- Overleveraged positions within the futures market made it more durable for a BTC breakout.

- The reset and liquidation cascades are obligatory for a long-term wholesome uptrend.

Bitcoin [BTC] struggled to interrupt out previous the $100k stage though it poked its head above the psychological stage a number of occasions throughout the previous week.

A BTC correction to $94.2k was seen on Monday, the ninth of December. What could possibly be in retailer for Bitcoin merchants subsequent?

Liquidations attain $1.7 billion

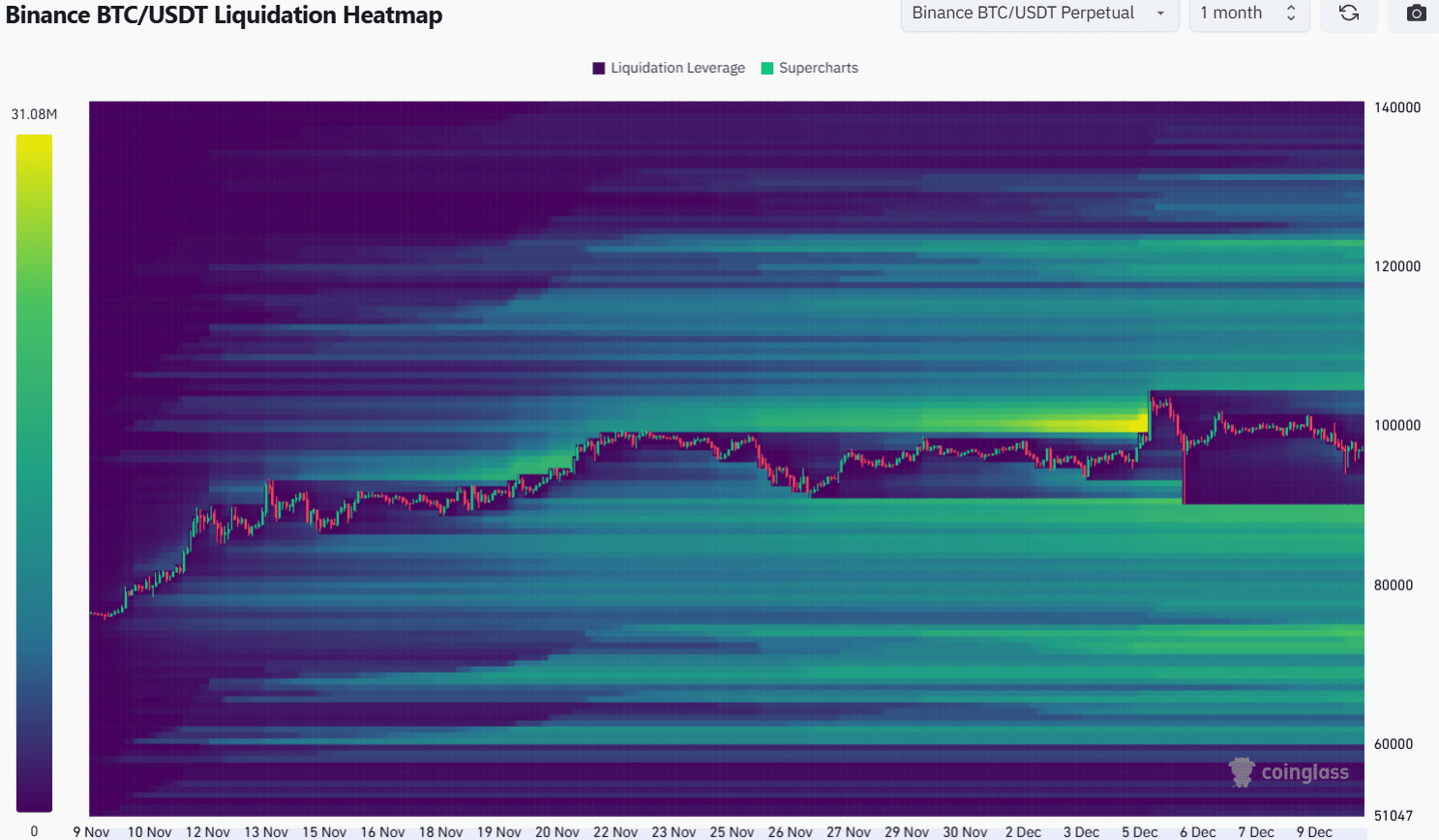

Supply: Coinglass

In a single day, the whole liquidations reached a whopping $1.7 billion for simply the Bitcoin pairs. This was probably the results of an intense tug of battle within the futures market. Overleveraged longs and shorts clustered across the $100k mark had been worn out.

