- Bitcoin was oversold and very imbalanced, however a direct worth bounce shouldn’t be assured.

- A protection of the $50k assist zone and a few stabilization may persuade buyers to bid regardless of the dangerous situations.

The crypto market was in a state of disarray when the worth of Bitcoin [BTC] was simply above the $60k stage a day earlier than press time. Since then, the $49k low has been set, and additional losses may come up in the course of the New York buying and selling session, sending members right into a panic.

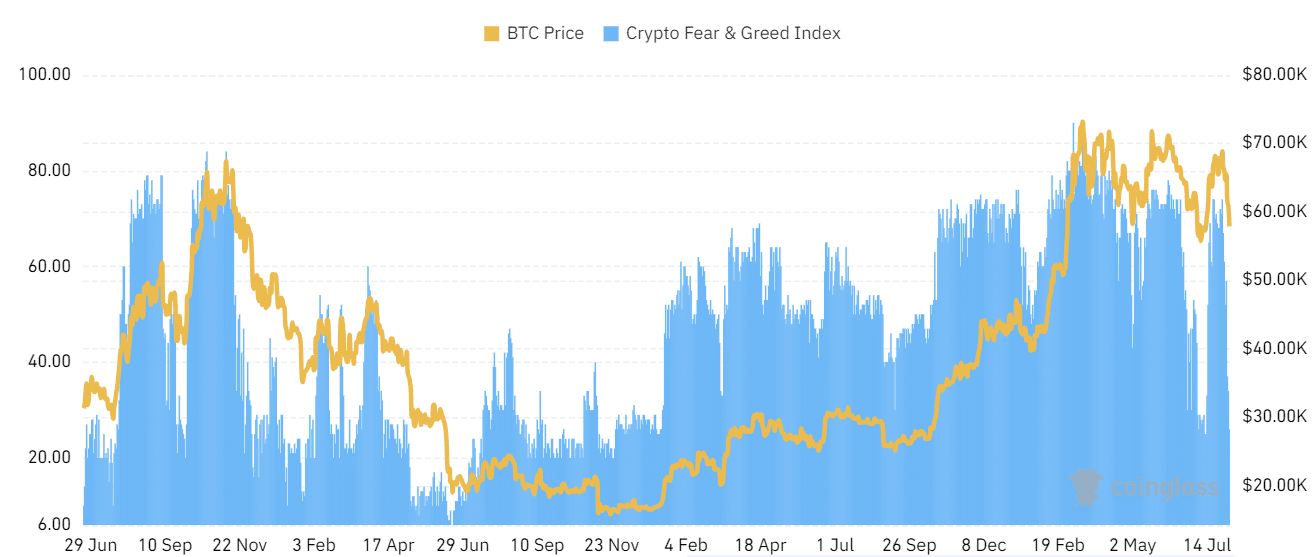

The crypto Concern and Greed index was at 31, displaying concern available in the market. Typically, fearful instances are good for purchasing alternatives. Will Monday become one other such second?

Concern and Greed Index plummets after crypto costs incite alarm

Supply: Coinglass

Because the twenty ninth of July, the altcoin market capitalization is down by $163 billion, or 28%. This measures the highest 125 altcoins excluding Ethereum [ETH] and naturally, Bitcoin.

The 2 giants haven’t fared effectively both, shedding 37.85% and 30% respectively at their lowest.

At press time, the index confirmed “fear” with a studying of 26. This has not been the norm for crypto in 2024, with concern readings seen on some days prior to now two months.

Supply: Coinglass

The newest instance was the thirteenth of July when the index fell to 25. The value of Bitcoin was at $57.8k then and bounced to $68.8k simply two weeks later.

If historical past repeats itself, Bitcoin may maintain on to the $50k assist and climb greater.

Will the late brief sellers be punished for his or her mistimed trades?

