- At press time, the crypto market nonetheless flashed ‘GREED,’ regardless of election worries

- Prediction websites favoured a Trump win, with Choices merchants eyeing $60k, $70k, and $80k targets

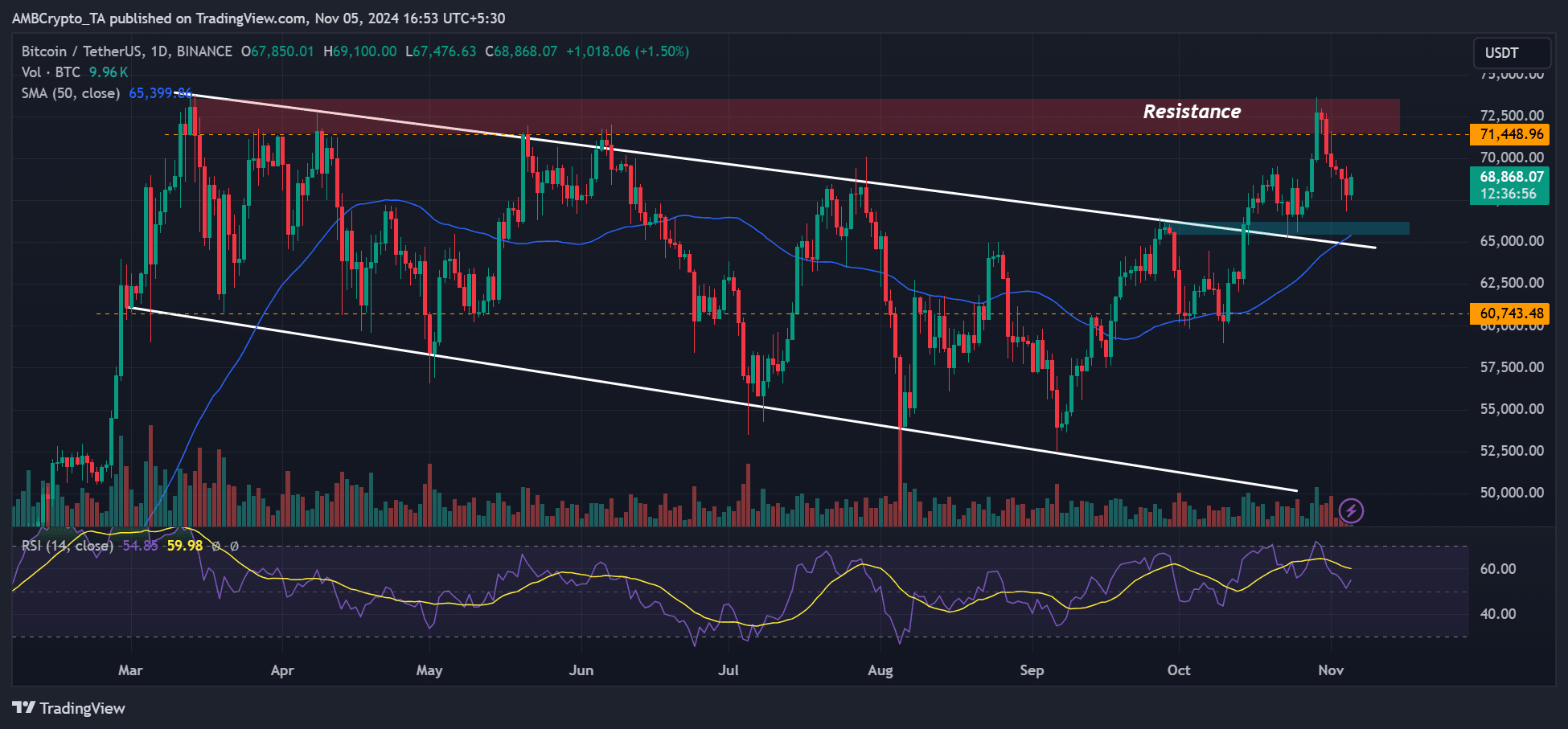

There’s unbelievable market anxiousness now that Election Day in the USA is right here. Nonetheless, regardless of Bitcoin’s [BTC] current pullback from close to its all-time excessive (ATH) to $68k, the Crypto Concern and Greed Index remains to be flashing “Greed.” On the time of writing, it had a studying of 70.

