- BTC’s ‘extreme greed’ hit 2020 highs, which preceded a 50% worth pullback.

- Markets have been pricing extremely the probability of BTC hovering above $100K.

Bitcoin’s [BTC] $100K goal expectation has pushed the market to 2020’s ‘extreme greed’ degree, which preceded a 50% worth pullback.

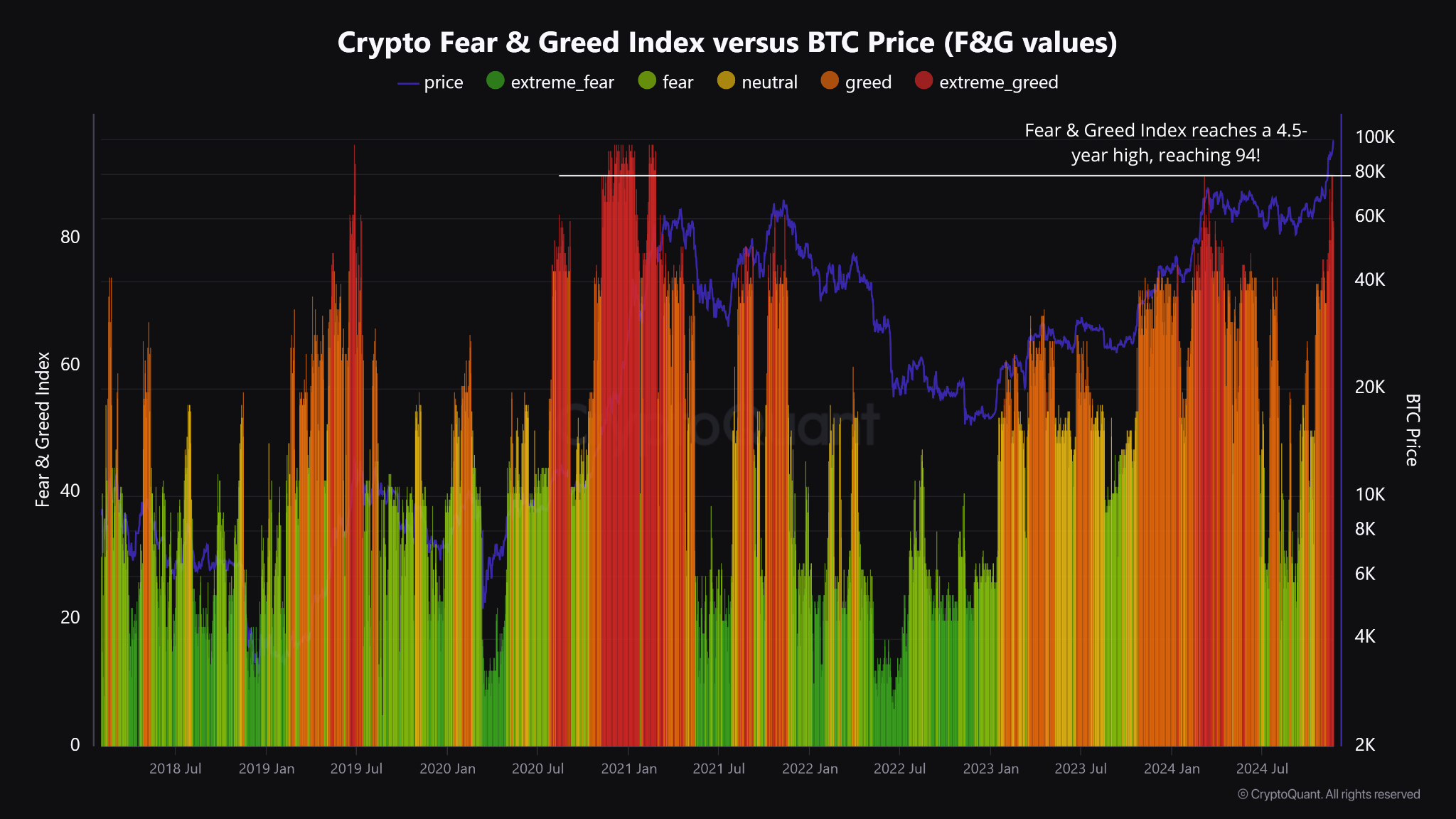

In line with CryptoQuant knowledge, BTC’s Worry and Greed Index (FGI) hit a 4.5-year excessive of 94.

