the king of cryptos’ efficiency. As per CoinMarketCap, after a cushty rise, BTC witnessed a correction within the final 24 hours as its worth plummeted by greater than 5%.

At press time, it was buying and selling at $59,451.39 with a market capitalization of over $1.18 trillion.

A attainable motive behind this current downturn might be an increase in promoting strain.

Our take a look at CryptoQuant’s information revealed that Bitcoin’s web deposit on exchanges was excessive in comparison with the final seven-day common, suggesting that traders have been promoting BTC. In the meantime, its aSORP turned inexperienced.

This indicated that extra traders have been promoting at a loss.

In the midst of a bear market, it will probably point out a market backside.

Supply: CryptoQuant

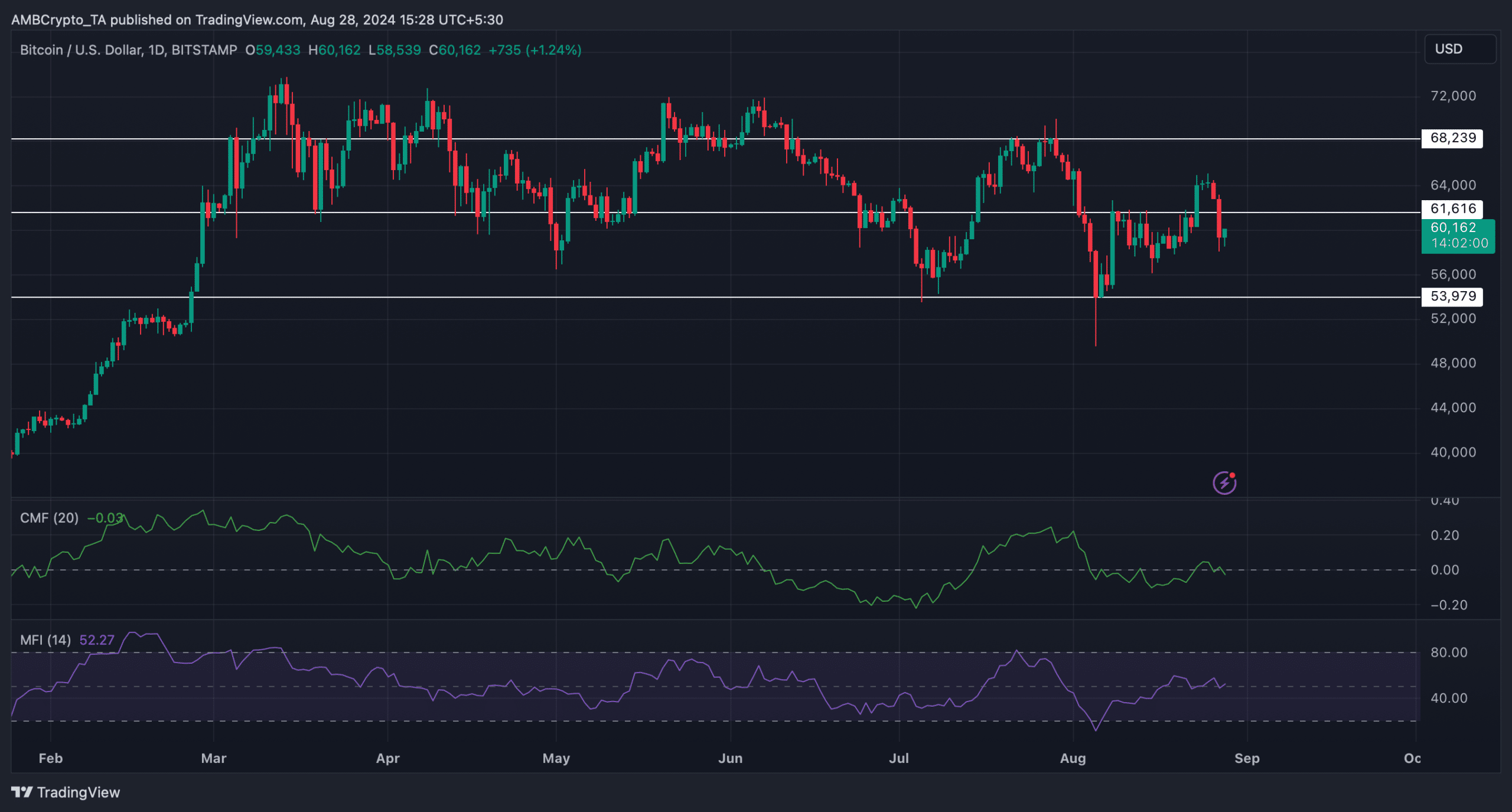

Due to this fact, AMBCrypto checked BTC’s each day chart to seek out whether or not issues may flip bullish once more. As per our evaluation, the Chaikin Cash Stream (CMF) remained bearish.

Nonetheless, the Cash Stream Index (MFI) gave hope of a pattern reversal because it registered a slight uptick. This may permit BTC to retest $61.6k this week.

Supply: TradingView

Altcoins: Assessing the crypto week forward

Subsequent, AMBCrypto deliberate to evaluate the state of high altcoins, starting with Ethereum. ETH’s final 24 hours have been worse than BTC’s, because the token’s worth plunged by over 7%.

