- BTC’s pump in the direction of $70K stalled forward of earnings season and US financial knowledge.

- Analysts consider whether or not BTC will breach the $70K psychological stage this week.

After a formidable run in the direction of $70K, Bitcoin [BTC] faltered and slipped beneath $67K throughout Monday, twenty first October, US hours.

The early-week cool-off mirrored nervousness within the US inventory market, which sank forward of this week’s earnings season for key corporations.

However BTC may stay range-bound in the direction of the weekend on what QCP Capital projected may change after the market will get a clearer Fed price path.

The buying and selling agency mentioned,

“Expect some sideways action until Thursday’s PMI numbers, which may offer clues on the Fed’s rate path.”

For context, PMI (Buying Supervisor’s Index) is a headline indicator for the state of the US economic system and will gauge November’s Fed price resolution.

Crypto week forward: Will BTC hit a brand new ATH?

At press time, markets had been pricing a 25 bps (foundation level) Fed price reduce within the November assembly. How Thursday’s PMI knowledge will tip the scales and affect BTC stays to be seen.

Supply: CME FedWatch

That mentioned, the US elections had been additionally a key consider BTC’s worth motion. We requested Maria Carola, CEO of crypto trade StealthEX, for her BTC outlook as US elections draw nearer.

Carola informed AMBCrypto that the growing odds of Donald Trump’s win had boosted the current BTC worth rally in the direction of $70K. Nonetheless, she believed BTC may hit new ATH in November however not this week.

“The likelihood of reaching a new all-time high (ATH) this week remains low…In November, Bitcoin will likely surpass ATH, initiating a steady growth towards the next major milestone of $100,000 per coin.”

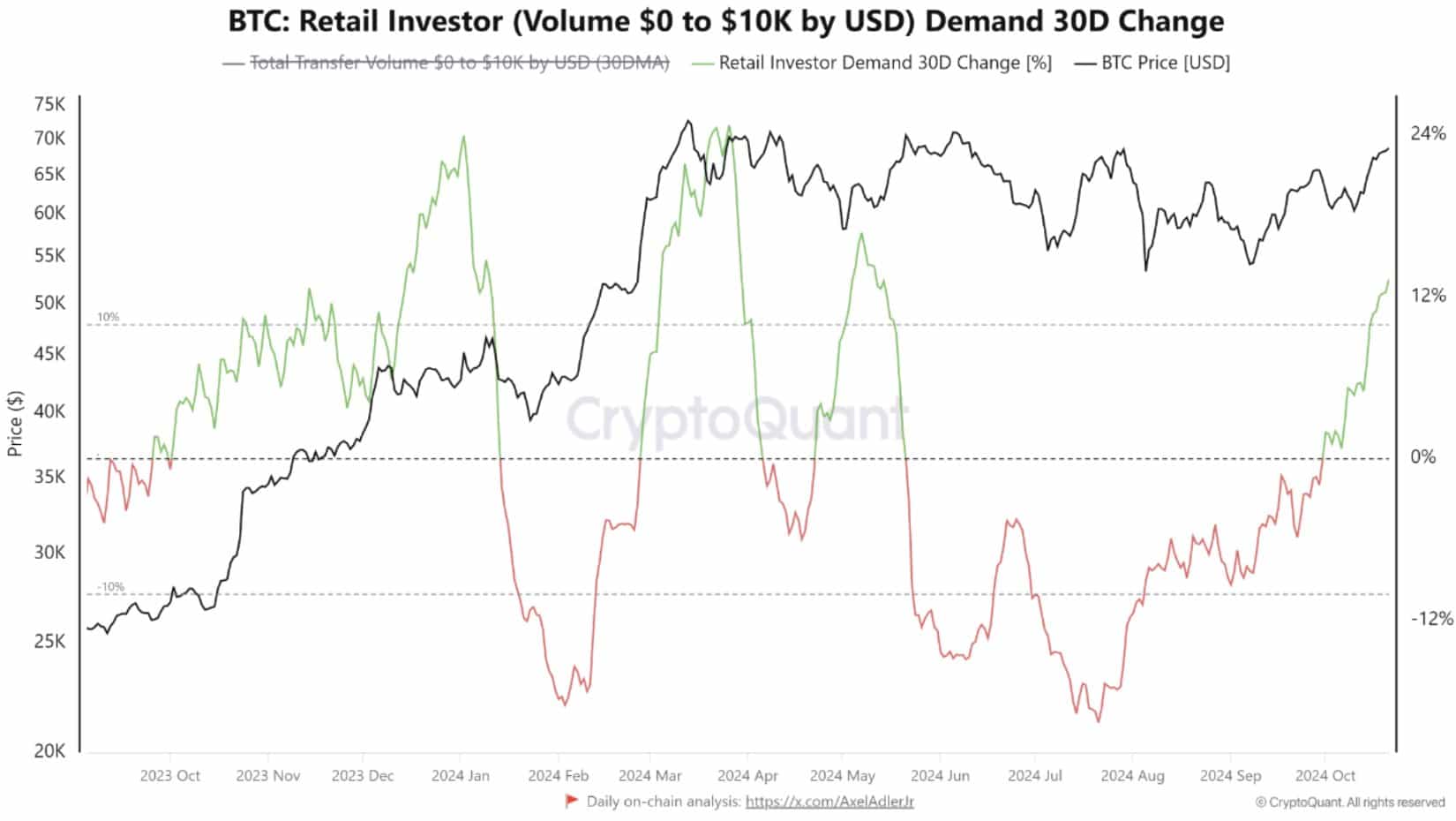

Within the meantime, the current pump in the direction of $70K triggered renewed retail curiosity in BTC.

In response to CryptoQuant, this pattern mirrored the same one in March, simply earlier than BTC hit a brand new ATH.

“In the last 30 days, retail demand grew by about 13%, highlighting a scenario that was only seen in March, when we were close to the last historical high.”

Supply: CryptoQuant

Will the renewed retail curiosity push the rally ahead prefer it did in March?

QCP Capital mentioned extra retail gamers may leap in if BTC breached the $70K resistance.

“Both are nearing key resistance—$70k for #BTC and $2800 for ETH—which could spark major retail interest.”