- Michael Saylor noticed Bitcoin as a safe and secure funding.

- Bitcoin’s RSI has shaped a bullish divergence on a each day time-frame, indicating a pattern reversal.

Michael Saylor, the Chairman of MicroStrategy has garnered vital consideration from crypto lovers following his latest Bitcoin [BTC] prediction.

On the tenth of September, throughout an interview with “CNBC Squawk Box,” Saylor made a daring prediction that Bitcoin might attain $13 million by 2045.

Micheal Saylor’s daring prediction

Throughout the interview, Saylor highlighted that BTC represented solely 0.1% of worldwide capital, however he believed it might develop to 7%. If this huge shift happens, it might push BTC’s worth to $13 million.

Moreover, Saylor identified that Bitcoin is exclusive as a result of it doesn’t depend on any third get together, which makes it much less dangerous as in comparison with different funding merchandise.

Whereas many view Bitcoin as a high-risk funding on account of its unstable nature, Saylor argued that it’s truly a protected possibility for buyers who consider in safe and secure funding.

Bitcoin technical evaluation and key ranges

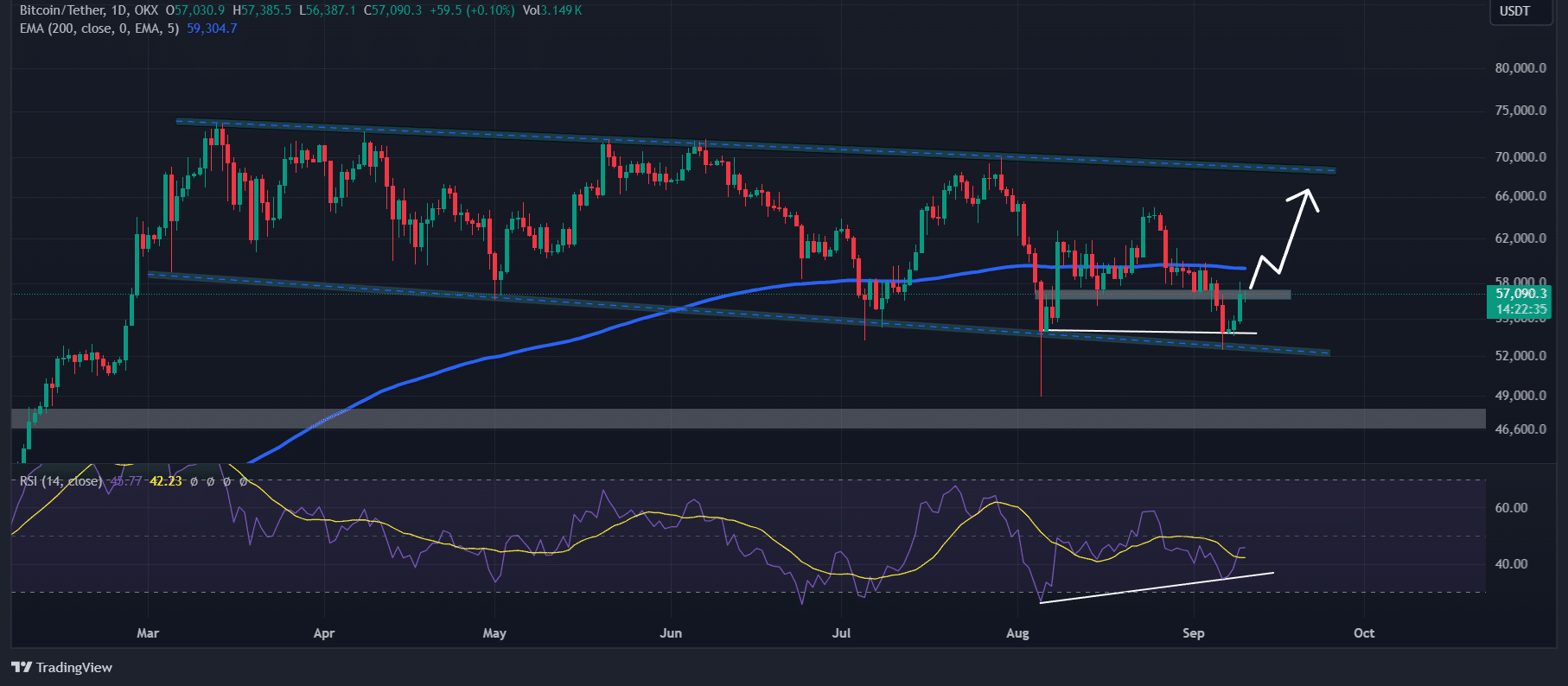

Regardless of Saylor’s predictions, which spans 21 years, AMBCrypto‘s present knowledgeable technical evaluation confirmed that Bitcoin appeared bullish, regardless of buying and selling under the 200 Exponential Shifting Common (EMA) on the each day timeframe.

Since March 2024, Bitcoin has been shifting inside a descending parallel channel, and through this era, the BTC worth has touched the decrease channel 5 occasions.

Supply: TradingView

Based mostly on historic information, at any time when BTC reaches the decrease channel, it tends to expertise a worth surge of over 20%. We might even see the same surge this time.

Nonetheless, Bitcoin is at present dealing with sturdy resistance close to the $57,300 stage.

If it breaks out and closes a each day candle above that stage, there’s a excessive chance BTC might soar considerably, and probably attain $65,000 and $69,000 within the coming days.

In the meantime, Bitcoin’s Relative Power Index (RSI) has shaped a bullish divergence on a each day time-frame, indicating a pattern reversal from a downtrend to an uptrend.

