- Bitcoin and Ethereum have been possible headed for his or her native highs this week.

- The band of resistance under $70k might pose a considerable impediment to the consumers.

Bitcoin [BTC] managed to climb previous the resistance zone at $60k-$61k and was buying and selling a couple of {dollars} under $63k at press time. Merchants have taken this as an indication that Bitcoin is headed towards its all-time excessive at $73.7k.

Promoting strain on BTC from the German authorities was depleted and spot ETF inflows final week have been strongly constructive, establishing a pleasant surroundings for a value rebound.

This sentiment noticed a constructive uptick on Monday, however right here’s what is probably going in retailer subsequent.

Utilizing the liquidation charts as a compass

Supply: Hyblock

In a put up on X (previously Twitter) crypto analyst CrypNuevo highlighted two situations for Bitcoin within the coming days. One among them was invalidated, which was a rejection from the previous vary lows at $60k.

The opposite was that the $60.6k resistance zone was flipped to help and retested earlier than the costs sure larger towards the $68k and $73k resistance zones.

These are the 2 liquidity swimming pools to be careful for larger, with $76.4k being one other zone that might set off a considerable amount of quick liquidations.

This expectation got here as a result of the decrease timeframe market construction would flip bullishly, and the liquidity ranges to the north can be the following goal after looking the $55k zone earlier this month.

Supply: CrypNuevo on X

A retest of the $61k-$62k area could possibly be a set off for bullish merchants to enter lengthy positions concentrating on the $72k-$73k zone.

A rise of $3.4 billion in Open Curiosity for the reason that thirteenth of July indicated bullish sentiment. Therefore, merchants can count on a constructive crypto week forward.

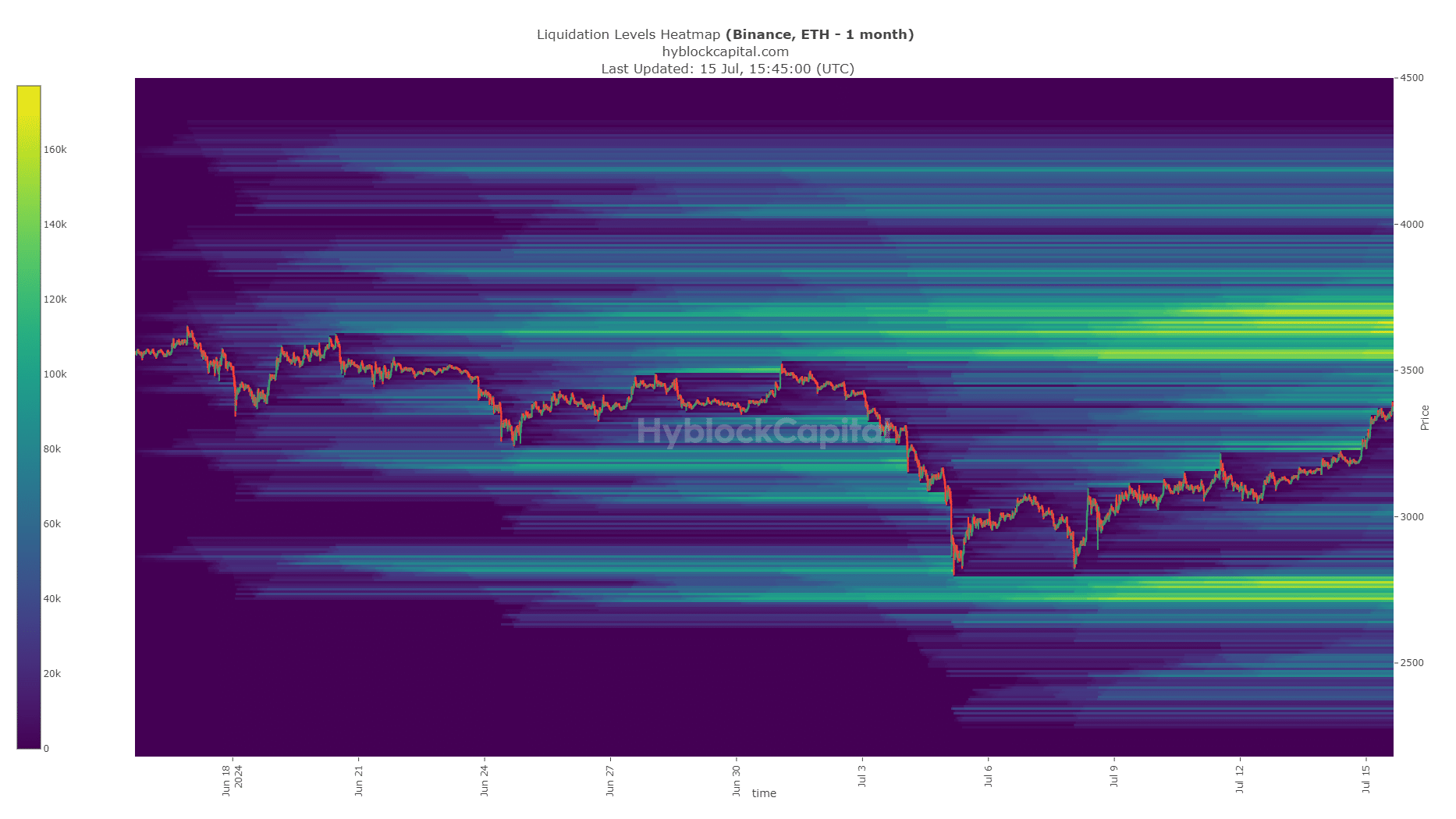

Ethereum additionally targets the native highs

Supply: Hyblock

The Ethereum liquidation heatmap confirmed that $3.5k-$3.7k is prone to be revisited quickly.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This was one other constructive improvement because the ETH bulls defended the $2.9k stage, the 61.8% Fibonacci retracement stage, and initiated a restoration from there.

A transfer towards $3.7k and as excessive as $4k was doable within the coming weeks. Over the following week, a transfer to $68k for Bitcoin and $3.7k for Ethereum was possible based mostly on the proof at hand.