- The full liquidations throughout the crypto market surpassed $875 million after Bitcoin fell under $100,000.

- Bitcoin lengthy liquidations additionally surged to a document excessive of $416 million.

The cryptocurrency market recorded a large surge in liquidations within the final 24 hours, which worn out over $875 million in leveraged lengthy and quick positions, marking the very best quantity of liquidations since 2021.

Per Coinglass knowledge, lengthy liquidations totaled $702 million whereas quick liquidations got here in at $173 million. These liquidations affected greater than 157,000 merchants.

Supply: Coinglass

Merchants betting on Bitcoin [BTC] gaining additional recorded probably the most losses, with lengthy BTC liquidations reaching $416 million. These positions had been closed after the king coin skilled a sudden spike in volatility, which noticed the value fall from above $100,000 to $92,000 in below 4 hours.

Altcoins additionally noticed a slight spike in volatility. Ethereum [ETH] worth fluctuated between $3,600 and $3,900 inflicting $85 million in liquidations. XRP [XRP] noticed the third-highest stage of liquidations of $40 million whereas Dogecoin [DOGE] recorded $22 million in liquidations.

This sudden surge in liquidated trades and volatility might have been a pressured correction after overleverage induced a market imbalance.

Liquidations surge on account of an overleveraged market

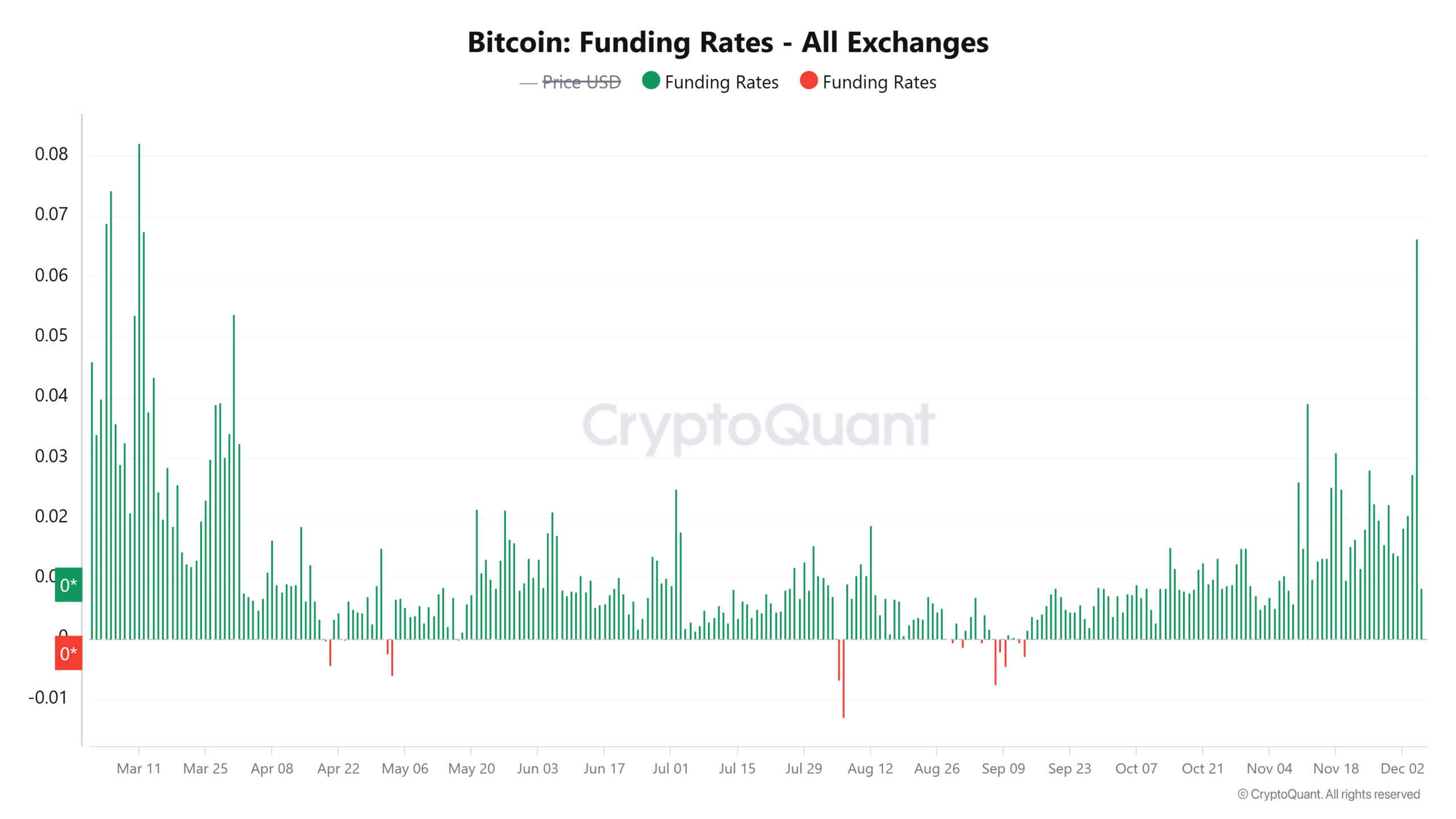

In response to CryptoQuant, Bitcoin funding charges reached a multi-month excessive of 0.0663 on fifth December, suggesting that lengthy positions had been more and more dominant.

