- Bitcoin breaks downtrend channel.

- Bitcoin’s prime merchants common leverage delta falls under 2.

Bitcoin [BTC] continues to achieve traction because the crypto markets present indicators of restoration from the current downturn.

Within the hourly timeframe, BTC has lastly damaged out of the downward parallel channel, which has continued since late July 2024. The vary has lasted for greater than 5o days.

The value motion of BTC/USDT has confirmed this a possible turning level for Bitcoin with a textbook retest. The value motion was forming of upper highs and better lows because it approached the breakout resistance.

Usually, when markets consolidate for prolonged durations, a parabolic run usually follows. This might set BTC up for a goal of $75k, barely surpassing its all-time excessive.

Supply: TradingView

A rally towards this essential zone is achievable if market circumstances stay favorable, as BTC has reclaimed the $62k stage and now targets $65k earlier than doubtlessly reaching $75k in This fall 2024 or early Q1 2025.

May this uptrend push BTC to $75k by the tip of the 12 months? Let’s discover the probabilities.

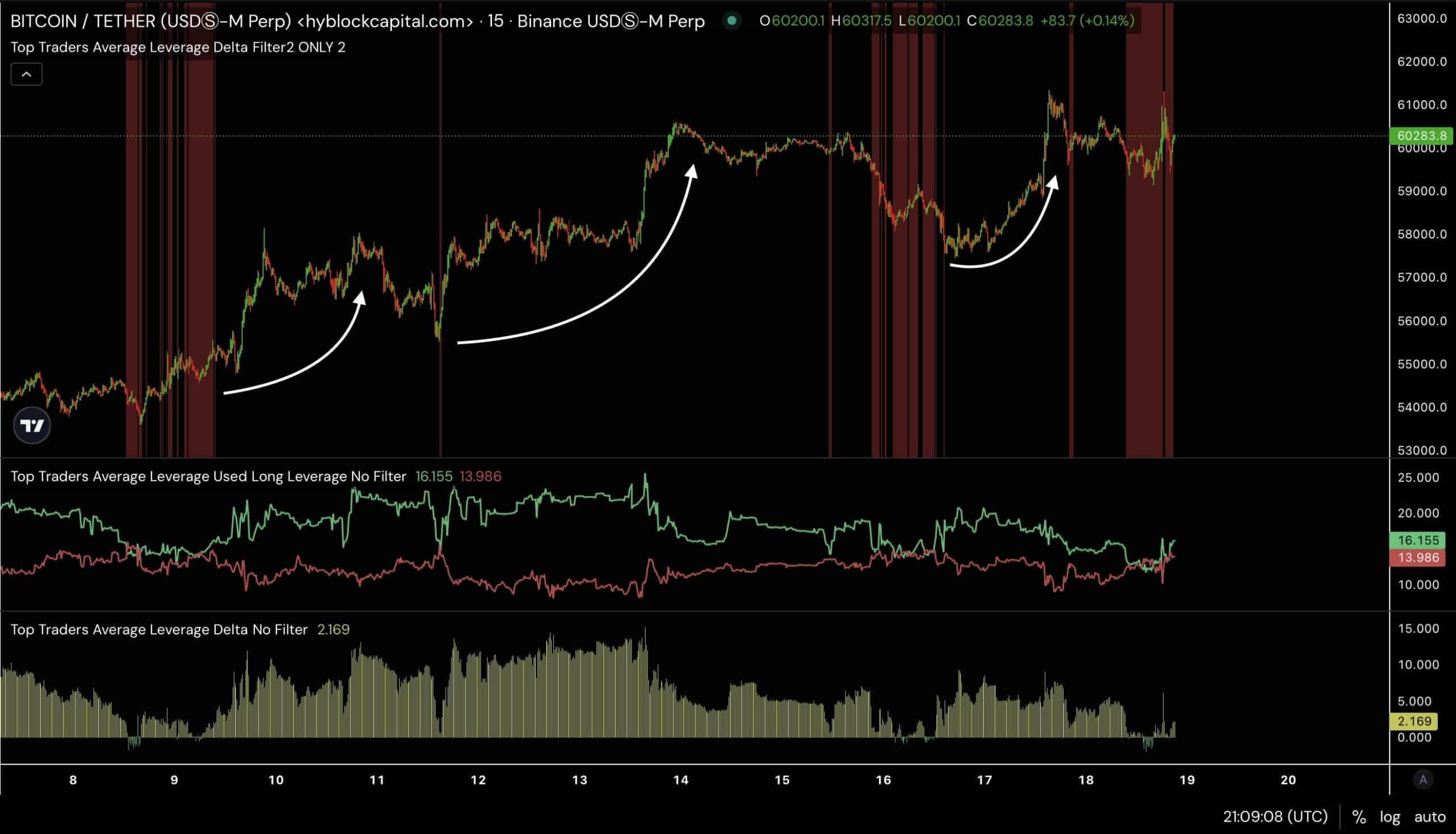

Prime merchants’ Common Leverage Delta alerts…

Traditionally, when the highest merchants’ common leverage delta dips under +2, because it did lately earlier than rising to 2.169, an uptrend has usually adopted.

