- Bitcoin was up 3% during the last seven days, at press time.

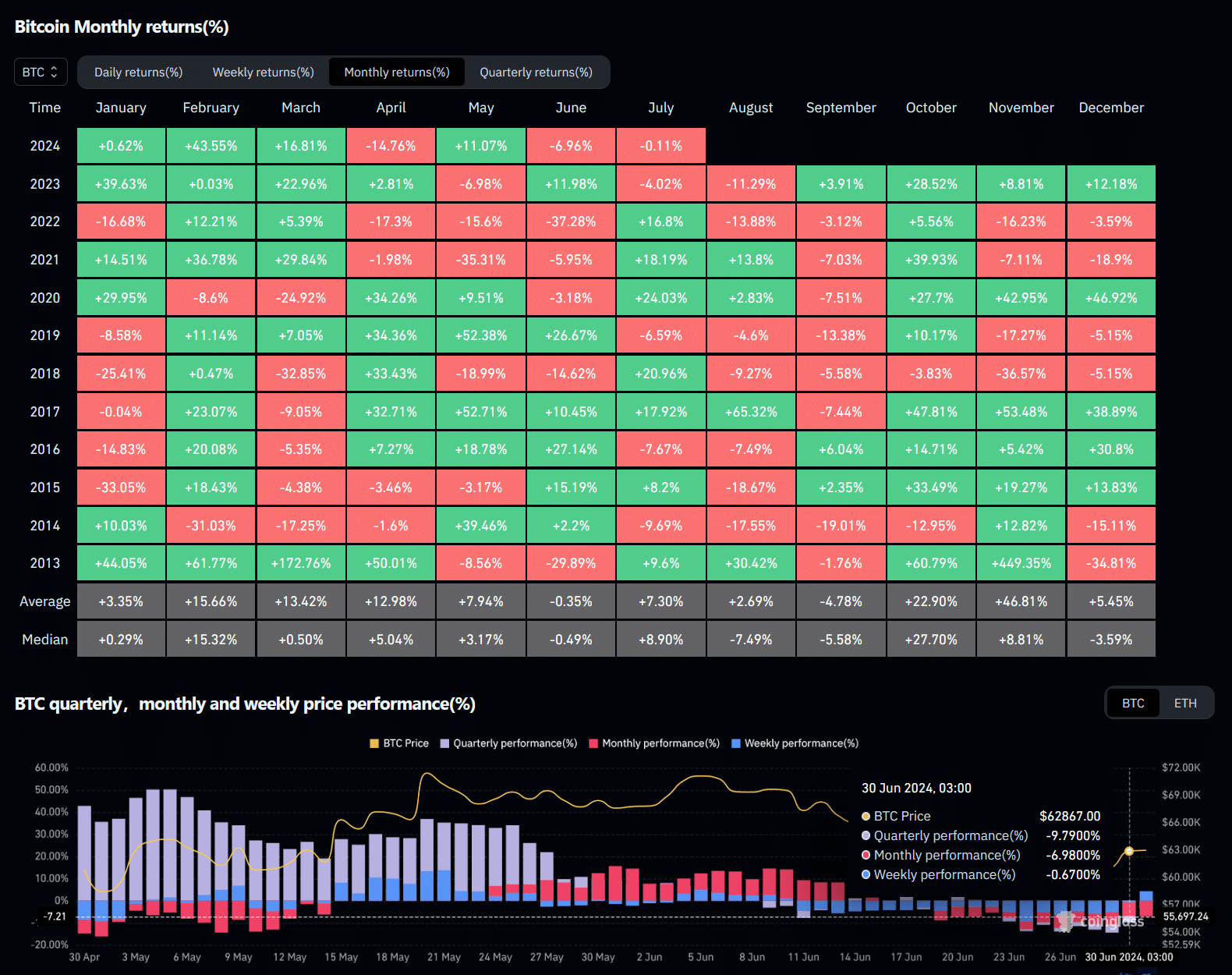

- June’s lackluster motion finally noticed Bitcoin register unfavorable returns of virtually 7%.