Every time funding charges attain excessive ranges, it tends to precede a pointy transfer in the wrong way of which merchants are anticipating the value to go.

Due to this fact, after a buildup of lengthy positions, a protracted squeeze ensued that triggered pressured promoting and induced funding charges to say no.

Supply: CryptoQuant

The estimated leverage ratio clearly reveals the market correction. This metric recorded a pointy rise to a seven-day excessive, as merchants elevated their leverage on Bitcoin. It later declined on account of overleveraged positions being closed.

MVRV ratio reveals there may be nonetheless room for extra beneficial properties

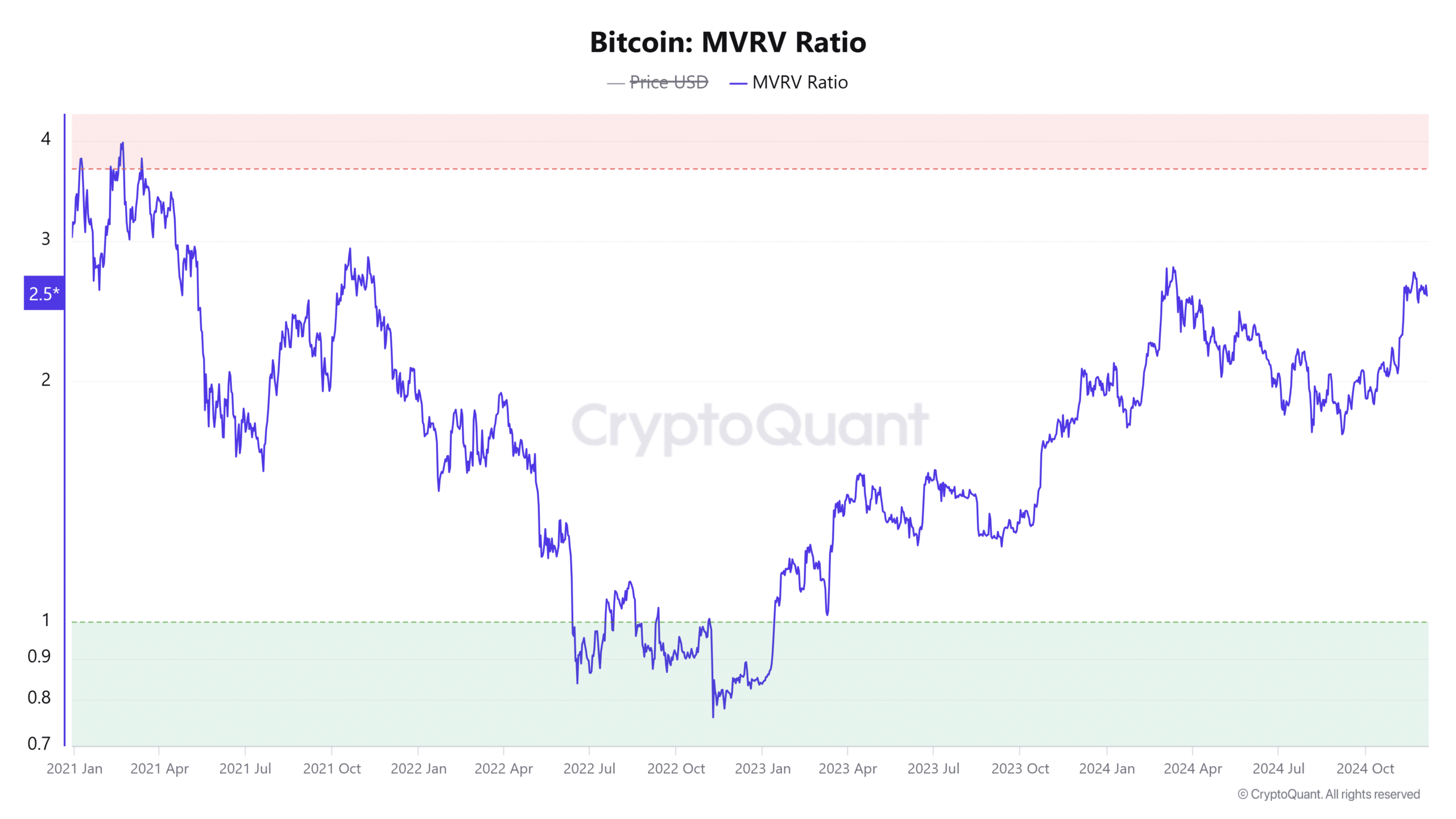

Bitcoin’s market worth to realized worth (MVRV) ratio reveals that regardless of the latest correction, BTC has but to succeed in its native prime.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The MVRV ratio, at press time, stood at 2.5 suggesting that the asset was nonetheless pretty priced. Within the final three months, Bitcoin’s MVRV ratio has elevated from 1.72 as profitability for holders elevated.

Supply: CryptoQuant

A surge within the MVRV ratio previous 3.5 will sign that Bitcoin has reached an area prime. Due to this fact, merchants ought to be careful for an extra rise on this metric to overvalued ranges.