This provides additional confidence {that a} BTC rally may need begun. The leverage delta for BTC at present sits at +0.49, indicating that the leverage utilized by each longs and shorts is almost equal.

The drop within the prime merchants’ common leverage delta helps the concept BTC/USDT’s breakout from the downward pattern channel might sign the beginning of a bull run.

Supply: Hyblock Capital

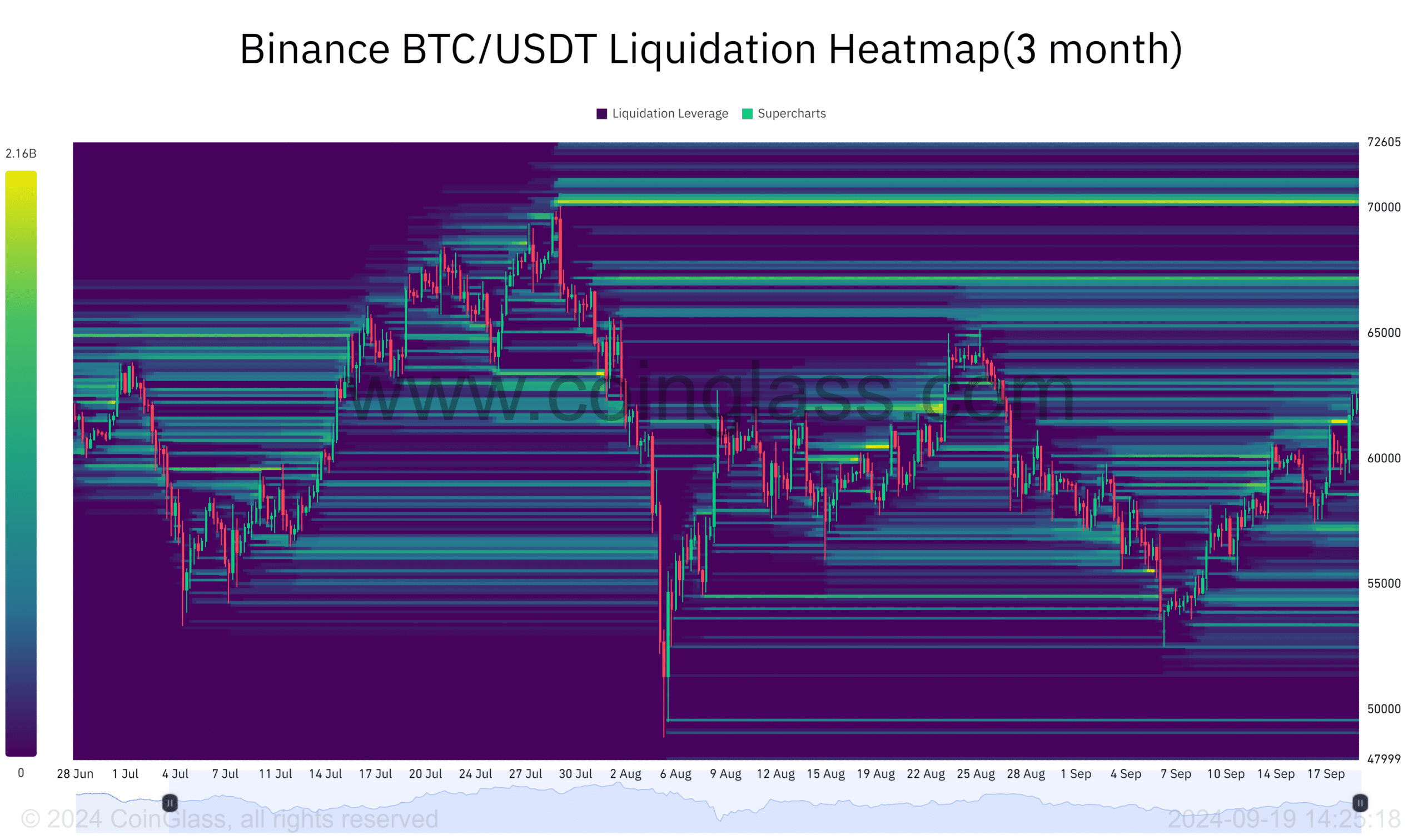

BTC liquidation heatmap

Moreover, Bitcoin’s value usually strikes towards excessive liquidity zones. Merchants liquidated roughly $179.70 million throughout futures markets when BTC reached $61,498.

This liquidation may gasoline additional upward motion as value targets liquidity at larger ranges.

A big liquidity cluster of $730.49 million can be current on the $70182 value stage, with one other $1.3 billion at $67250.

Supply: Coinglass

BTC might climb larger to achieve these liquidity ranges, additional fueling its upward momentum, and doubtlessly reaching the $75k goal.

The common Bitcoin cycle

Moreover, the common Bitcoin cycle traditionally begins 170 days after halving and peaks 480 days afterward.

At the moment, BTC is 151 days post-halving, which locations it lower than 20 days from the historic begin of a post-halving rally.

This cycle sample provides one other layer of confidence to the potential rally towards $75k, alongside the highest merchants’ common delta signaling a bull run.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Supply: X

The crypto market appears poised for a optimistic transfer, pushed by technical alerts and liquidity patterns, which counsel Bitcoin is primed for larger beneficial properties.