- Speculators’ threat urge for food for BTC improved with bids from long-term holders.

- However bulls may solely affirm market edge in the event that they reclaimed $91.5K.

Speculative curiosity in Bitcoin [BTC] recovered barely, pushing it to $88K, however a powerful, sustained restoration path wasn’t clear but, not less than at press time, per analysts.

In keeping with Swissblock, an analytics agency by Glassnode founders, threat aversion eased barely however didn’t assure a breakout.

“Market risk easing…Now below the 25 threshold, signaling a shift into a low-risk regime. A key step in the bottoming process. Reduces the likelihood of a sharp drop but doesn’t guarantee a breakout.”

Supply: Swissblock

Bitcoin breakout prospects

The outlook was confirmed by the Crypto Worry and Greed Index, which elevated from an excessive worry of 10 to a impartial degree of 47 on the time of writing.

However the agency added that the low-risk regime may appeal to new demand and liquidity wanted for a possible breakout.

As well as, Swissblock said that the breakout may solely be confirmed if BTC reclaimed $90K.

Famend BTC dealer and analyst Cryp Nuevo echoed an identical sentiment. He stated,

“Very good reaction from the 1W50EMA, our buy zone and likely bottom of this correction. We’ll be out of the woods once/if we can flip $91.5k which was the previous range lows.”

Supply: X

Regardless of the warning, buyers appeared optimistic, as illustrated by the $420M BTC withdrawn from exchanges up to now week. In reality, on the twenty fourth of March, $220M BTC was moved from exchanges, reiterating an accumulation spree.