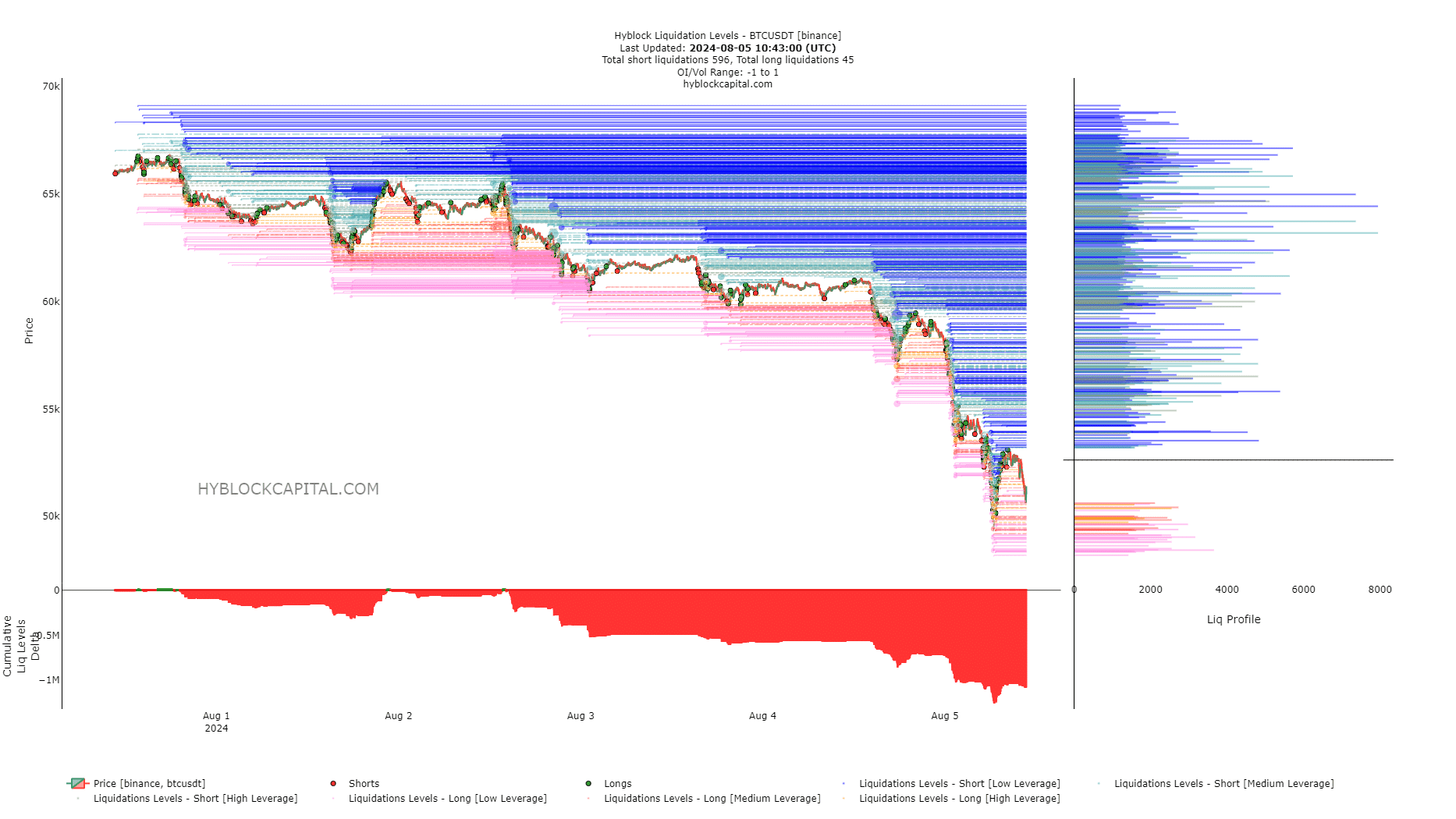

Supply: Hyblock

The every day RSI was at 23, reflecting oversold situations. The cumulative liquidation ranges delta on the chart above was more and more favoring the brief positions.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This imbalance may be worn out by a pointy worth bounce.

With sentiment as it’s and concern ruling the market, robust shopping for strain may not arrive for an additional 24-48 hours. If it does, the $53.9k and $55.7k ranges could be the short-term resistances to observe.