- Buying and selling at round $60,000, BTC gave the impression to be on the verge of a demise cross

- Over $1.7 billion value of BTC was withdrawn from exchanges regardless of the value decline

Not too long ago, Bitcoin registered important worth declines, falling beneath the $60,000 mark — A stage lengthy considered a steady and secure vary. This surprising drop triggered panic throughout the market as merchants and buyers reacted to the sudden shift.

Nonetheless, opposite to the final market response, massive holders, sometimes called ‘whales,’ appeared to maneuver in a unique course.

Bitcoin whales transfer in opposition to market pattern

The current important declines in Bitcoin’s worth have elicited a spread of responses from merchants and buyers. Whereas many opted to dump their holdings in an try and safe earnings or minimize losses, a notable pattern of accumulation was additionally seen, notably amongst large-scale buyers or “whales.”

In accordance with Netflow information from IntoTheBlock, Bitcoin famous internet outflows from exchanges totaling over $1.7 billion over the previous week. Right here, this determine represents the biggest quantity of outflows in over a yr, underscoring important motion of BTC away from exchanges.

Supply: IntoTheBlock

Such outflows are sometimes interpreted as an indication of accumulation as buyers transfer their holdings to personal wallets. The motion is for long-term holding, slightly than leaving them on exchanges for potential sale.

What may this imply for the broader market?

This pattern means that regardless of the market’s downturn, confidence amongst some buyers stays excessive, with important shopping for exercise seen as the value dips. These massive holders possible view the present decrease costs as strategic shopping for alternatives. They anticipate that the market will rebound in the long run.

For the broader market, the numerous outflows and related accumulation by whales may stabilize and even push costs again up if this pattern continues. It’s a signal of bullish sentiment amongst among the market’s most influential gamers, which could assist mitigate current bearish pressures.

