- On the thirtieth of July, crypto liquidations dropped to $132 million.

- BTC’s liquidation would rise once more at $70 whereas ETH’s would rise close to $3.45k.

The crypto market witnessed a lot volatility over the previous few days, which may be attributed to a number of elements. Within the meantime, crypto liquidations elevated sharply.

This occurred whereas the Federal Reserve’s choice concerning new financial coverage is predicted quickly.

Crypto liquidations elevated

Current knowledge revealed that the crypto market’s liquidations reached $170 million. Most of those positions had been longs, that are thought of a bullish place.

A potential purpose behind this might be BTC’s worth motion. The king of crypto’s worth reached $70k at press time, after which lengthy positions merchants liquidated. This occurred at a time when seven developments passed off.

For a rise, the US authorities offered $2 billion value of Bitcoins. Moreover, the Federal Reserve’s coverage assembly was held, which was anticipated to offer insignia on the upcoming financial insurance policies.

As per AMBCrypto’s evaluation of Coinglass’ knowledge, the liquidation did decline on the thirtieth of July.

To be exact, crypto liquidations touched $132 million, out of which $109.5 million had been lengthy positions whereas $22.74 million had been quick positions.

Supply: Coinglass

Are BTC and ETH affected?

This rise in liquidation additionally had an impression on Bitcoin’s [BTC] and Ethereum’s [ETH] worth actions, as they turned bearish.

In accordance with CoinMarketCap, each of those cash’ costs dropped marginally within the final 24 hours. On the time of writing, BTC was buying and selling at $65,980, whereas ETH had a worth of $3,311.

AMBCrypto then checked their liquidation heatmaps to seek out out when liquidation will improve once more.

As per our evaluation, BTC would as soon as once more witness a big rise in liquidation if its worth retouches $70k. Earlier than reaching that stage, BTC’s liquidation would stay comparatively low.

Supply: Hyblock Capital

Mentioning Ethereum, its liquidation would attain $43.5k when its worth touches $3.45k. Above that, ETH’s liquidity would rise once more close to the $3.8 mark.

