- Per Senator Lummis, a 30% tax on Bitcoin mining might push the business exterior the nation.

- She cited the Laffer Curve to warn of lowered tax revenues from elevated mining taxes.

On the twenty third of July, Senator Cynthia Lummis printed a report difficult the Biden administration’s instructed 30% excise tax on the power utilized by Bitcoin [BTC] miners.

Highlighting its potential destructive influence, Lummis’s report titled “Powering Down Progress: Why A Bitcoin Mining Tax Hurts America,” famous,

“This move endangers America’s hard-won leadership position and the future of Bitcoin mining in America.”

Senator Lummis argued that the proposed 30% excise tax on BTC mining power might disrupt America’s quickly rising Bitcoin mining sector.

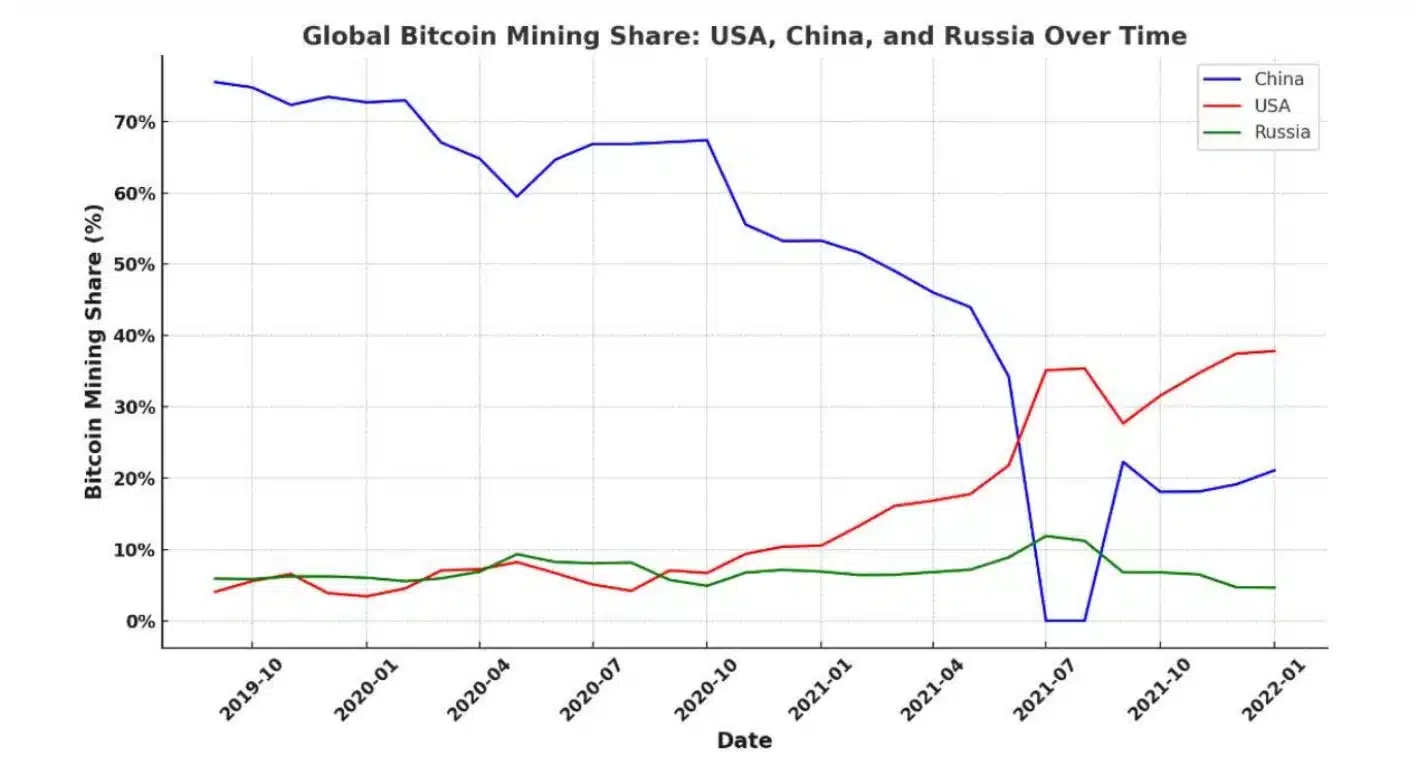

For context, following China’s 2021 ban on BTC mining, the U.S. capitalized on the chance. The States attracted vital investments and expertise, leveraging its robust power market and authorized framework.

Because of this, many main Bitcoin mining operations are actually primarily based within the U.S.

Crypto mining not a risk: Lummis

Lummis warned that this new tax might drive the business abroad, suggesting that the Treasury’s rationale for the tax displays outdated views on power consumption and technological progress.

“The U.S. is now estimated to account for more than 35% of the global BTC “hashrate,” a measure of the computing energy devoted to mining.”

That being stated, Lummis referenced the Bitcoin Vitality and Emissions Sustainability Tracker to argue that BTC mining is extra environmentally pleasant than typically perceived.

In accordance with the tracker, as a lot as 52.6% of Bitcoin mining could possibly be carried out with minimal or zero emissions.

Supply: Batcoinz

She additional added,

“The administration’s proposal claims that Bitcoin mining creates “risks” with native utilities on their grid operations. Nonetheless, it gives no assist for these claims. On the contrary, empirical proof exhibits Bitcoin mining strengthens America’s power grids.”

The Laffer Curve evaluation

In her report’s conclusion, Lummis highlighted the ideas of the Laffer Curve, which illustrated how greater tax charges might result in decrease general tax revenues by discouraging financial exercise.

Supply: Senator Cynthia Lummis report

Reiterating the identical, Lummins, aptly summarized the scenario along with her remark when she stated,

“If America fails to create a supportive and stable environment for Bitcoin mining, we risk squandering the advantages we currently enjoy and may find ourselves playing catch-up in a race we once had every opportunity to lead.”