Supply: Various.me

Bitcoin speculators stay optimistic

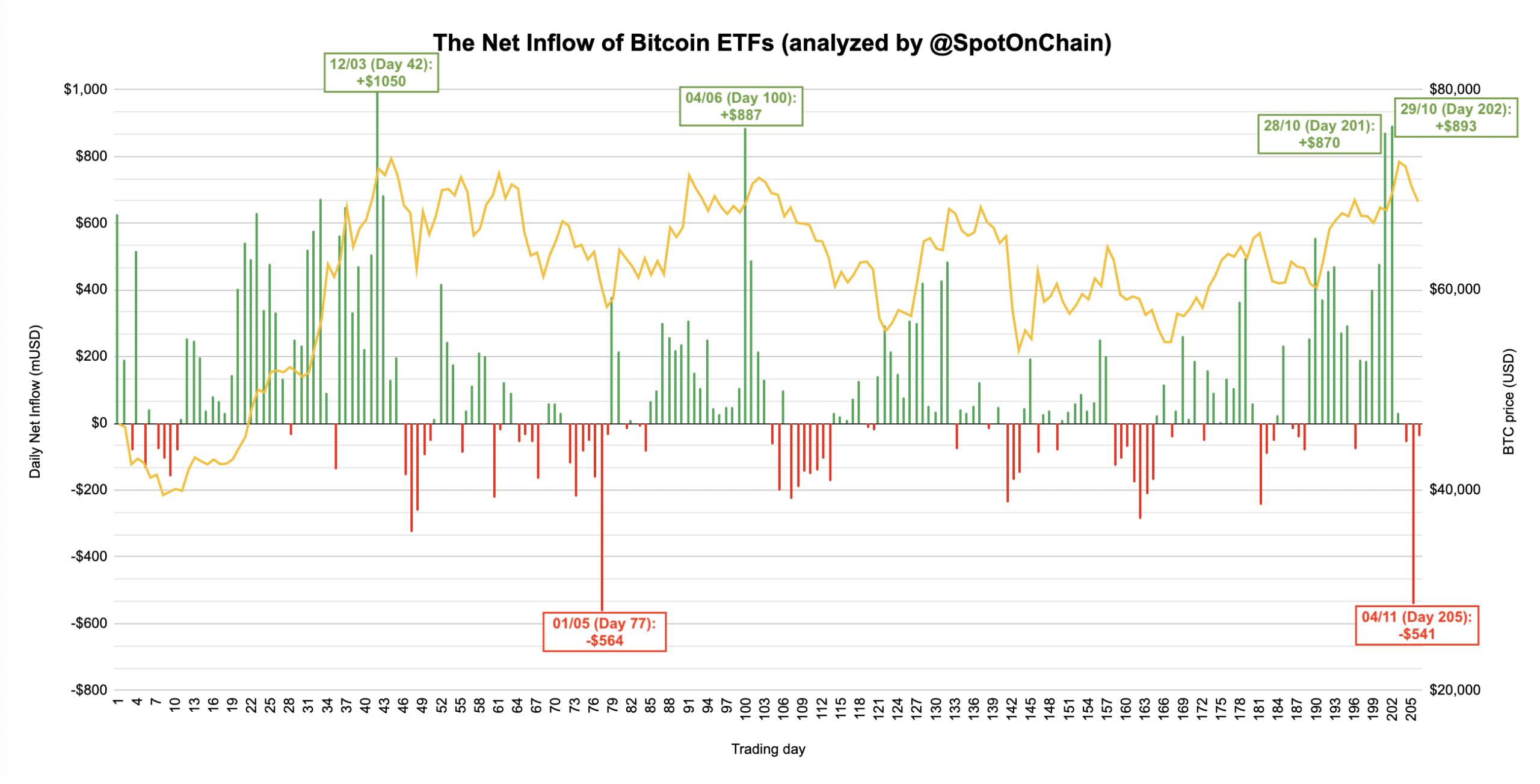

In truth, even Monday’s risk-off transfer throughout U.S Spot BTC ETFs didn’t deter BTC speculators. The merchandise noticed cumulative day by day internet outflows of $541 million, led by 21Shares (ARKB) and Bitwise’s BITB.

In keeping with Spot On Chain, the Monday sell-off was the second-largest day by day outflow for these merchandise. This mirrored a broader market de-risking throughout U.S equities simply earlier than Election Day.

Supply: Spot On Chain

Maybe, Trump’s lead throughout prediction websites and prime election fashions was partly chargeable for the boldness seen in BTC and crypto markets.

Price noting, nonetheless, that crypto buying and selling agency QCP Capital cautioned that the market has been underpricing potential post-election dangers and even Harris’s seemingly win.

A part of the agency’s election commentary learn,

“The crypto market is currently pricing in a +/-3.5% in BTC spot movement on the election night itself. Yet, traders may be underpricing post-election risk: the current lack of volatility premium beyond the November 8 expiry suggests that markets expect a quick resolution, possibly underestimating potential delays or contested outcomes.”

The agency anticipated erratic BTC worth swings when polling outcomes stream in. For its half, Amberdata projected that the worth swings might be $6k-$8k in both path.

It added {that a} Harris win may push BTC to $60k, whereas a Trump win may set off a brand new ATH for BTC ($75K/$77K).

That mentioned, over the weekend, the Choices market noticed giant funds favor bullish outcomes with upside targets of $70k —$85k.

The newest Deribit knowledge revealed that off-shore markets eyed $72k —$75k targets based mostly on large name shopping for (upside expectation) from European and Asian markets on Monday. A part of its replace learn,

“Outsized T-1 Option flows jack IV higher. APAC-Euro flow: 1.5k Nov 72+75k Calls bought. At US open, as BTC peaked at 69.3k, Nov29 60k Put bought x1k funded by Nov29 80k Call, and Nov15 64k Put bought 1.5k.”

Additionally, the hike in curiosity in put choices (draw back bets), eyeing $60k, echoed Amberdata’s targets if Harris wins the election.

Moreover, it looks as if whoever wins, Choice merchants anticipate BTC to remain above $60k. On the worth charts, $65k will stay a key degree to observe if the decline extends itself.

Supply: BTCUSDT, TradingView