Supply: Hyblock Capital

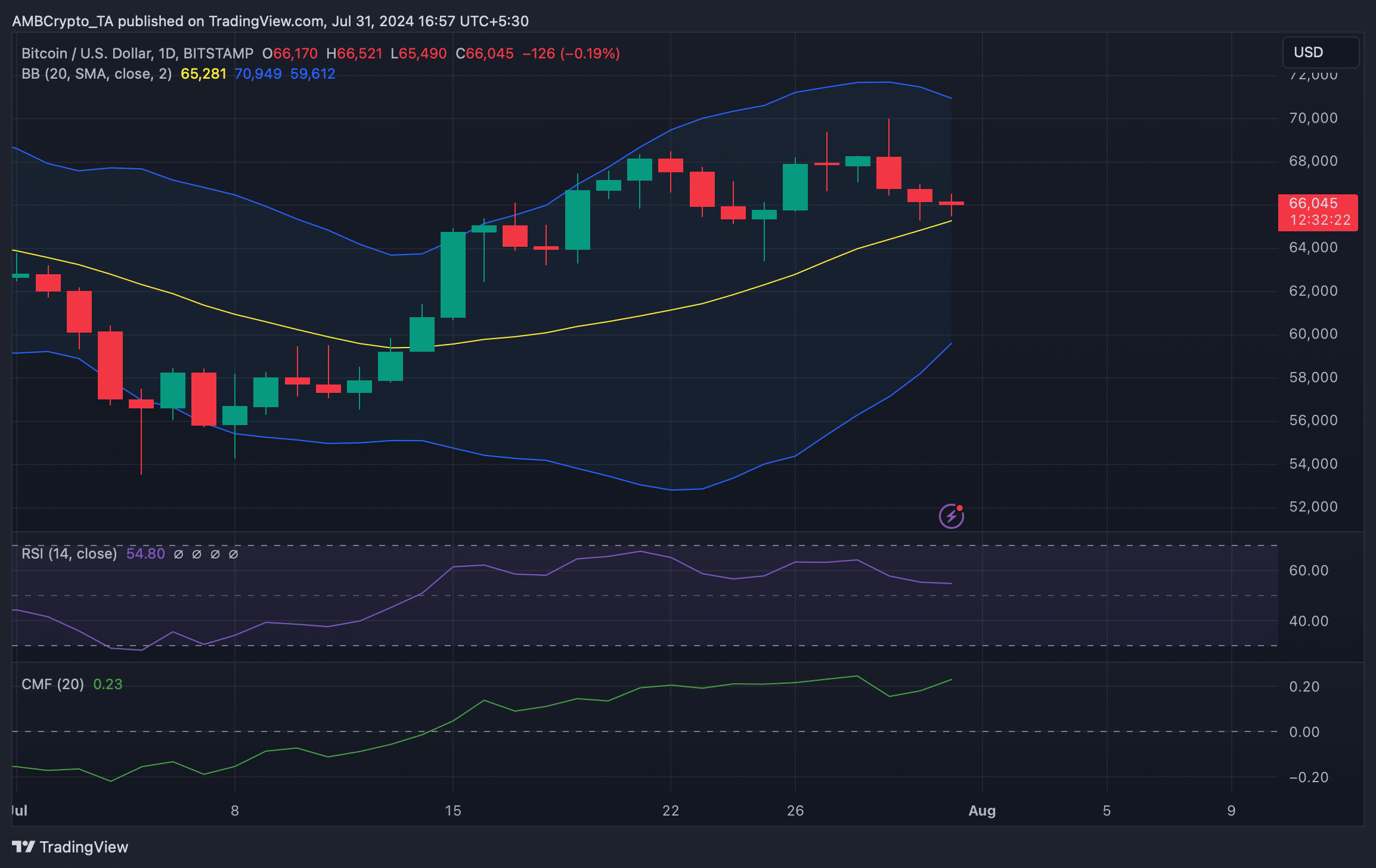

AMBCrypto then checked their day by day charts to seek out how seemingly it’s for them to achieve the aforementioned stage within the quick time period. The Bollinger Bands revealed that BTC was testing its 20-day Easy Shifting Common assist.

A profitable check of that would enable BTC to start yet one more bull rally. Its Chaikin Cash Circulate (CMF) additionally remained bullish because it moved up. However the Relative Power Index (RSI) supported the bears.

Supply: TradingView

Learn Ethereum’s [ETH] Value Prediction 2024-25

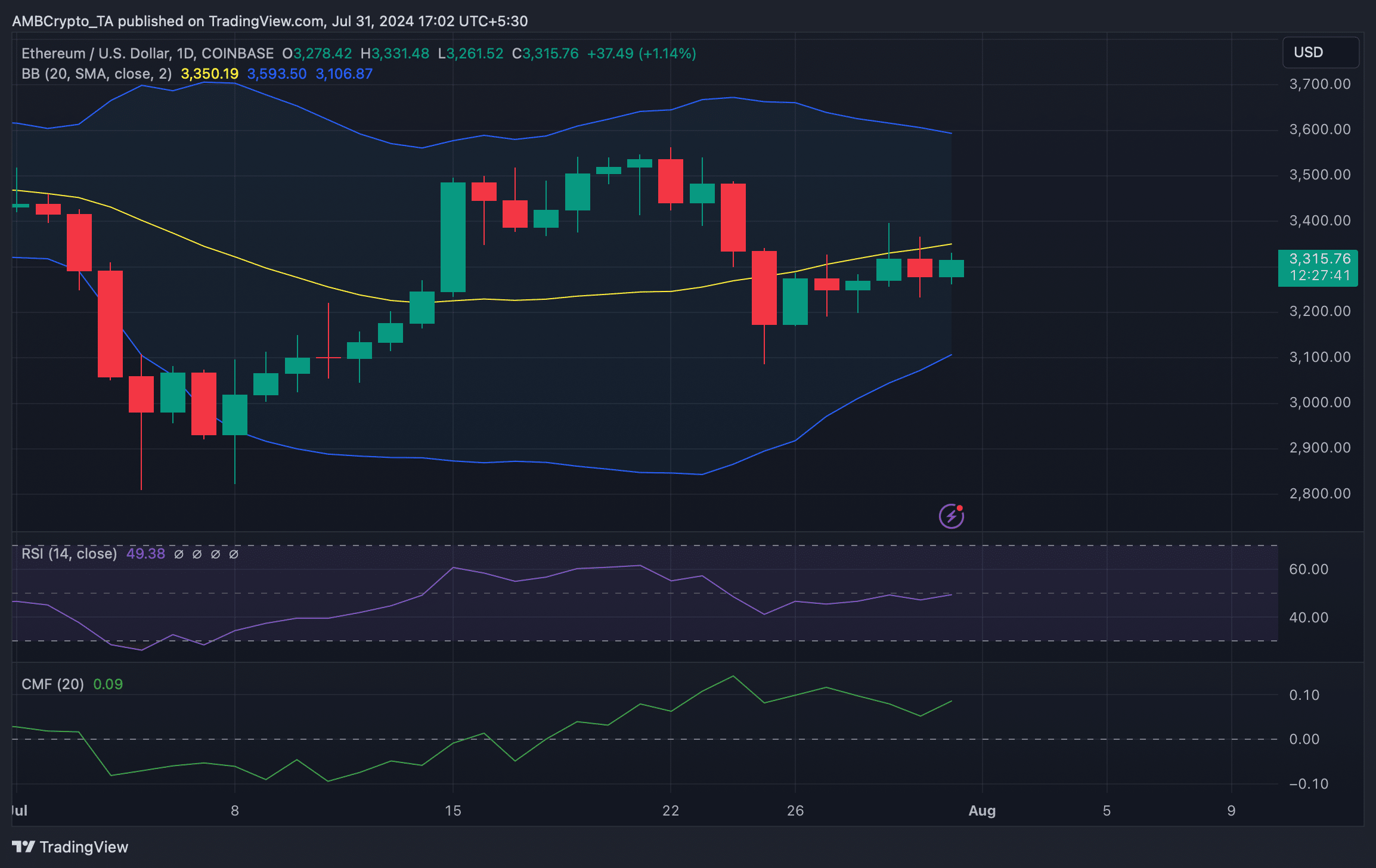

Curiously, whereas BTC was testing its assist, Ethereum was testing its resistance at its 20-day SMA. The excellent news was that its RSI registered an uptick.

Moreover, its Chaikin Cash Circulate (CMF) additionally moved northward. Each of those indicators advised that the probabilities of ETH turning bullish once more had been excessive.

Supply: TradingView