Bullish on-chain metrics

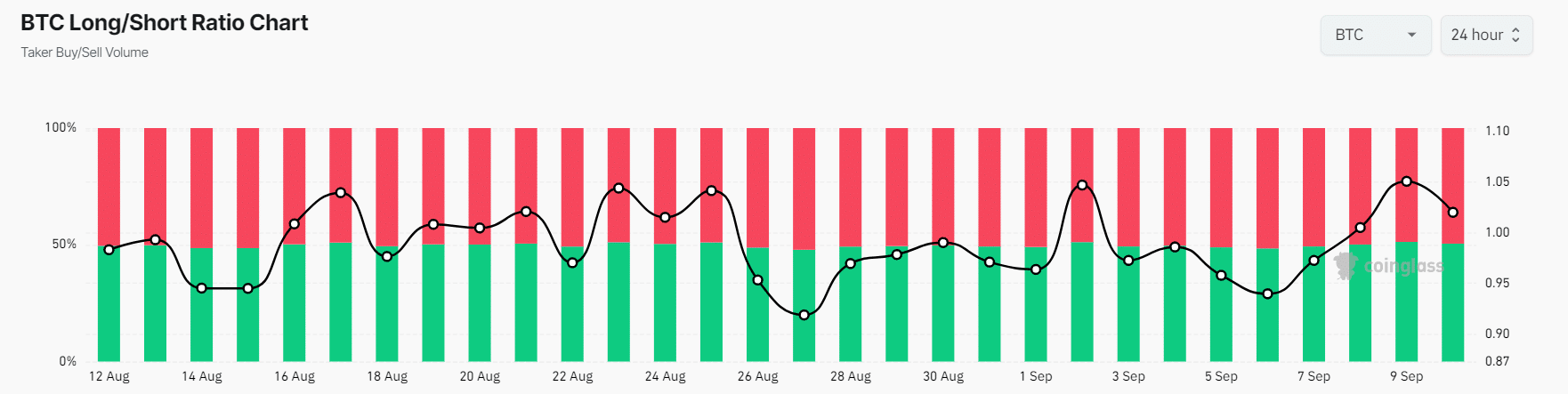

On-chain metrics additionally assist this bullish outlook. Coinglass’s BTC Lengthy/Brief ratio stood at +1.039 at press time, reflecting a optimistic sentiment amongst bullish merchants over the past 24 hours.

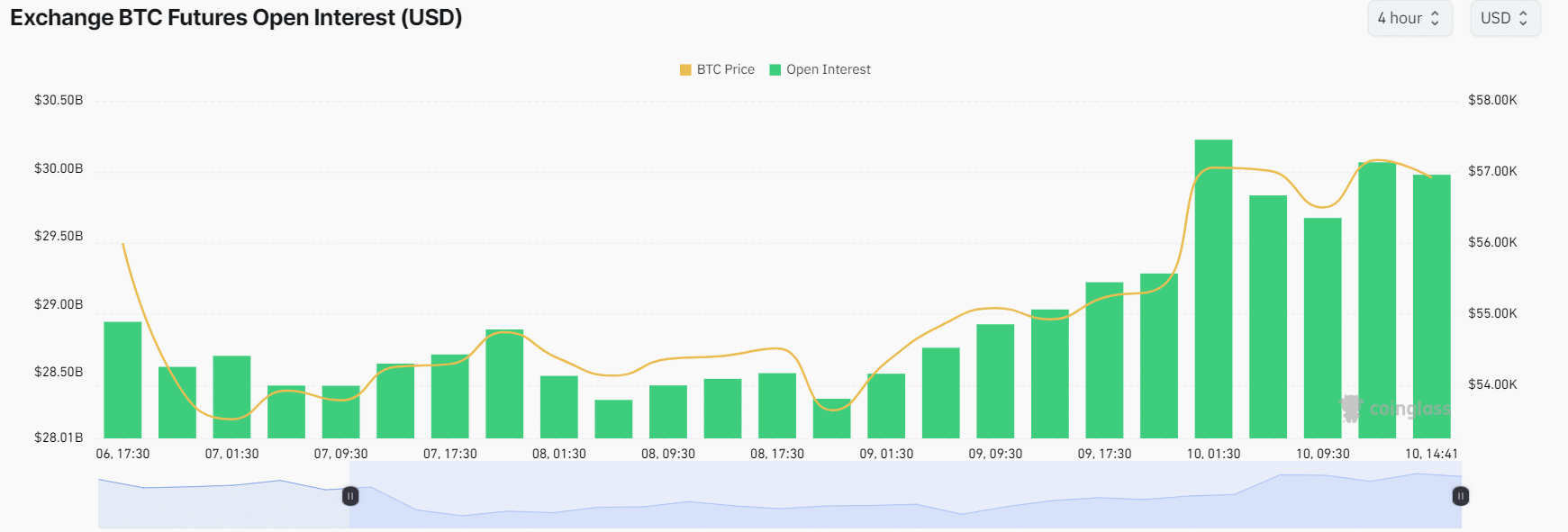

BTC’s Future Open Curiosity has elevated by over 3% throughout the identical interval and has been rising steadily for the previous few days.

Supply: Coinglass

A optimistic lengthy/brief ratio and excessive Open Curiosity suggests potential shopping for alternatives. Merchants typically use this mixture to construct their positions.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

At press time, BTC was buying and selling close to the $57,000 stage, having skilled a worth surge of over 3% within the final 24 hours.

Its buying and selling quantity has skyrocketed by 46% throughout the identical interval, indicating greater participation from crypto lovers amid worth restoration.