- Bitcoin ETFs noticed important inflows because the market reacted to potential Fed fee cuts.

- BlackRock elevated Bitcoin holdings, reflecting rising institutional curiosity amid shifting financial situations.

Current tendencies revealed a notable uptick in Bitcoin [BTC] Alternate-Traded Funds (ETFs), Inflows reached $202.6 million as of the twenty sixth of August, based on Farside Traders.

Regardless of this constructive momentum within the ETF market, BTC itself was struggling to surpass the $65,000 threshold, buying and selling at $62,898 after a 1.11% decline up to now 24 hours, as reported by CoinMarketCap.

What’s at play?

This discrepancy highlights a broader confusion amongst traders concerning the interaction between central financial institution interest-rate insurance policies and their affect on the valuation of threat belongings similar to cryptocurrencies and shares.

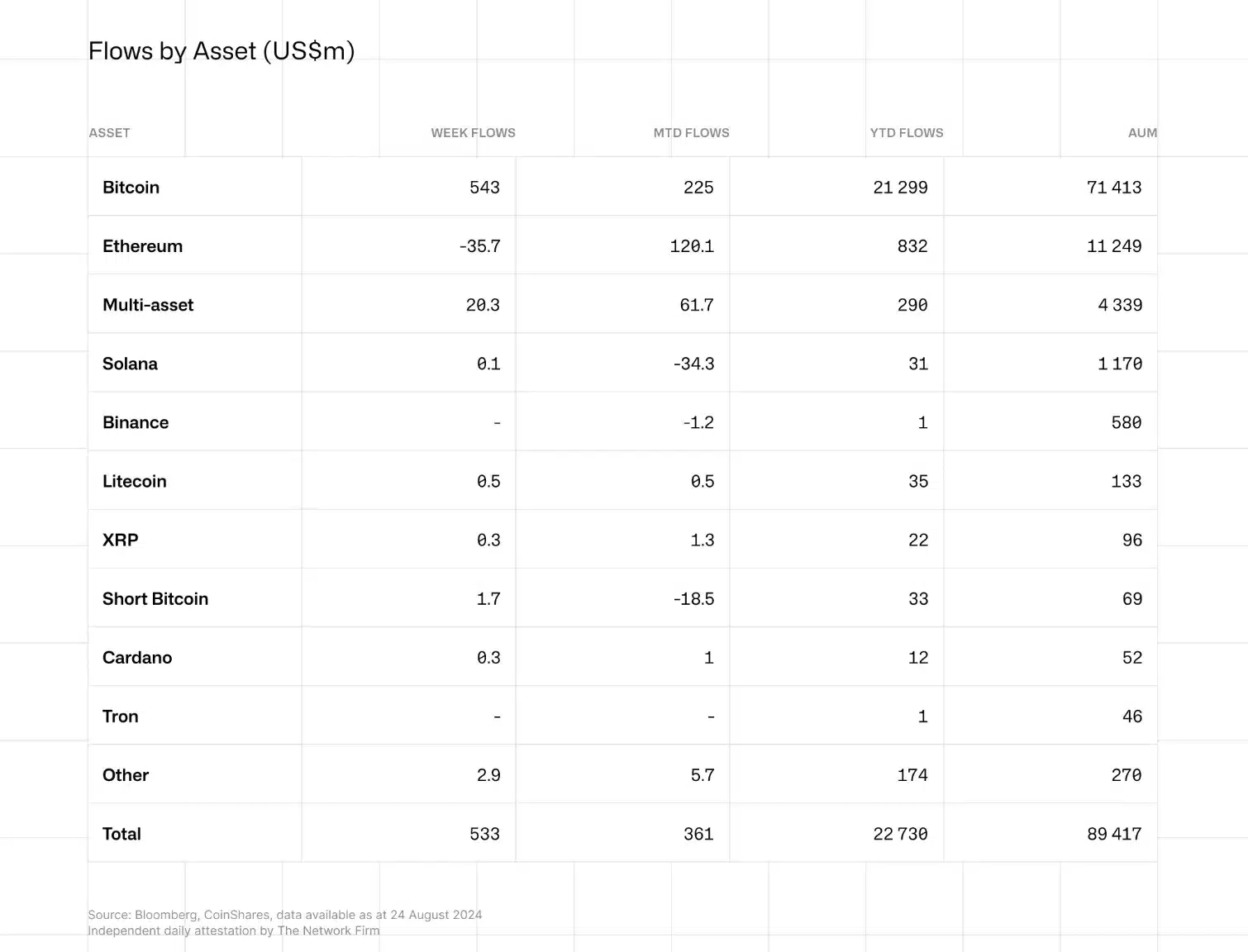

Highlighting the interaction within the crypto market, a latest report printed on twenty sixth August by CoinShares titled — {Digital} Asset Fund Flows steered,

“Last week, digital asset investment products saw inflows totalling US$533m, marking the largest inflows in five weeks.”

Supply: CoinShares

For context, this latest surge in Bitcoin ETFs got here within the wake of Jerome Powell’s feedback on the Jackson Gap Symposium, the place he hinted at the potential for an preliminary rate of interest minimize in September.

This prospect has sparked a renewed curiosity in threat belongings. Regardless of a slight dip in buying and selling volumes in comparison with latest weeks, exercise remained sturdy, with weekly buying and selling reaching $9 billion.

Influence of Fed fee minimize on digital belongings

The report additional confused on the efficiency of Bitcoin and famous,

“Bitcoin was the primary focus, seeing US$543m of inflows, interestingly, the majority of those inflows were on Friday [23rd August], following the dovish comments from Jerome Powell, indicating Bitcoins sensitivity to interest rate expectations.”

Supply: CoinShares

Evidently, the report additionally highlighted Ethereum [ETH] ETFs, noting important withdrawals from the Grayscale Ethereum Belief.

This noticed $118 million in redemptions and contributed to a complete of $2.5 billion in outflows over the previous month.

Supply: CoinShares

What’s extra to it?

Additionally, Wall Avenue anticipates a big discount in Federal Reserve rates of interest from 5.33% to three.33% over the following 18 months.

This anticipated easing will decrease borrowing prices for households, companies, and asset managers, resulting in elevated liquidity and funding alternatives.

Consequently, digital belongings are anticipated to see an increase in worth, pushed by the broader availability of capital.

Seeing this coming, many establishments have began rising and are gearing up.

First, BlackRock lately disclosed an up to date portfolio for its Strategic International Bond Fund, revealing a rise in its holdings of iShares Bitcoin Belief shares.

As of the thirtieth of June, the fund held 16,000 shares, up from 12,000 shares reported in Could, indicating rising funding in Bitcoin.

Thus, it stays to be seen how the Fed’s fee cuts will unfold and considerably affect asset costs.