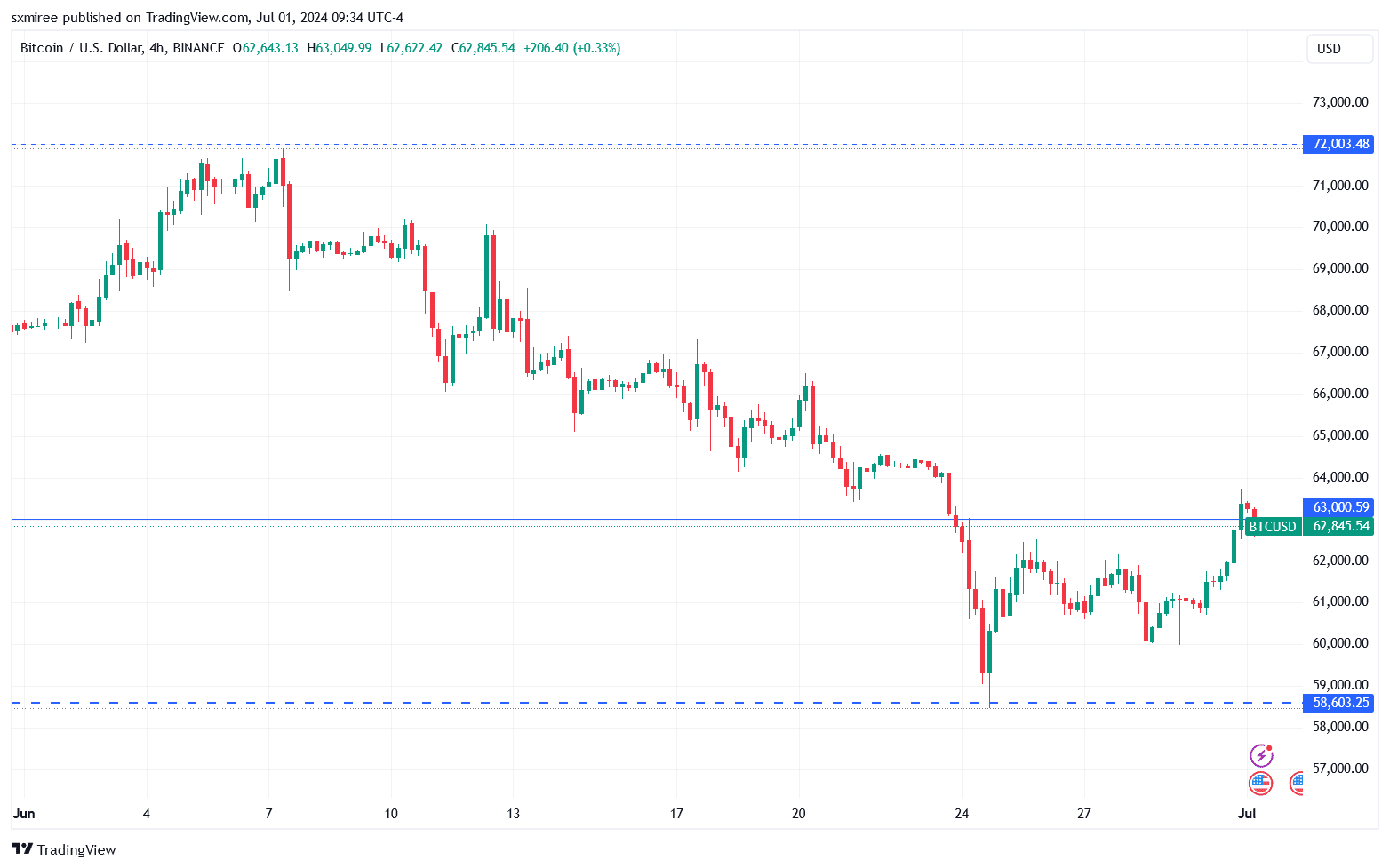

Bitcoin [BTC] traded promisingly above $63,000 coming off the weekend as bulls tried to realize greater floor forward of the month-to-month shut.

Although they efficiently defended the essential $60,000 psychological assist degree boosted by value beneficial properties on the final day of the month, the BTC/USD pair nonetheless printed pink month-to-month and quarterly candles.

Supply: TradingView

Here’s what is forward for the main cryptocurrency:

Bitcoin value motion

June’s lackluster motion finally noticed Bitcoin register unfavorable returns of virtually 7% throughout the month and about 12% for the just-concluded quarter.

The BTC/USD pair faces extra value volatility triggers within the second half of the yr following a weak efficiency final quarter throughout which the pair booked two journeys beneath $60,000.

Supply: Coinglass

Fundamentals point out that Bitcoin continues to be poised for potential upside in Q3. Bitcoin’s value has traditionally rebounded in July after monitoring unfavorable returns in June with an aggregated common return of seven.3% and a median return of 8.9%.

Whereas historic information from Coinglass confirms Bitcoin’s July restoration narrative after being subdued in June, some market individuals aren’t fully bought on a bullish setup.

Macroeconomic image

Uncertainties proceed to linger within the macro image going into the brand new month. This week, markets welcome gentle catalysts within the type of US macroeconomic information releases, which might present insights into central bankers’ view of inflation and rates of interest.

Fed Chair Jerome Powell is predicted to talk at a European Central Financial institution convention in Sintra, Portugal on Tuesday, adopted by Wednesday’s launch of minutes from the Fed’s earlier assembly.

On Friday, inventory markets will reopen and welcome the US jobs June report.

Indicators of easing inflation up to now have seen market commentators wager on a price cutting-cycle by the US Federal Reserve in some unspecified time in the future this yr.

Markets broadly forecast two charges of 25 foundation factors every by the Fed earlier than the tip of the yr per CME’s FedWatch instrument. These potential price cuts by the Fed might imply extra investor inflows into various belongings like cryptocurrencies.

In its annual financial report launched on thirtieth June, the Financial institution of Worldwide Settlements (BIS) nonetheless warned towards untimely easing of financial coverage.

The BIS suggested at its annual normal assembly,

“A premature easing could reignite inflationary pressures and force a costly policy reversal – all the costlier because credibility would be undermined. Indeed, risks of de-anchored inflation expectations have not gone away, as pressure points remain,”

Market individuals might want to control the following Federal Open Market Committee (FOMC) assembly scheduled for July 30-31 to get a greater studying on the Fed coverage.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

BTC/USD technical evaluation

Bitcoin reclaimed $63,000 throughout 1st July’s buying and selling session setting an intraday excessive of $63,700 within the course of. From a technical standpoint although, Bitcoin continues to be displaying weak spot contained in the $58,500 to $72,000 vary however Monday’s value motion.

Supply: TradingView

A detailed beneath the 20-exponential shifting common (EMA) at round $63,650 might see the crypto fall towards vital assist at $60,000 once more.