Supply: CryptoQuant

Apparently, the present development mirrored the 2020 sample. The ‘extreme greed’ degree of 94 was hit in November 2020.

Three months later (February 2021), BTC declined by 20% and prolonged its decline to 50% by mid-2021. However earlier than the disadvantage, it pumped 250% in three months.

Markets pricing above $100K

It’s additionally value noting that after the 250% decline in H1 2021, BTC rallied 120% to hit a cycle high of $69K in H2 2021.

Maybe because of this most cycle analysts count on a possible cool-off in early or late 2025. Considered one of them, Alex Kruger, reiterated the identical outlook and mentioned,

“In 2021, the top signals started to roll in February.”

Will the sample affect BTC between now and early or late 2025?

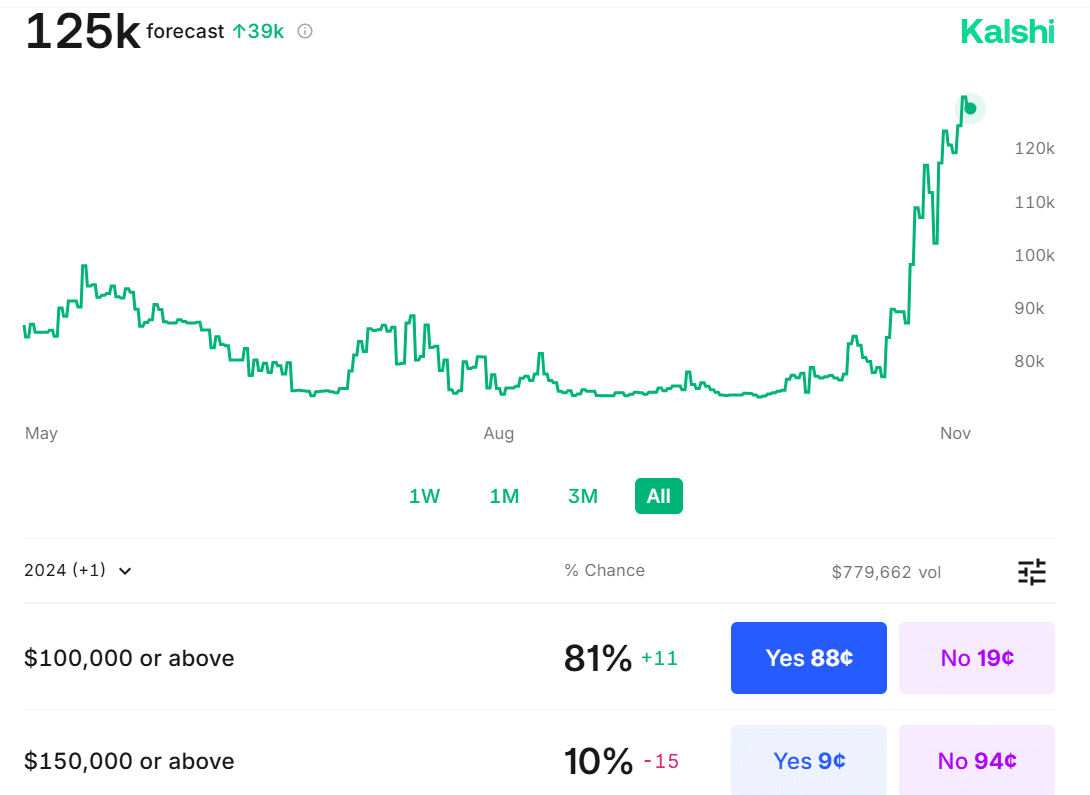

Supply: Kalshi

As of the time of writing, prediction markets have been pricing BTC hovering above $100K. In line with Kalshi, the odds of BTC hitting $100K or $150K by the tip of the yr stood at 81% and 10%.

On its half, the asset supervisor VanEck projected that the cryptocurrency might hit a cycle excessive of $180K.

The agency cited the pro-BTC regulatory surroundings and post-2020 election section of +10% funding charges. A part of its mid-November BTC report learn,

“We anticipate another period of high performance, reminiscent of the post-2020 election phase when sustained 10%+ funding rates drove a 260% gain over 186 days. Our $180k price target remains plausible.”

