- Harris now main Polymarket odds at 50%, with Trump carefully trailing at 49%.

- Trump’s WLF undertaking is going through criticism, including uncertainty to his presidential odds.

With simply two months to go till the U.S presidential elections, the newest Polymarket odds present Vice President Kamala Harris holding a slim lead. In line with the identical, she has 50% odds of successful the elections, over Donald Trump’s 49%.

Whereas this isn’t a numerically vital margin, it’s nonetheless a vital one. Particularly since VP Harris has for lengthy trailed the Former President on Polymarket.

Supply: Polymarket

Presidential debate and its influence

For a lot of days, Trump had been main Polymarket’s odds. Nonetheless, issues took a stunning activate 10 September when he and Harris confronted off of their first presidential debate.

The talk coated varied subjects, from the economic system to immigration. Nonetheless, notably, cryptocurrencies have been largely absent from any dialogue. Regardless of a lot anticipation, neither candidate delved into the topic, leaving many within the crypto neighborhood ready for readability on their positions.

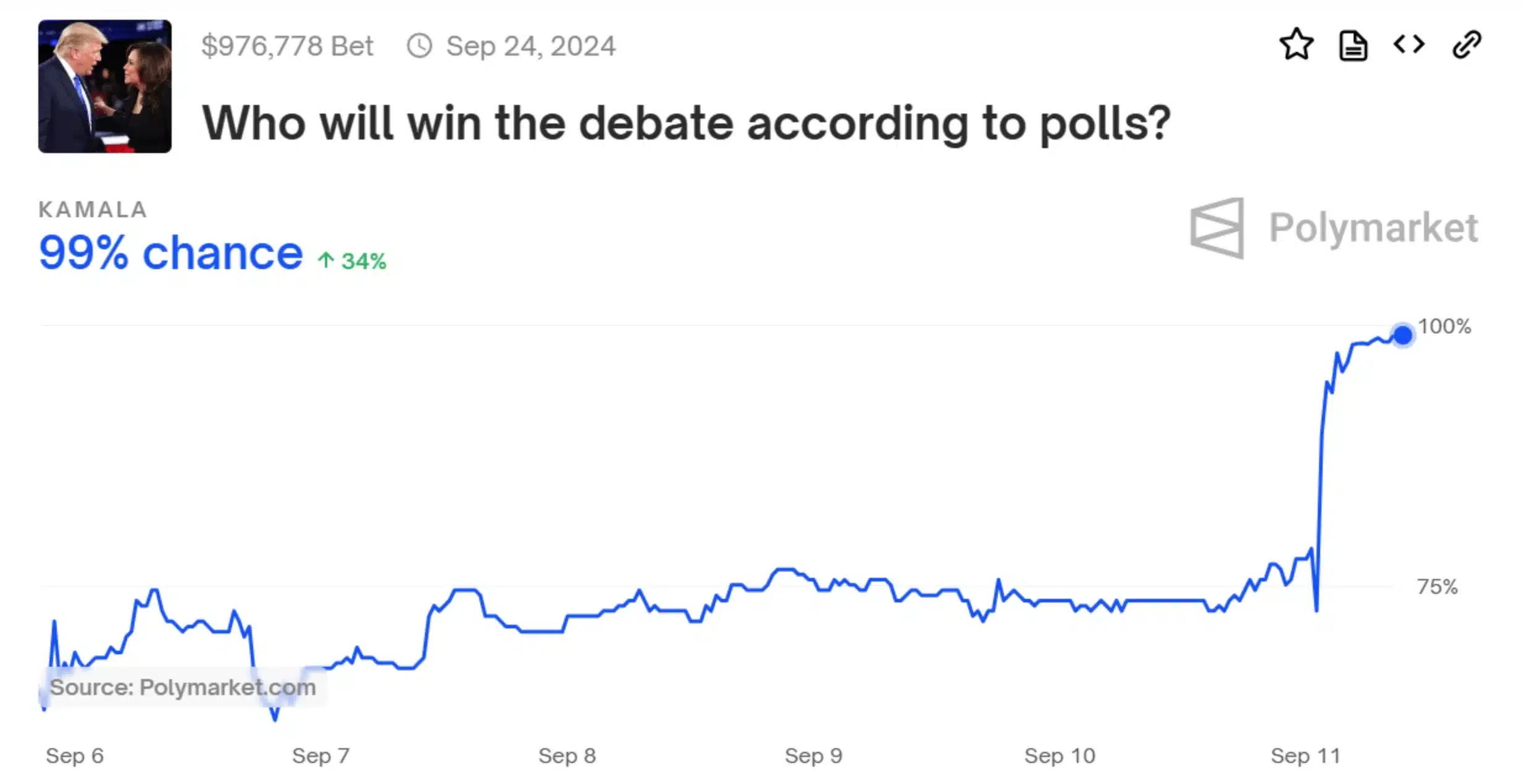

Outdoors of that, there seemed to be a normal consensus that Trump’s debate efficiency fell wanting expectations. In reality, data from blockchain-based betting platform Polymarket revealed that 99% of voters favored Harris as the talk winner.

Supply: Polymarket

For these unaware, previous to the talk, Trump led with 53% of the projected votes, whereas Harris trailed at 45%.

Nonetheless, instantly after the talk, the race tightened considerably, with each candidates neck-to-neck at 49% every.

Supply: i/o/X

Trump’s push to prime the prediction polls

In gentle of his declining presidential odds, Trump turned to X (previously Twitter) on 12 September to announce that he would go stay on the platform on 16 September. Within the video, he revealed plans to launch World Liberty Monetary (WLF) – A undertaking led by his sons, Donald Trump Jr. and Eric Trump.

He stated,

“We’re embracing the future with crypto and leaving the slow and outdated big banks behind.”

Sadly, the response to this plan wasn’t as appreciated as many initially anticipated. In reality, the reactions have been tepid from many within the crypto-community too.

For instance – Colin Talks Crypto took to X and advised,

Supply: Colin Talks Crypto/X

Trump’s crypto engagement up to now

Whereas particulars stay imprecise, Trump has beforehand hinted that World Liberty Monetary can be a decentralized finance (DeFi) platform for borrowing and lending.

That is simply the newest step in his pivot in the direction of cryptos over the previous yr and a half although. His engagement with the crypto neighborhood has been notable, together with participation in Bitcoin conferences, accepting crypto donations, internet hosting NFT-themed dinners, and launching Bitcoin-related merchandise.

These actions have contributed to many within the crypto house nonetheless backing him as U.S President. Regardless of his poor debate efficiency.

What lies forward?

There’s a robust risk that Trump might reclaim the highest spot on the Polymarket charts as soon as WLF goes stay.

Nonetheless, regardless of Trump’s robust crypto engagement, latest criticism of the WLF initiative has raised considerations. Particularly about potential conflicts of curiosity ought to he win one other time period.

In reality, even Nic Carter, a companion at Fortress Island Ventures and Trump supporter, has labeled the undertaking a “huge mistake.”