- Bitcoin flashes a number of indicators indicating that it’s again on a bearish leg a minimum of within the brief time period.

- Can Bitcoin align with market expectations regardless of kicking off October with some profit-taking?

Bitcoin [BTC] buyers have exhibited lots of optimism about BTC in October, to the purpose that Uptober has been trending. This may occasionally must do with a number of components equivalent to decrease rates of interest, historic efficiency in October and BTC’s newest bullish efficiency.

Though the bullish expectations for Bitcoin in October are excessive, there are indicators that issues would possibly end up completely different. For instance, a latest CryptoQuant evaluation means that BTC’s newest highs noticed in the direction of the tip of September might mark its newest native excessive.

The evaluation was primarily based on BTC’s NVT golden cross and its latest push above 2.2. One other evaluation means that Bitcoin will probably battle to keep up bullish momentum in October primarily based on historic efficiency.

In response to the evaluation, Bitcoin rallied for 2 weeks after a serious fee lower in 2019, adopted by two months of bearish efficiency.

These observations counsel that Bitcoin should be topic to promote strain regardless of the prevailing. That is already evident in BTC’s newest efficiency.

The cryptocurrency has already given up a few of its September beneficial properties, indicating that some buyers have been taking income.

Bitcoin promote strain accelerates

Bitcoin lately threatened to dip under $60,000 on 1 October. It exchanged fingers at $61,430 at press time. It has to this point tanked by 7.8% from its highest value in September.

This implies it’s on monitor to fall to the $59,580 and $57,940 value vary as per the Fibbonacci retracement.

Supply: TradingView

The pullback is sufficient indication that the post-rate lower announcement hype has run its course. Nonetheless, this raises extra questions than solutions. Will demand resume if value retests the Fibonnacci stage?

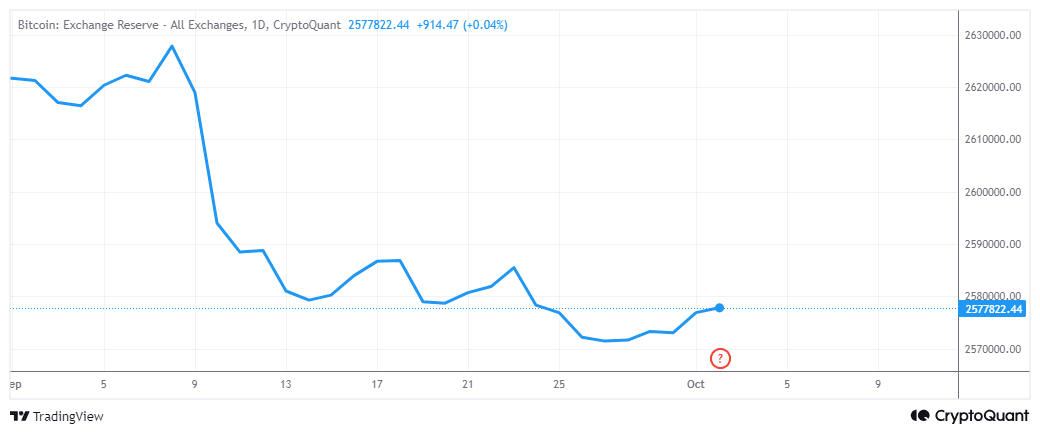

On-chain information offered info that was according to the bearish consequence. For instance, Bitcoin change reserves have maintained an general downtrend for the previous few months with slight upticks right here and there.

The Bitcoin change reserves concluded September with a little bit of an uptick. This confirms that some cash have been shifting from personal wallets to exchanges. Most often, that is according to a resurgence of promote strain in the previous few days.

Supply: CryptoQuant

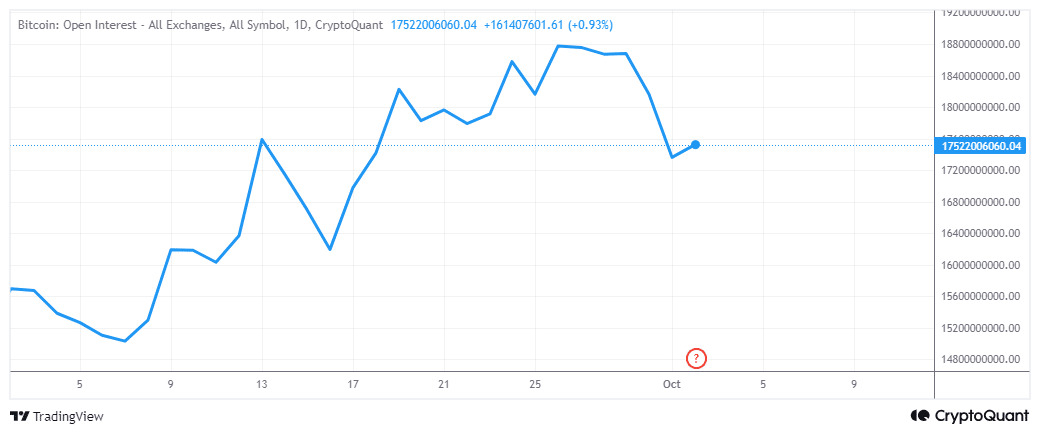

The change reserve uptick was additionally according to a dip in Bitcoin open curiosity since twenty sixth September. This confirms that the demand for Bitcoin within the derivatives phase additionally slowed down.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The findings counsel a major risk that BTC could face extra promote strain within the brief run. As is at present the scenario however this doesn’t essentially present a transparent timeline.

It could possibly be a short pullback or change into an extended one relying on how issues will unfold.