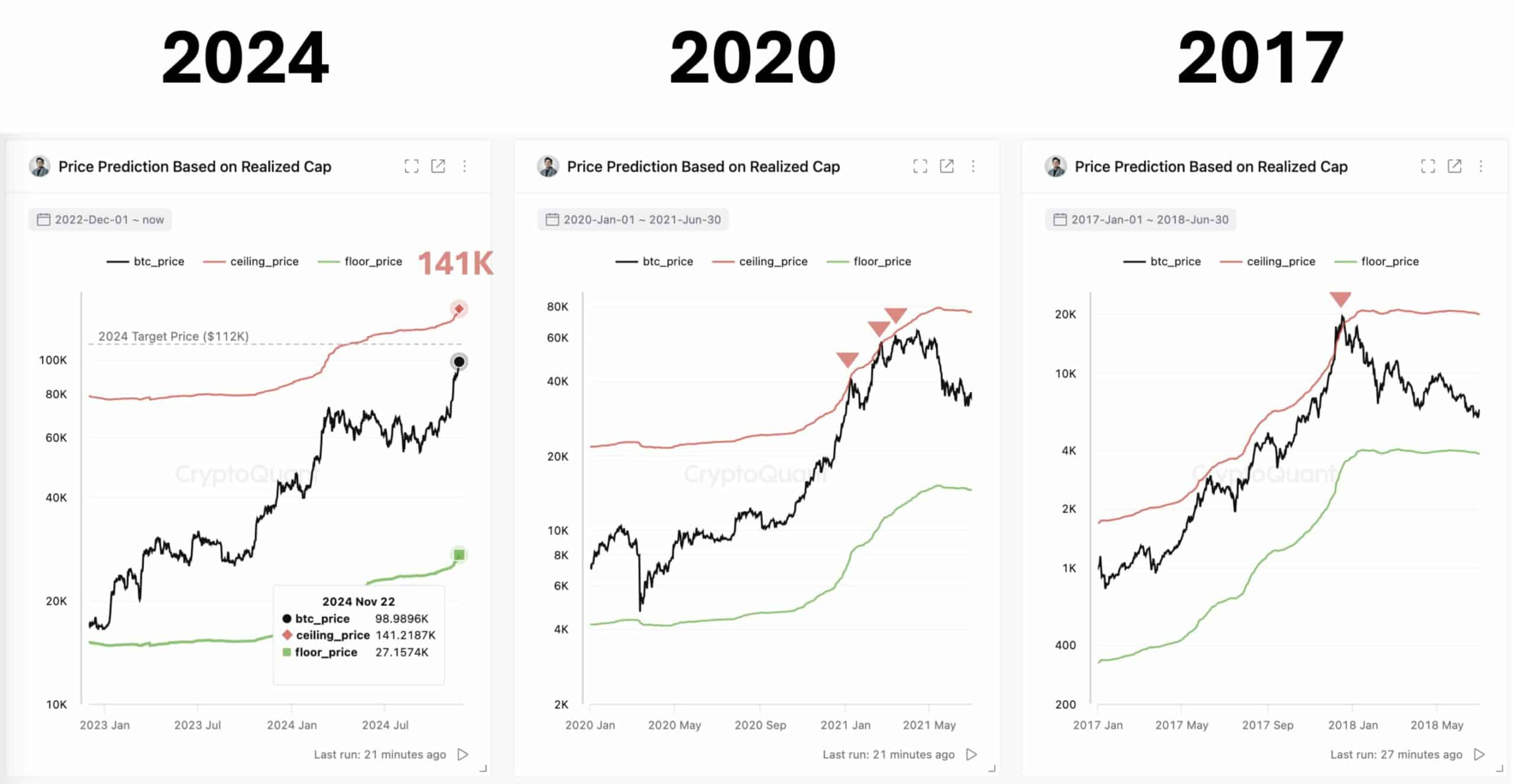

Nonetheless, CryptoQuant’s founder Ki Younger Ju projected a conservative cycle excessive of $141K and a 2024 goal of $112K based mostly on the realized cap valuation.

He famous that the market was not but overheated. In 2020 and 2021, BTC topped after tapping the higher band of the realized cap.

Supply: CryptoQuant

In brief, the market anticipated BTC to soar above $100K, as illustrated by the elevated ‘extreme greed’ degree. Nonetheless, any potential high sign might turn out to be evident in early 2025.