On the time of writing, ETH was buying and selling at $2,543 with a market cap of over $306 billion. Like BTC, ETH’s web deposit on exchanges was additionally excessive in comparison with the final seven-day common, hinting at rising promoting strain.

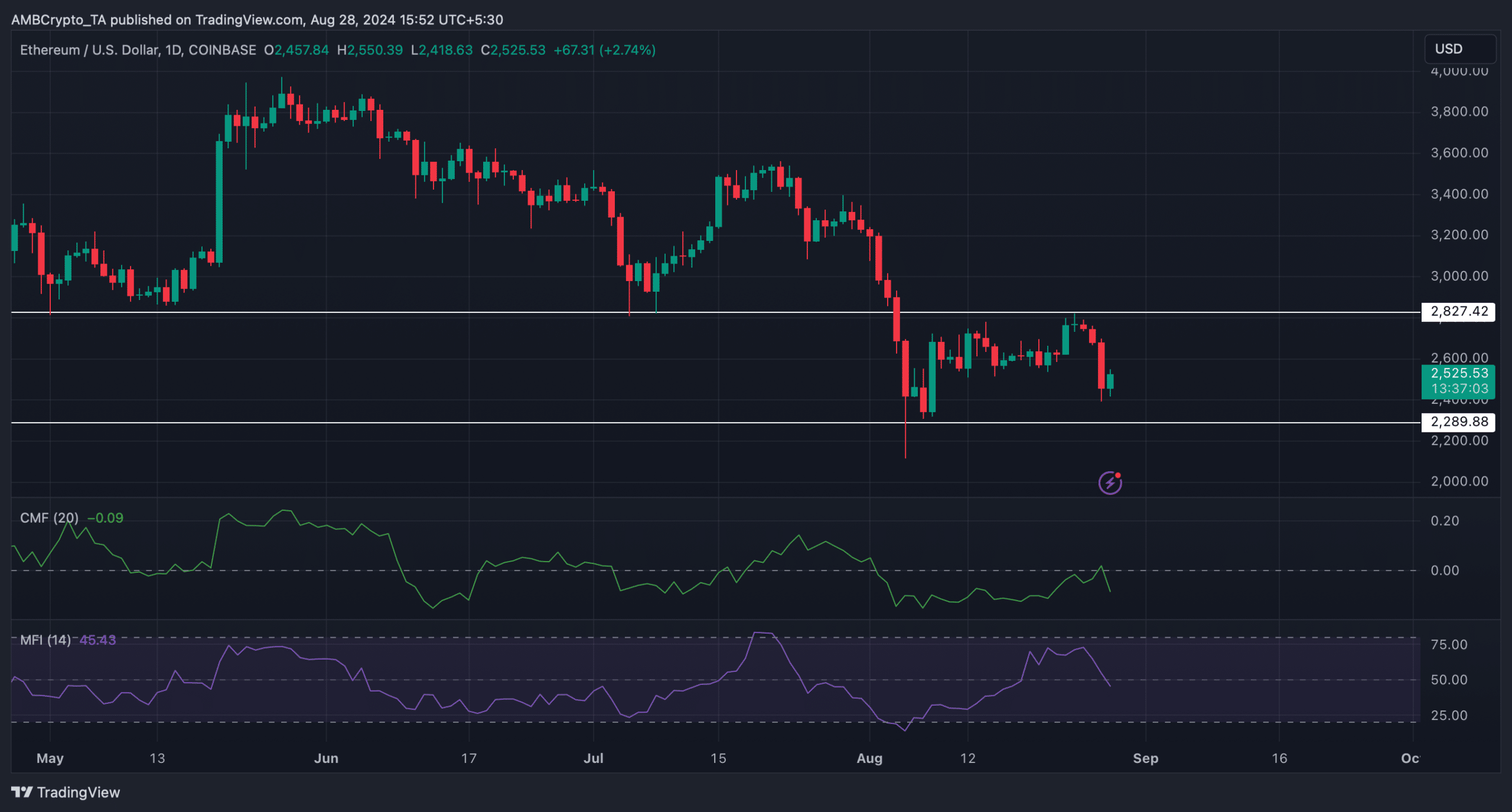

If the promoting strain pushes ETH down additional, then the token may drop to $2.28k this week. The possibilities of that taking place appeared possible as each the CMF and MFI registered downticks.

Nonetheless, if the bulls handle a comeback, then ETH may first goal $2.8k.

Supply: TradingView

Solana bears additionally dominated the market within the final 24 hours because the token’s worth dropped by greater than 4%. At press time, it was buying and selling at $146.99 with a market cap of over $68 billion.

Our evaluation of Hyblock Capital’s information revealed that if the bearish rice pattern continues, then traders may witness SOL dropping to $140.

Supply: Hyblock Capital

Learn Solana’s [SOL] Worth Prediction 2024–2025

Final however not least, AMBCrypto checked how DOGE, the world’s largest memecoin, was doing. Not a lot of a shock, DOGE additionally witnessed a 4% drop through the previous day.

At press time, it had a worth of $0.1009. As per our evaluation, a continued worth drop may push DOGE all the way down to $0.09. Nonetheless, if bulls step up their sport, then Dogecoin may contact $0.11 this week.

Supply: Hyblock Capital