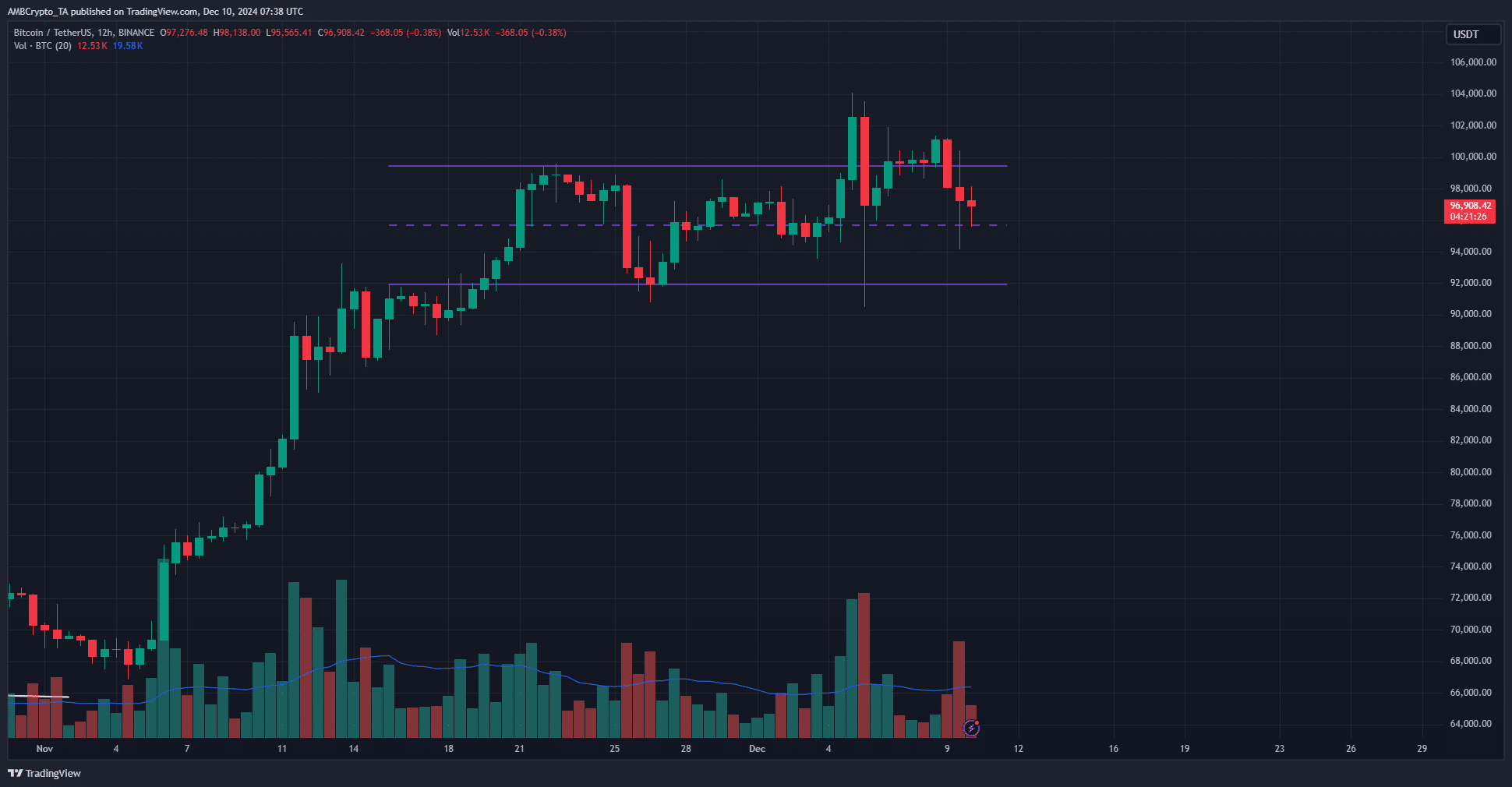

Supply: BTC/USDT on TradingView

The fifth of December additionally noticed heightened volatility as the worth bounced between key liquidity pockets. On that day, near $1.1 billion value of positions had been liquidated within the BTC market.

The 12-hour worth chart confirmed that the king of crypto was again close to the mid-range help stage at $95.8k. It might fall decrease to the $94k and even the $90k ranges earlier than the bulls can regain management.

Bitcoin liquidation heatmap reveals increased is likelier

Supply: Coinglass

AMBCrypto’s evaluation of the 1-month liquidation heatmap confirmed that top liquidity clusters have been effectively constructed and worn out over the previous ten days.

