- Bitcoin’s long-term holder SOPR hit 1, indicating common sells at break-even

- Evaluation of BTC’s key metrics and patterns advised the bull run continues to be on.

Bitcoin’s [BTC] latest value motion and on-chain metrics are essential for understanding market sentiment, given its place because the cryptocurrency with the most important market cap.

The Lengthy-term Holder SOPR that tracks Bitcoin transactions by those that’ve held BTC for over 155 days is a key metric. When the SOPR’s worth is above 1, it signifies income, whereas a price beneath 1 indicators losses.

After the newest Bitcoin value drop, the SOPR hit 1, that means many merchants offered at break-even – An indication of market warning.

Supply: CryptoQuant

Bitcoin [BTC], which had beforehand surged to $62k, is now buying and selling beneath this stage because of huge liquidations across the aforementioned stage.

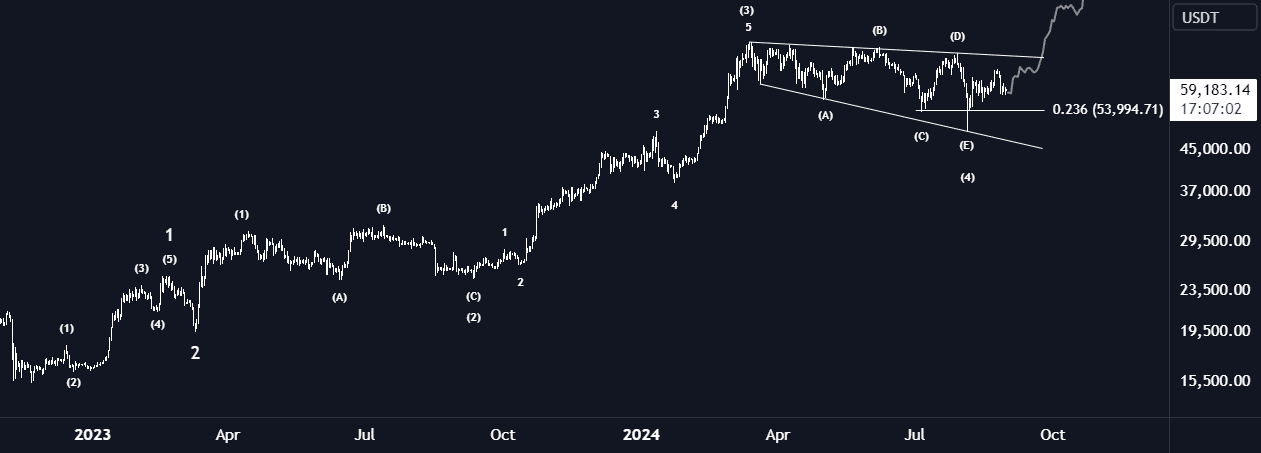

BTC’s broadening wedge at crucial help stage

Proper now, Bitcoin’s value motion within the BTC/USDT pair is advancing inside a broadening wedge sample. That is usually a consolidation section, signaling the calm earlier than a possible market transfer.

This sample is sitting at a crucial help stage, with accumulation persevering with as merchants stay skeptical about Bitcoin’s potential for an upward projection.

Now, there may be potential for Bitcoin to slide to the $53k value stage earlier than a attainable upturn, seemingly in This fall 2024. The value stalling round $59k provides to the uncertainty surrounding this crucial interval.

Supply: TradingView

Additional evaluation of funding charges from Coinglass revealed little change over the previous month. This, regardless of the huge market flush on 5 August triggered by Japan’s inventory market crash because of charge hikes.

Since then, whereas funding charges have stabilized, they’ve remained comparatively low. This helps the concept that Bitcoin is in an accumulation section.

BTC RSI breakout pointed to a rebound

Furthermore, Bitcoin’s Relative Energy Index (RSI) lately recorded its second important breakout throughout this bull cycle, which could possibly be setting the stage for one more rally.

If Bitcoin [BTC] dips additional beneath the $53k stage, it’d set off panic promoting, probably resulting in a rebound.

The RSI breakout, much like a earlier occasion that led to a significant bullish rally, advised that BTC may be gearing up for one more northbound surge.

Supply: TradingView

Historical past of final quarter’s post-halving

Traditionally, the final quarter of the 12 months following a Bitcoin [BTC] halving has been bullish. This pattern would possibly proceed in 2024.

Regardless of a irritating and stagnant summer time market, Bitcoin buyers and merchants ought to stay affected person, because the market has a historical past of rewarding those that maintain on throughout such intervals.

This could possibly be an opportune time to build up extra BTC, anticipating a possible rally within the remaining quarter of the 12 months.

Supply: Titan of Crypto/X