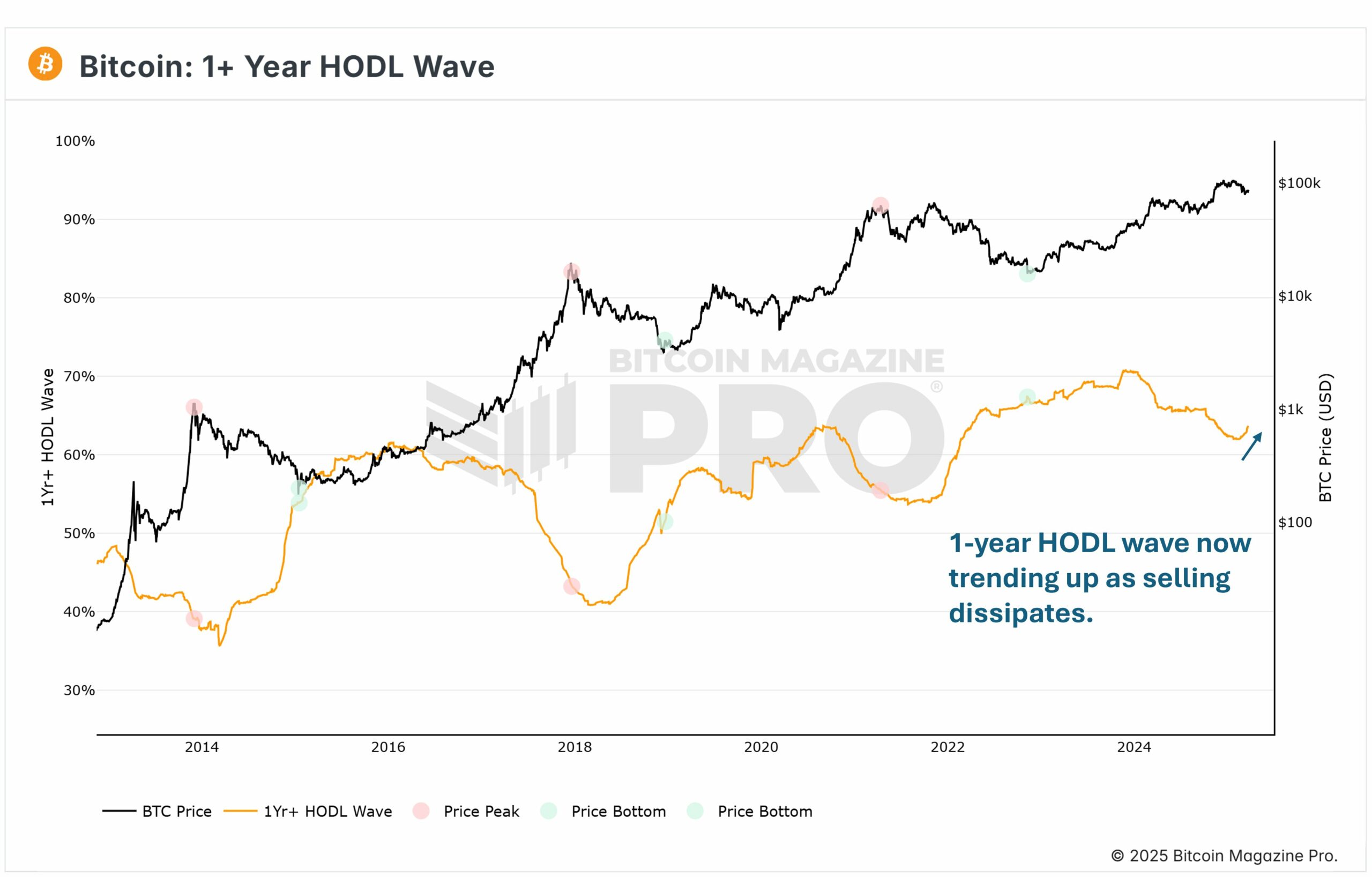

Renewed curiosity from long-term holders additional corroborated the quiet demand, as illustrated by 1-year HODL waves. After promoting through the ‘Trump pump,’ analyst Philip Swift famous they have been bidding once more.

“Long-term BTC holders have stopped selling their BTC around $100k. +1 Year HODL Wave is now trending back up. Expect this to trend down again only once we are comfortably above $100k.”

Supply: BM Professional

Per the chart, the +1 yr HODL cohort sometimes bids throughout market fears and dumps after which sells throughout value rallies.

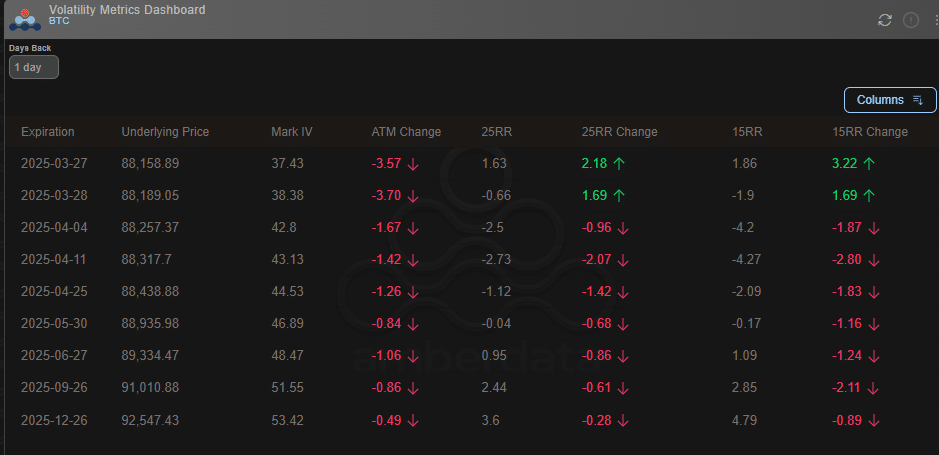

Nevertheless, the Choices market appeared considerably cautious, as put choices traded at a slight premium (there was extra demand for draw back threat protections).

This was illustrated by 25RR (25-delta threat reversal) for the twenty eighth of March, which has an expiry at -0.66.

Moreover, the early April expiry had a 25RR of -2.5 and -2.73, additional reinforcing merchants’ warning within the first half of subsequent month.

Supply: Amberdata