In late November and early December, the tantalizing strategy of the $100k mark set of a liquidity hunt that reached $104k.

Hours later, a retracement to the $90.5k help from the twenty sixth of November swept one other key liquidity zone.

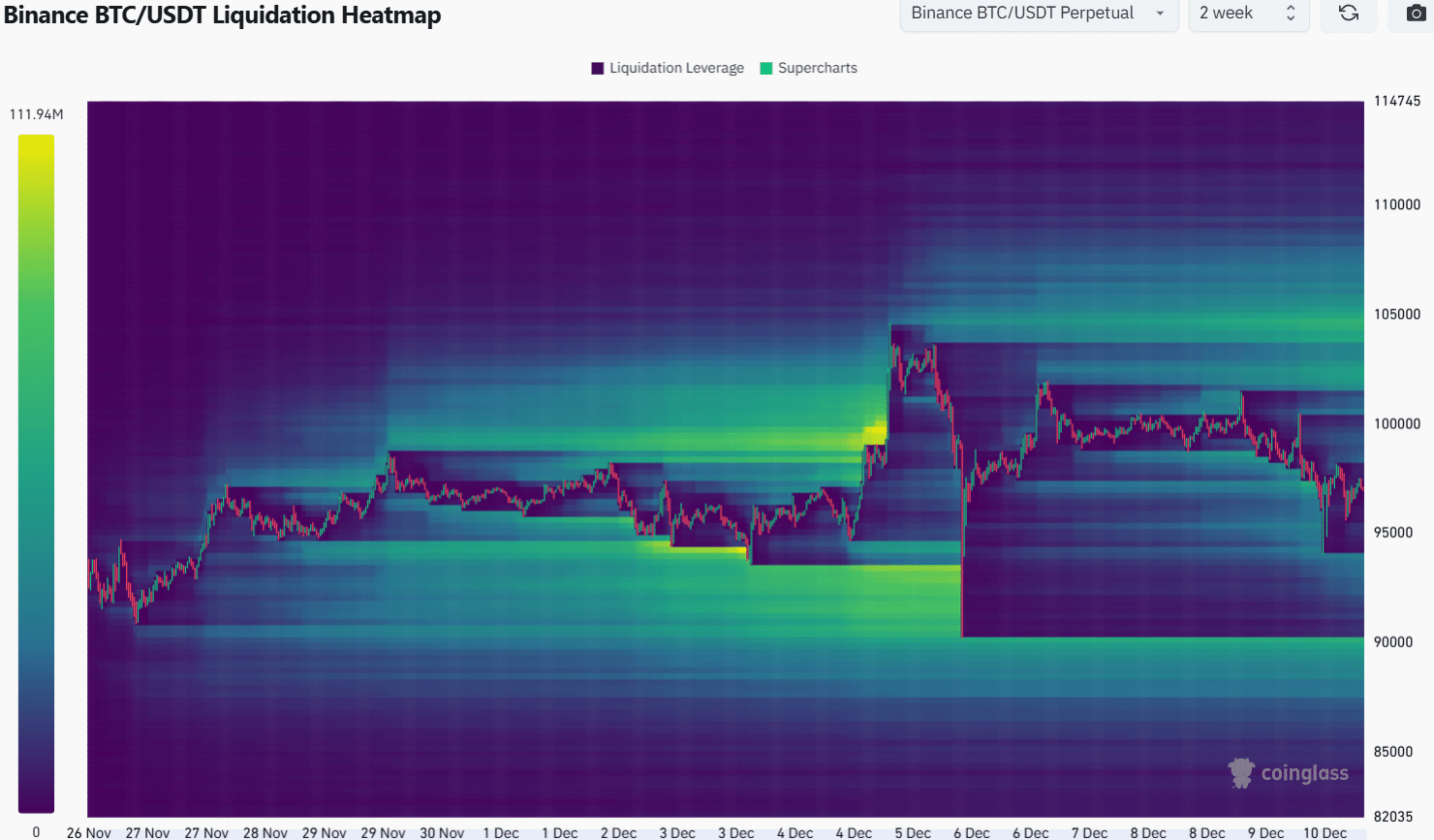

Supply: Coinglass

The 1-month lookback interval confirmed that one other retracement towards $90k or decrease was potential. Zooming in on the 2-week heatmap, the liquidity constructing round $105k was stronger than what was current on the $90k mark.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The liquidity at $102k was additionally a horny goal. Therefore, a transfer northward to $102k and $105k was barely extra probably. Regardless of this view, merchants ought to be ready for a drop to $89k and handle their danger accordingly.

The break of the short-term help at $94k can foreshadow a deeper drop.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion