- Bitcoin ETFs recorded the very best inflows in almost 5 months.

- ETFs may possible overtake Satoshi’s holdings by December.

Bitcoin [BTC] continued to exceed expectations with its staggering worth rise and record-breaking exchange-traded fund (ETF) inflows.

On the twenty ninth of October, BTC peaked at over $73,000. Concurrently, spot BTC ETFs reported a web influx of $870 million, based on knowledge from SoSo Worth.

This marked the very best single-day web influx since early June.

Supply: SoSo Worth

It’s value noting that usually, such volumes spike throughout downturns are anticipated as buyers “buy the dip.”

Ergo, the query: why are inflows surging alongside a rising BTC worth?

Why are Bitcoin ETF inflows rising?

Curiously, Eric Balchunas, senior ETF analyst at Bloomberg, additionally discovered this rise “a bit odd” in a latest put up on X. Nonetheless, he defined:

“Occasionally tho volume can spike if there a FOMO-ing frenzy.”

The analyst additional remarked,

“Look for (more) big inflows this week.”

He added that iShares Bitcoin Belief ($IBIT) noticed buying and selling volumes soar to $3.3 billion, the most important determine in six months. Nonetheless, this product wasn’t the one one seeing elevated buying and selling volumes.

Though it led by a major margin, all main Bitcoin ETFs skilled elevated exercise, suggesting that FOMO was undoubtedly at play.

ETFs closing in on Satoshi

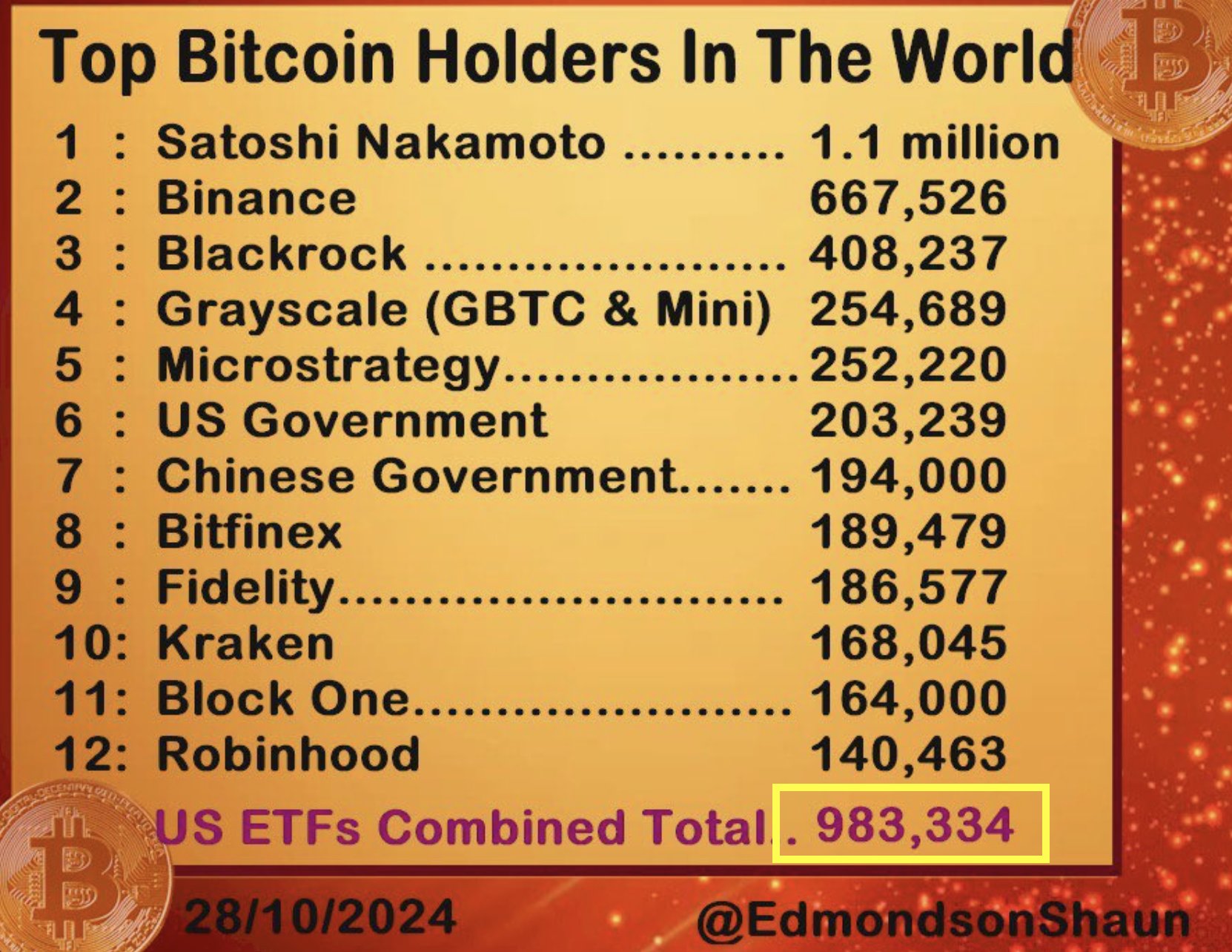

Notably, inflows weren’t the one space the place ETFs gave the impression to be thriving. In one other put up, Balchunas highlighted {that a} main milestone looms for Bitcoin ETFs as the overall BTC held by U.S. spot ETFs is ready to surpass 1 million BTC by subsequent Wednesday.

Moreover, it may exceed the holdings attributed to Bitcoin’s creator, Satoshi Nakamoto, by mid-December.

Supply: Eric Balchunas/X

He famous that the ETFs have been buying roughly 17,000 BTC weekly, pushing them nearer to holding extra Bitcoin than the enduring Satoshi pockets—a historic achievement for this asset class.

But, Balchunas cautioned that this fast accumulation isn’t with out potential disruption, stating,

“Anything can happen, eg a violent selloff and all this is delayed albeit still inevitable.”

He added that, beneath sure circumstances, together with a worth surge or Donald Trump taking the Oval Workplace, FOMO may speed up the timeline even additional.

Institutional demand continues to climb

In the meantime, the acceptance of Bitcoin ETFs has expanded throughout each sort of institutional investor. Balchunas famous that not too long ago, Emory College grew to become the primary endowment fund to report a Bitcoin ETF place.

The college disclosed possession of over $15 million value of shares within the Grayscale Bitcoin Mini Belief in a submitting with the U.S. Securities and Change Fee [SEC].

This improvement signaled that Bitcoin ETFs at the moment are represented in a broad spectrum of institutional classes, together with banks, hedge funds, insurance coverage firms, advisors, pensions, enterprise capital, and household workplaces.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

For an ETF market phase beneath a 12 months previous, this degree of institutional adoption underscored Bitcoin’s maturing function in conventional finance and its enchantment amongst skilled buyers.