Information suggests customers on Binance responded to the Ethereum exchange-traded fund (ETF) information by aggressively longing the cryptocurrency.

Ethereum Internet Taker Quantity On Binance Has Simply Seen Its Greatest Candle Ever

As defined by CryptoQuant neighborhood supervisor Maartunn in a submit on X, the Ethereum Internet Taker Quantity has noticed a pointy improve after rumors have surfaced that the ETH spot ETFs have a renewed likelihood of gaining approval.

The “Net Taker Volume” right here refers to an indicator that retains monitor of the distinction between the ETH taker purchase and taker promote volumes on any given centralized trade.

Associated Studying

When the worth of this metric is constructive, it signifies that the taker purchase or lengthy quantity is outpacing the taker promote or brief quantity on the platform proper now. Such a pattern implies a bullish sentiment is dominant among the many buyers.

Then again, the indicator being damaging suggests the presence of a majority bearish mentality among the many customers of the trade because the shorts are outpacing the longs.

Now, here’s a chart that reveals the pattern within the Ethereum Internet Taker Quantity on the cryptocurrency trade Binance over the previous few years:

As displayed within the above graph, the Ethereum Internet Taker Quantity on Binance has simply registered an enormous constructive spike, the implying buyers have simply opened a considerable amount of longs on the platform.

Extra particularly, the indicator’s worth throughout this spike has been $530 million, which, in keeping with the analyst, is the one largest spike the cryptocurrency has ever seen.

“Binance-traders are longing the Ethereum ETF-news like there is no tomorrow,” notes Maartunn. This isn’t notably stunning, contemplating the market may be very properly conscious what a spot ETF might imply for the asset after having witnessed what went down for Bitcoin.

The ETF information pre-approval had been bullish for BTC and whereas the approval itself had initially led to bearish worth motion, it will definitely paid off for the asset as capital began quickly flowing in via these funding autos and the coin loved a rally that led to a brand new all-time excessive (ATH).

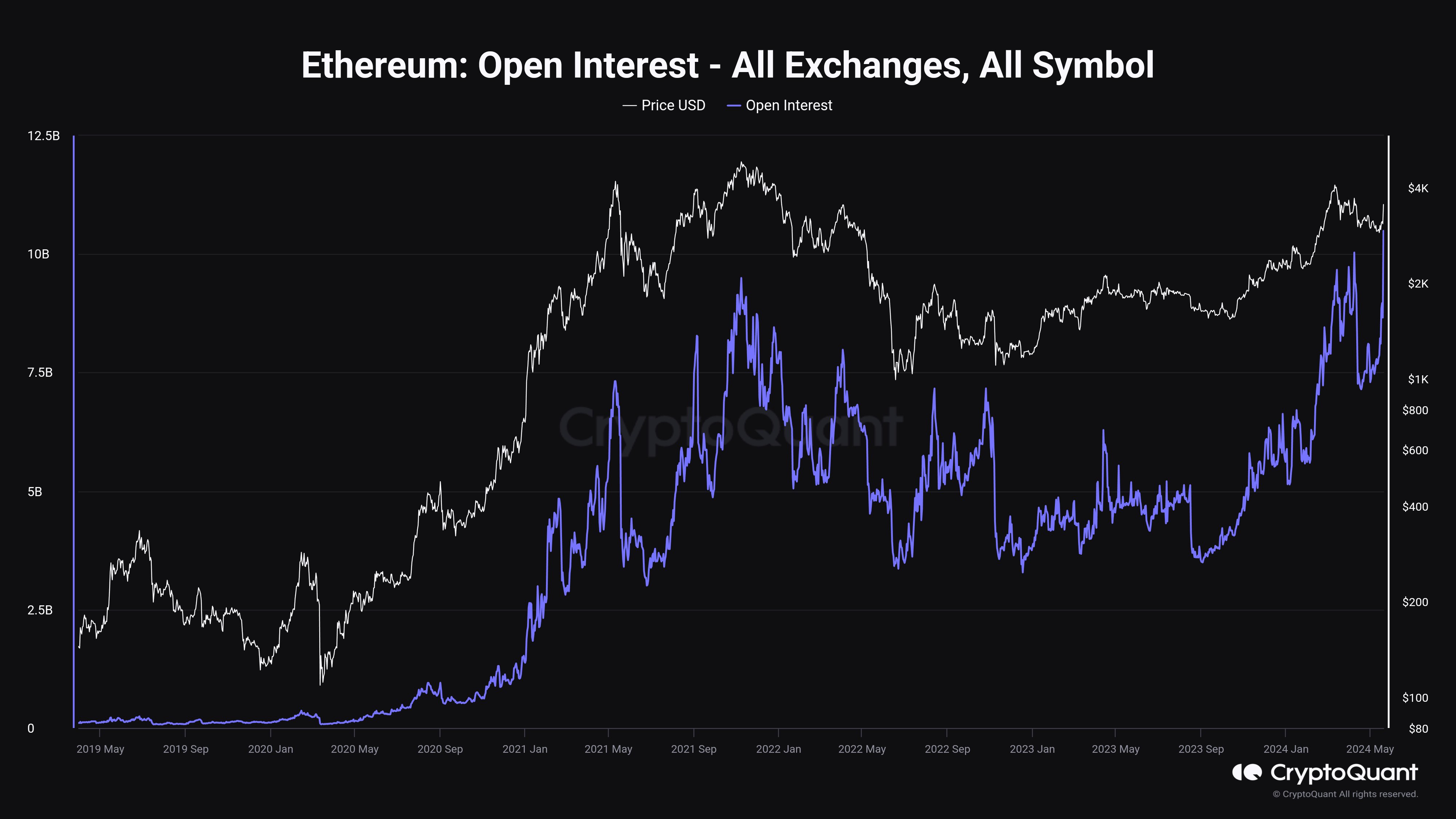

In one other X submit, the CryptoQuant analyst identified that the Ethereum Open Curiosity has shot up as properly. The “Open Interest” measures the entire quantity of ETH-related positions which can be at the moment open on all by-product exchanges.

This pattern isn’t that sudden, on condition that derivatives customers have been opening a considerable amount of longs for the asset. With this speedy surge, the Ethereum Open Curiosity has managed to set a brand new ATH.

Associated Studying

Traditionally, intense hypothesis has usually led to extra volatility for the coin, as the danger of huge liquidations taking place can turn into excessive in such durations. As such, this Open Curiosity spike could sign some turbulent instances forward for Ethereum.

ETH Worth

Up to now within the rally fueled by the ETF information, Ethereum has managed to interrupt previous the $3,800 degree, which is a milestone the coin hadn’t achieved since mid-March.

Featured picture from Shutterstock.com, CryptoQuant.com, chart from TradingView.com