- Crypto market has reclaimed the $2 trillion mark

- BTC and ETH nonetheless maintain over 60% of the market

The crypto market declined considerably over the previous week, with the full market capitalization dropping under the $2 trillion mark. This decline was accompanied by a surge in lengthy liquidation volumes as costs fell throughout main cryptocurrencies.

Nevertheless, the market is now displaying indicators of a reversal. And, the outlook for the crypto week forward seems constructive, in comparison with the earlier week.

Crypto week forward: Market capitalization

An evaluation of the crypto market capitalization on CoinMarketCap revealed that the market has had bouts of depreciation in current weeks. Probably the most important drop occurred final week, bringing the full market capitalization right down to round $1.9 trillion.

The value drops in main property like Bitcoin and Ethereum primarily drove this decline.

Supply: CoinMarketCap

Nevertheless, it has rebounded over the previous three days, hitting the $2 trillion threshold once more. Together with this restoration, main cryptocurrencies have proven constructive uptrends, suggesting the market might see additional positive aspects within the week forward.

If this development holds, it might start a extra constructive section for the crypto market.

Crypto week forward: Market liquidations

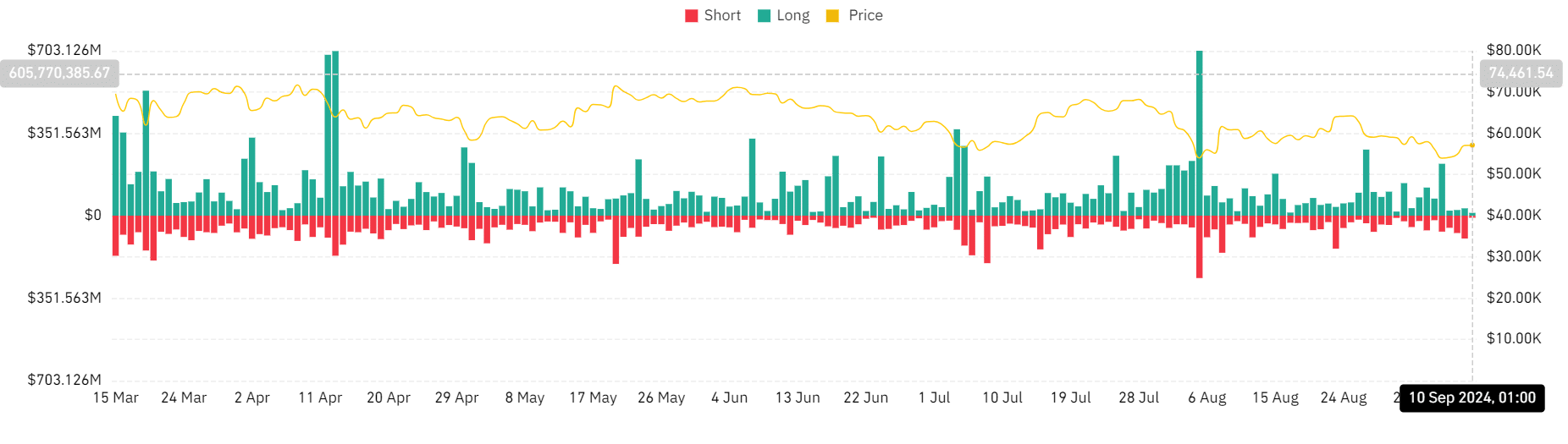

An evaluation of the full liquidations chart on Coinglass revealed that the market noticed a surge in liquidations over the previous week, with lengthy liquidation volumes dominating. This confirmed the noticed market capitalization decline. The info additionally underlined that lengthy liquidations totalled over $520 million, whereas brief liquidations amounted to round $223 million.

Nevertheless, because the market started to get well, the amount of lengthy liquidations fell and brief liquidations noticed an uptick. This shift suggests the market could also be regaining upward momentum and brief positions could also be more and more in danger.

Supply: Coinglass

If this development continues, the week forward will probably be difficult for brief positions. Particularly as rising asset costs could result in extra brief liquidations. With the market displaying indicators of restoration, merchants holding brief positions could face rising strain as bullish sentiment returns.

Bitcoin and Ethereum leads market dominance

An evaluation of the final seven days confirmed that Bitcoin (BTC) has misplaced over 3% of its worth whereas Ethereum (ETH) famous a steeper decline of over 6%. Regardless of these declines, nevertheless, each property proceed to dominate the cryptocurrency market.

Bitcoin’s market capitalization, at press time, was round $1.13 trillion, representing 56.5% of the full crypto market. Ethereum’s market capitalization stood at $282.9 billion, with a dominance of 14.6%.

These two property stay essentially the most influential within the cryptocurrency house, and their worth actions will considerably impression the general market trajectory of the crypto week forward.