Marathon {Digital} (MARA) is among the largest gamers within the Bitcoin mining house, and it has simply unveiled a brand new strategy to managing value of operations.

In a bid to ease monetary pressures and generate returns, the corporate is lending 7,377 BTC, or about 16% of its deposit. This strategic play demonstrates how the cryptocurrency sector is responding to growing vitality prices and intense competitors.

Utilizing Bitcoin For Stability

With almost 45,000 BTC in reserves, or roughly $4.4 billion, MARA’s determination to lend a few of its property comes at a vital time. The corporate has arrange short-term mortgage agreements with dependable third events to generate modest, single-digit returns.

The administration of MARA is assured about their technique, regardless of the dangers inherent in such precautions, particularly within the risky crypto lending business.

There was vital curiosity in @MARAHoldings BTC lending program, so right here’s a bit extra element:

– It focuses on short-term preparations with well-established third events.

– Generates a modest single-digit yield.

– It has been energetic all through 2024.

– The long-term…— Robert Samuels (@RobSamuelsIR) January 3, 2025

This strategy signifies an elevated tendency amongst Bitcoin miners to search for new methods by which they are going to stay worthwhile. As mining grows more and more aggressive, outdated strategies of operation will not be adequate sufficient.

Navigating Dangers In Crypto Lending

The selection to lend out Bitcoin just isn’t with out its share of points. The crypto playbook has seen the failure of a number of high-profile lending platforms prior to now, throwing doubt on such endeavors. To cut back these risks, MARA has highlighted the significance of due diligence and deciding on dependable companions.

Regardless of the problems, leasing Bitcoin permits miners like MARA to generate new income streams, permitting them to fulfill escalating operational prices with out having to liquidate their major asset.

BTCUSD buying and selling at $99,487 on the day by day chart: TradingView.com

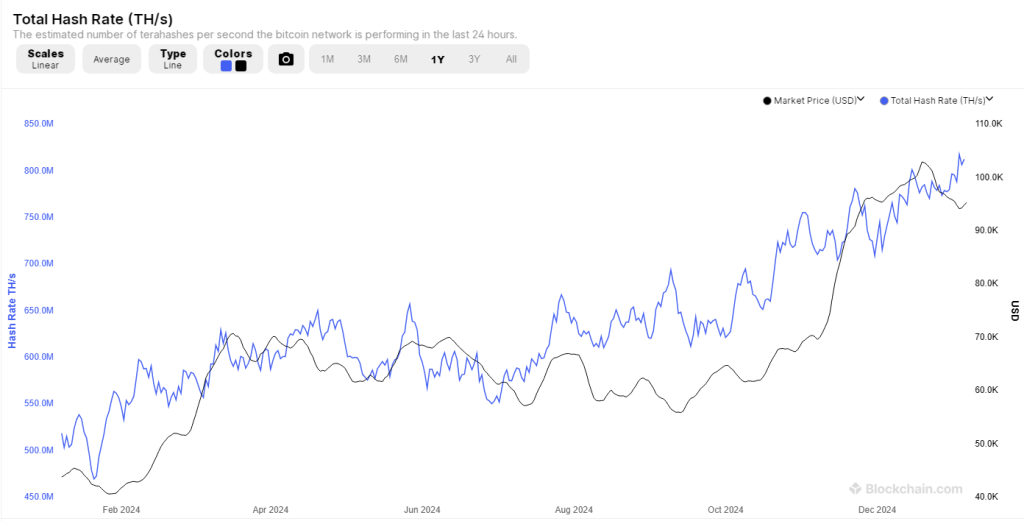

Document-Breaking Hashrate

This occasion happens as Bitcoin’s community hashrate hits new highs, signifying heated rivalry amongst miners. An elevated hashrate pushes vitality consumption up, nevertheless it additionally forces miners to seek out new methods to remain afloat.

As demonstrated by its constant development, MARA can successfully reply to such challenges. From mining to acquisition, the agency has at all times added to its Bitcoin reserves and ensured that it has remained one of many market leaders in crypto mining.

Supply: Blockchain.com

Marathon {Digital} is offsetting prices with calculated dangers. Its newest motion speaks to altering realities within the crypto mining sector, and balancing threat and return would possibly simply make MARA’s determination to lend 7,377 BTC a priority for different miners beneath comparable operational pressures.

By utilizing the Bitcoin property to generate yield, MARA displays resilience within the ever-changing surroundings. Whether or not long-term success on this technique has but to be seen, what is certain, nonetheless, is that MARA’s strategy would possibly affect future mining sector developments.

Featured picture from TokenMetrics, chart from TradingView