Picture supply: Getty Photos

We’re now only a week away from the Britain’s subsequent common election. If investor predictions show correct, we may very well be about to see a surge within the worth of UK shares.

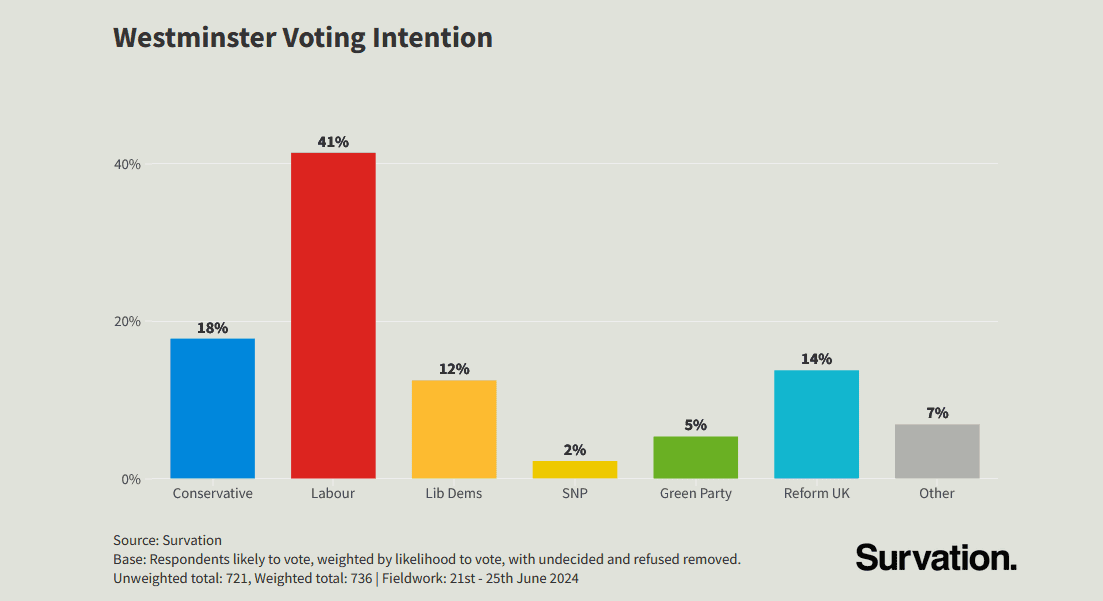

As I kind, it seems the Labour Social gathering is heading in the right direction to safe a thumping Home of Commons majority. A convincing win by any political celebration is at all times cheered on by the markets, due to the soundness it gives.

The outcomes are in!

New analysis means that many retail traders consider a Labour victory may very well be good for the London inventory market.

In line with eToro, 44% of traders suppose British share costs will enhance if Keir Starmer enters Downing Road. That compares with 30% who consider the alternative.

There’s some historic foundation for believing a brand new bull run may quickly be upon us. Dan Moczulski, UK managing director at eToro, says that “when Labour won power in 1997 the FTSE 100 rallied by 35% over the next 12 months.”

He provides that “whilst we’re unlikely to see anything quite so dramatic this time around,” he notes that “the FTSE 100 has already returned 7% so far this year, indicating that markets are comfortable with the expected outcome of this election.”

Nothing’s sure

Nevertheless, there are some necessary caveats for traders to recollect. Previous efficiency isn’t any assure of future returns. And, proper now, inflationary pressures and escalating geopolitical stress stay a risk to share costs throughout the globe.

It’s additionally necessary to keep in mind that not all shares will profit equally from a possible Labour victory. Housebuilders like Barratt Developments and constructing supplies suppliers like Kingfisher may benefit from a doable rise in newbuild numbers.

Elevated spending on healthcare and training may also enhance major healthcare facility supplier Assura and academic sources provider Pearson respectively.

Nevertheless, potential losers may very well be water provider United Utilities and prepare operator FirstGroup, given the larger risk of re-nationalisation.

A possible riser?

These searching for doable sturdy performers after the election could wish to take a look at Greencoat UK Wind (LSE:UKW). It’s one among many renewable vitality shares within the UK that might profit from Labour’s drive to enhance inexperienced funding.

In line with its election manifesto, Labour plans to “work with the personal sector to double onshore wind, triple solar energy, and quadruple offshore wind by 2030“.

Manifesto guarantees famously aren’t legally binding. However the rising local weather emergency means rising funding in clear vitality seems to be a certainty, no matter which celebration wins the election.

Wind generators generated 29.4% of Britain’s electrical energy in 2023, in keeping with Nationwide Grid. This was up from 26.8% a 12 months earlier than as wind capability continued to sharply rise.

This doesn’t imply corporations like Greencoat will ship highly effective earnings progress yearly. Even a ‘supermajority’ gained’t enable Labour to regulate the climate. So companies will nonetheless endure throughout calm intervals when vitality technology tails off.

However over the long run, shopping for renewable vitality shares may provide vital returns to traders. FTSE 250-listed Greencoat has delivered a complete shareholder return near 270% over the previous 12 years. This might enhance considerably if Labour makes good on its inexperienced funding plans.