- Bitcoin ETFs confronted $804.8 million in outflows from twenty seventh August to 4th September.

- North Korean hackers goal crypto companies, impacting ETF stability and investor confidence.

September has been a tough month for the main cryptocurrency, Bitcoin [BTC].

Not solely has Bitcoin struggled to interrupt previous the $60K mark, however Bitcoin exchange-traded funds (ETFs) have additionally confronted vital challenges.

Over the previous few days, Bitcoin ETFs noticed outflows of $804.8 million, sending shockwaves by way of buyers and fanatics.

Of explicit concern was BlackRock’s iShares Bitcoin Belief ETF (IBIT), which has failed to draw any inflows since twenty seventh August.

The fund had zero inflows on many days, together with the twenty seventh, twenty eighth, thirtieth of August and third of September, including to market considerations.

North Korean hackers to be blamed?

Amid these occasions, U.S. authorities have issued a warning about an imminent menace posed by North Korean hackers, particularly concentrating on crypto companies concerned within the rising Bitcoin ETF market.

For context, North Korean hackers, notably the Lazarus Group, have a well-established sample of concentrating on cryptocurrency companies and platforms.

The FBI has revealed that North Korean cybercriminals are focusing their efforts on staff at decentralized finance (DeFi) and cryptocurrency companies.

Based on the announcement, these criminals are using extremely “difficult-to-detect social engineering campaigns.”

Supply: ic3.gov/

The warning has raised considerations in regards to the long-term viability of the Bitcoin ETF house because it navigates each monetary and cybersecurity challenges.

IBIT buyers’ shift

Nevertheless, it’s vital to notice that, IBIT’s cumulative internet inflows since its launch on eleventh January have been approaching $21 billion.

In truth, on twenty second July, IBIT skilled a major influx of half a billion {dollars}, the most important since thirteenth March, in response to SpotOnChain knowledge.

This shift highlights the ETF’s fluctuating enchantment to buyers over time, reflecting altering market dynamics and sentiment.

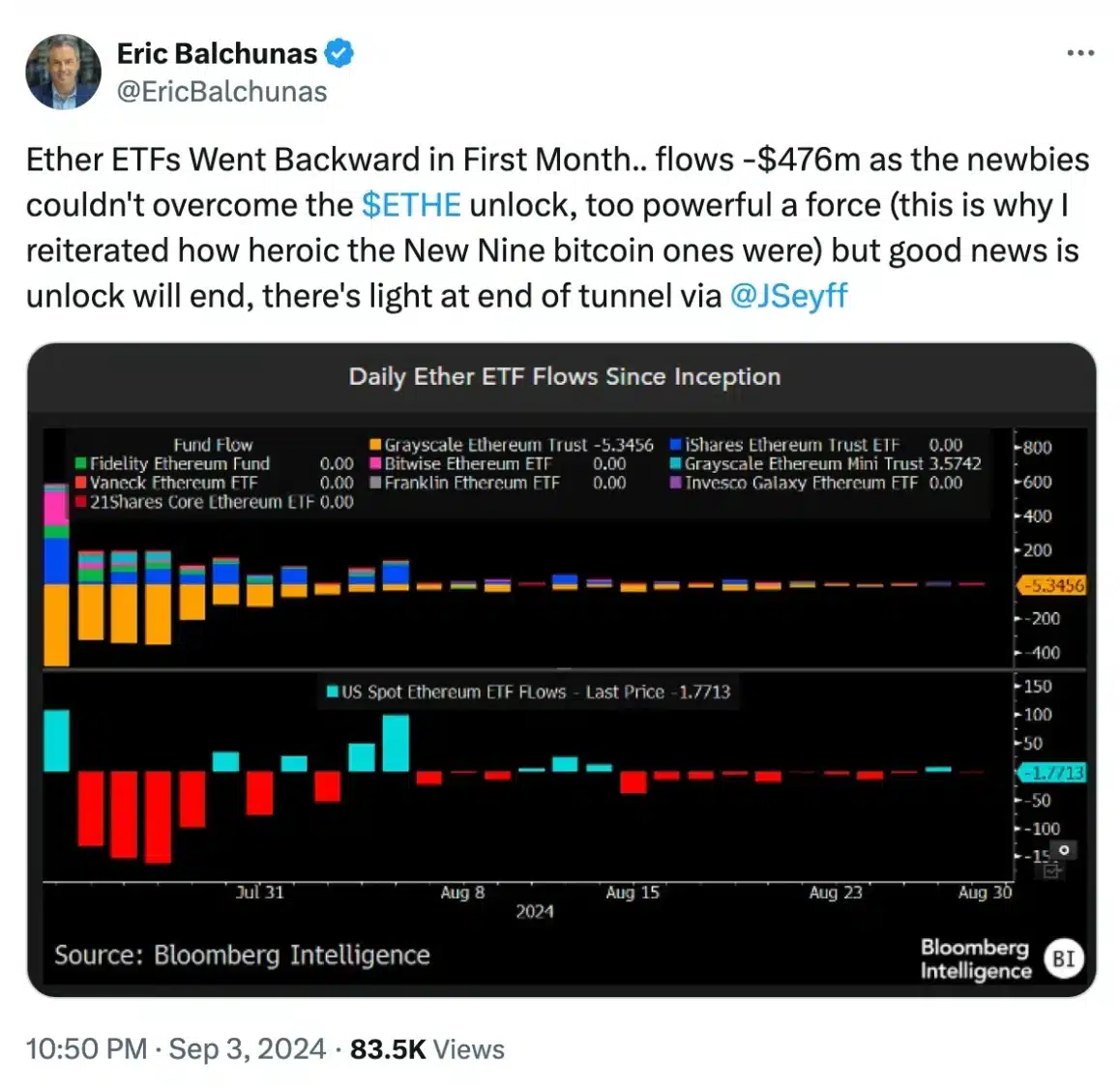

Ethereum ETF continues to outflow

In distinction, Ethereum [ETH] ETFs have been on a constant outflow streak, with solely transient durations of inflows.

Evaluating the identical timeframe used for Bitcoin ETFs—from twenty seventh August to 4th September—ETH ETFs recorded outflows on twenty seventh, and twenty ninth August and once more on third and 4th September.

On thirtieth August and 2nd September, the ETFs noticed zero inflows.

The one notable influx occurred on twenty eighth August, when ETH ETFs registered a modest internet influx of $5.9 million, in response to Farside Traders.

Equally, BlackRock’s Ethereum ETF skilled predominantly zero flows over the previous few weeks, mirroring the development seen with BlackRock’s Bitcoin ETF.

Nevertheless, regardless of the current turmoil, ETF analyst Eric Balchunas maintains a optimistic outlook, believing that brighter days are forward.

Supply: Eric Blachunas/X