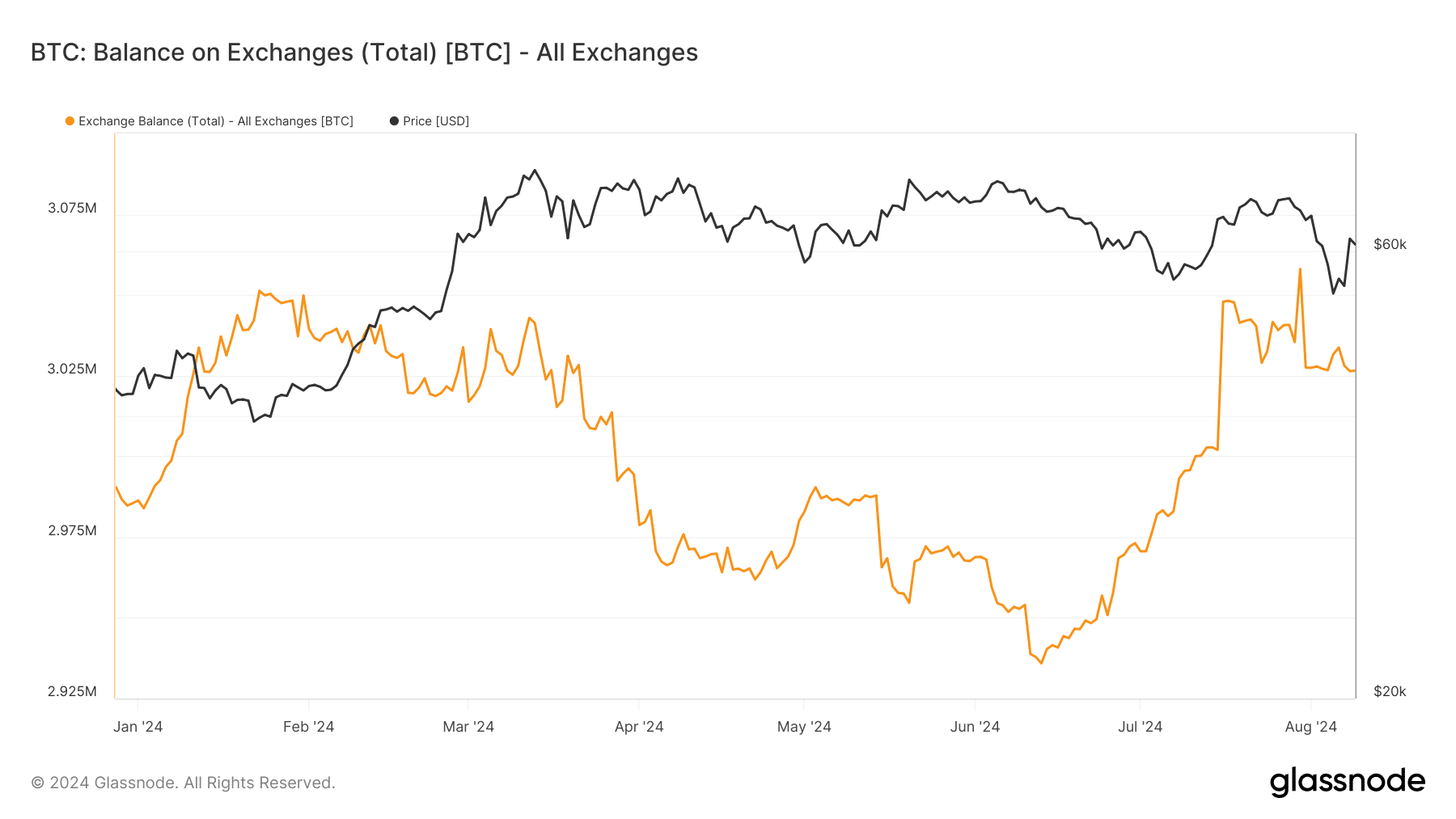

Development of Bitcoin steadiness on exchanges

An evaluation of Bitcoin’s steadiness on exchanges, in line with information from Glassnode, revealed a big lower in current weeks. Regardless of hovering across the 3 million mark for a while, there was a pointy decline within the steadiness held on exchanges.

Particularly, the steadiness was roughly 3.057 million BTC on 30 July. Nonetheless, this fell to round 3.026 million BTC at press time.

Supply: Glassnode

This discount in Bitcoin steadiness on exchanges aligns with findings from Netflow analyses over the previous few weeks, which have indicated a pattern of BTC transferring off exchanges.

Such actions are usually interpreted as an indication of accumulation amongst buyers.

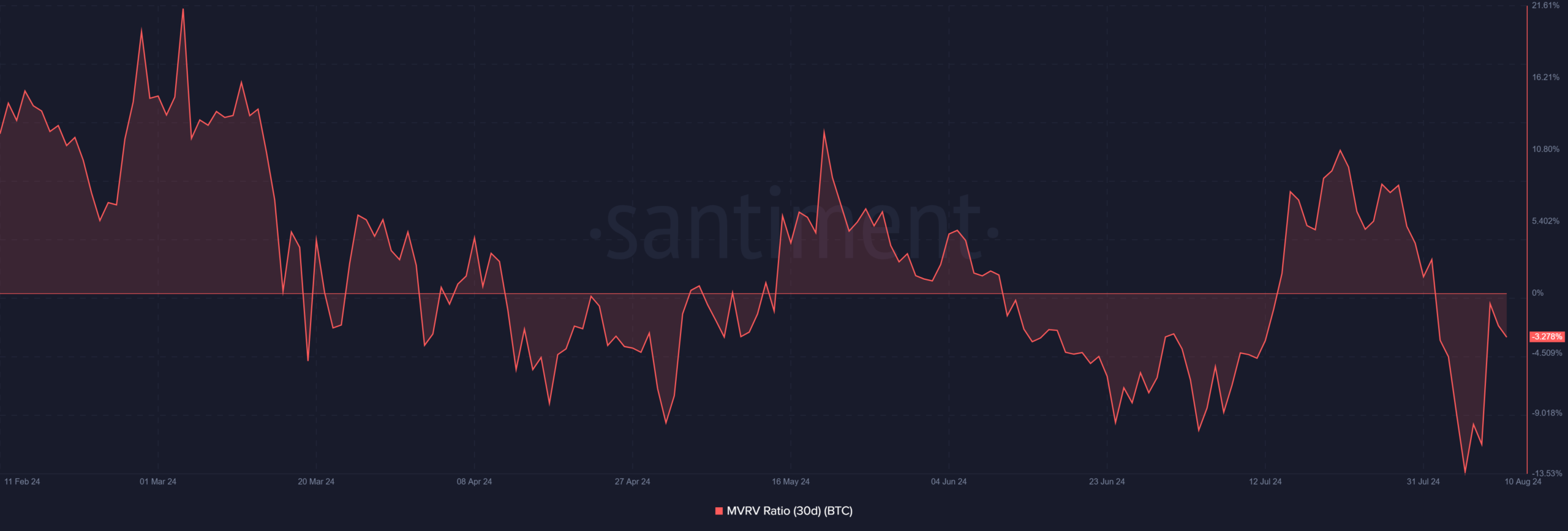

MVRV reveals destructive pattern

Lastly, an evaluation of the MVRV ratio chart revealed that Bitcoin’s 30-day MVRV, at press time, was at -3.278%.

This means that the common holder over the previous month has been at a loss. This destructive worth additionally signifies that BTC is likely to be undervalued, as holders maintain at costs decrease than their buy price.

Supply: Santiment

– Learn Bitcoin (BTC) Value Prediction 2024-25

Traditionally, such low MVRV ranges have typically been seen as potential shopping for alternatives. The chart aligns with the current pattern of enormous buyers accumulating Bitcoin throughout market downturns.

Total, it signifies that the present market sentiment could also be shifting in the direction of accumulation, in anticipation of a future worth restoration.