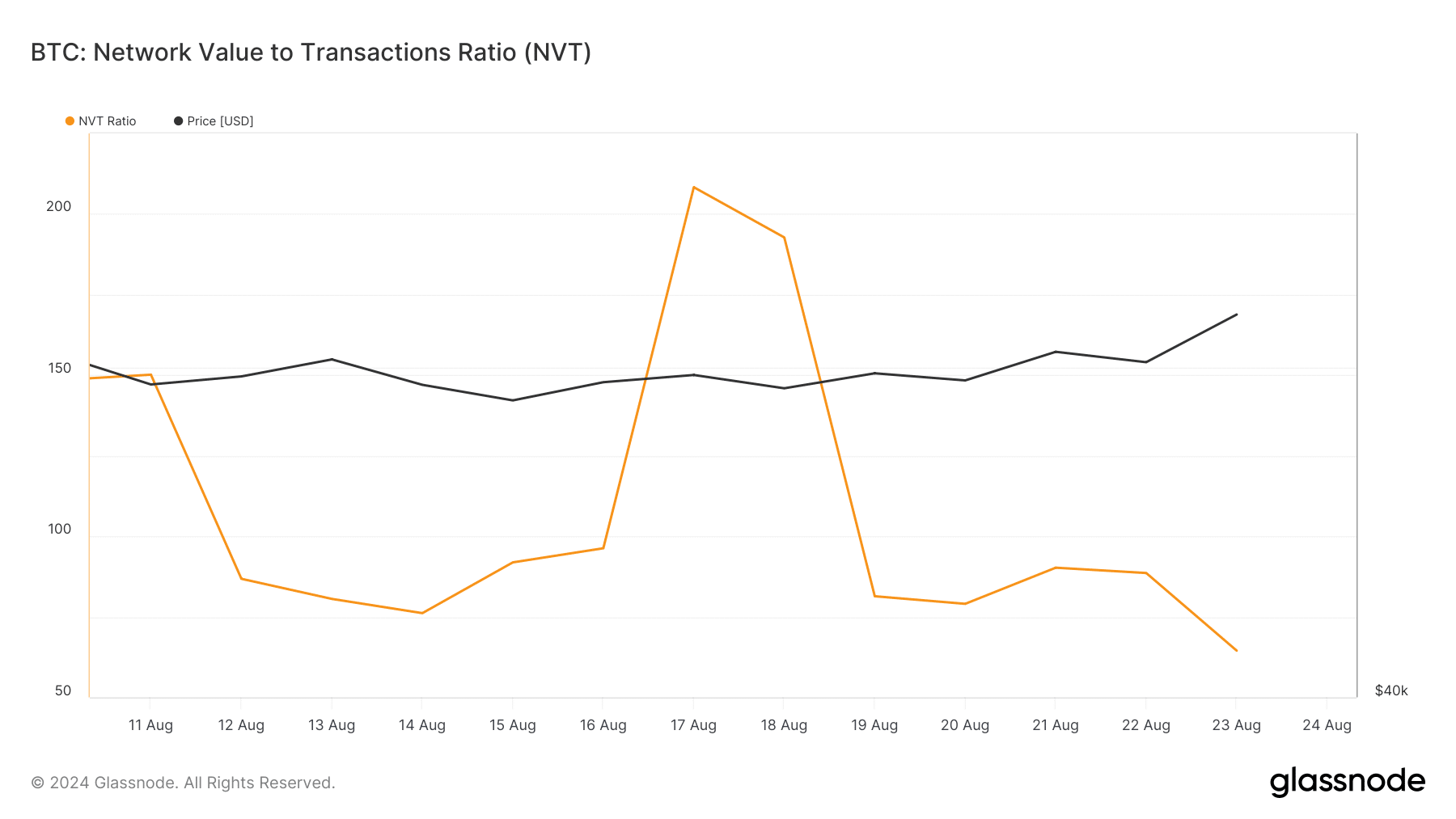

- BTC’s NVT ratio indicated that it was undervalued on the charts

- A couple of metrics had been bearish, hinting at a drop in direction of $57k

Bitcoin [BTC] buyers, at press time, had been having a superb time because the king of cryptos’ worth motion as soon as once more turned bullish. The most recent BTC worth uptick additionally pushed a key indicator into the bull zone. Therefore, it’s value taking a better have a look at the crypto’s present state to see how lengthy bulls can maintain this new uptrend.

Bitcoin turns bullish once more

Bitcoin crossed the $61k-level on 23 August and since then, sentiment across the coin has been bullish. In truth, the crypto was quick approaching $65k. Based on CoinMarketCap, for example, its worth has appreciated by greater than 5% within the final 24 hours.

On the time of writing, BTC was buying and selling at $64,276.61 with a market capitalization of over $1.26 trillion. Due to this worth hike, practically 86% of BTC buyers had been in revenue.

Supply: IntoTheBlock

That’s not all although.

Ali, a preferred crypto analyst, lately shared a tweet revealing a bullish growth. Based on the identical, since early August, the BTC bull-bear market indicator has been oscillating between bearish and bullish. Now, it has switched again to bullish once more.

Which means that BTC’s newest upswing may proceed additional.

Supply: X

BTC’s upcoming targets

Because the aforementioned indicator turned bullish, AMBCrypto checked different datasets to learn how doubtless it’s for the king coin to stay bullish.

Our evaluation of Glassnode’s knowledge revealed that BTC’s NVT ratio registered a pointy decline. A drop on this metric implies that an asset is undervalued, indicating a worth hike on the horizon.

Supply: Glassnode

Moreover, as per CryptoQuant’s knowledge, BTC’s internet deposit on exchanges was low in comparison with the final seven-day common, hinting at a drop in promoting strain. Aside from this, AMBCrypto reported beforehand that the NASDAQ shaped a bearish divergence sample. Which means that a resurgence in promote strain might see liquidity circulate from shares to Bitcoin.

Nonetheless, a couple of of the metrics did flip bearish. For instance, the aSORP was purple, which means that extra buyers had been promoting at a revenue. In the course of a bull market, it may point out a market high.

Additionally, its NULP identified that buyers are in a perception part the place they’re at the moment in a state of excessive unrealized income.

Supply: CryptoQuant

Subsequently, AMBCrypto checked BTC’s each day chart to raised perceive whether or not it may maintain the bull momentum. The technical indicator MACD displayed a bullish crossover. Its Chaikin Cash Move (CMF) additionally registered an uptick.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

If the bull rally continues, then BTC may quickly go above the $65.2k resistance and strategy $68k subsequent. Nevertheless, in case of a bearish takeover, Bitcoin may drop to $57k once more.