- Lengthy liquidations had been loads larger than shorts after BTC fell under $70,000

- Demand for the coin may lower as sentiment remained adverse

The crypto market, led by Bitcoin [BTC], witnessed a tough day on the workplace on 7 June as costs plunged. At press time, BTC had misplaced 2.83% of its worth within the final 24 hours whereas buying and selling at $69,262.

On account of the decline which was reportedly triggered by a U.S jobs information , the full market capitalization dropped to $2.55 trillion. This was a 3.48% fall over a single 24-hour interval. As anticipated, merchants weren’t resistant to the results of this replace both, in line with information from Coinglass.

On the time of writing, the full worth of liquidations was $410.42 million. Out of this, Bitcoin contracts accounted for $70.73 million.

Supply: Coinglass

Liquidations change the standpoint

Crypto liquidations happen when market circumstances are unfavorable. Due to this, exchanges forcefully shut the leveraged positions of merchants who can not fulfill the margin necessities.

Notably, a big a part of the liquidations which occurred inside the timeframe had been longs. For context, longs are merchants with bets on a worth hike. Subsequently, it was evident {that a} l0t of merchants had been optimistic about Bitcoin’s worth because it began buying and selling above $71,000 on 7 June.

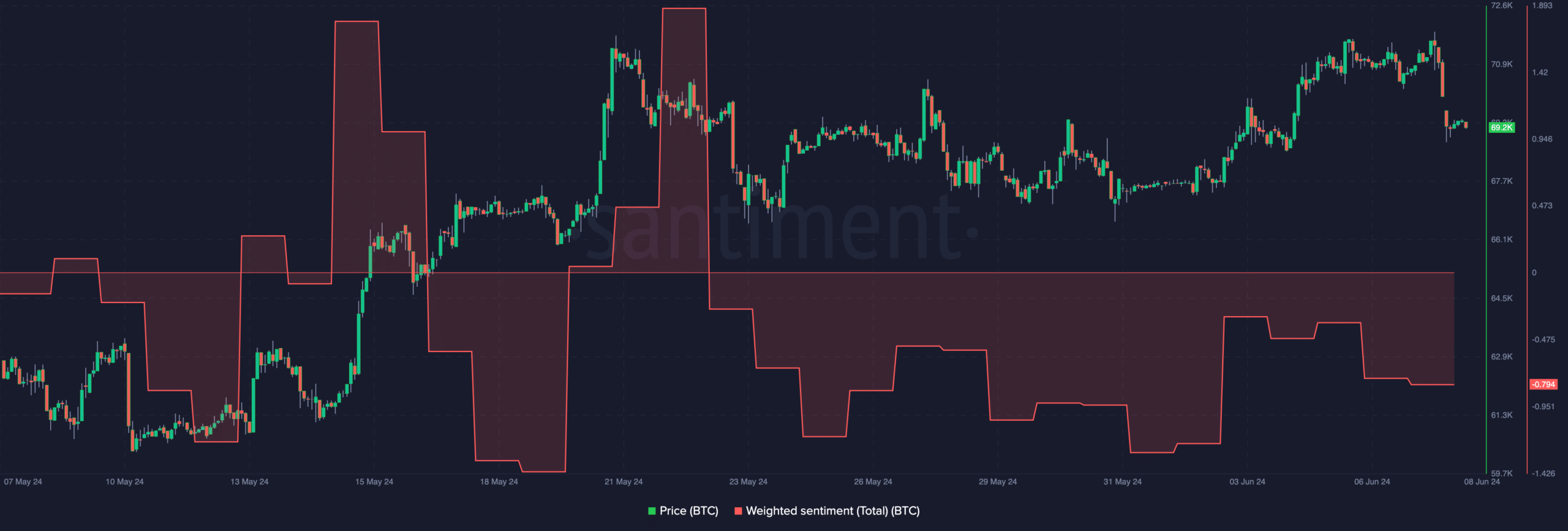

Moreover, the autumn in costs appeared to have affected the sentiment throughout the market. Although the Weighted Sentiment was adverse earlier than the cascade of liquidations, the studying fell additional right down to -0.794.

This decline implied that many of the conversations about Bitcoin on-line tilted in direction of the bearish facet. As such, demand for the coin could possibly be gradual, suggesting that the worth may slip on the charts once more.

Supply: Santiment

Ought to this be the case, the worth of BTC may fall to as little as $67,450. Nevertheless, outdoors of on-chain exercise, a key issue supporting a rebound is Bitcoin ETF complete netflows.

Subsequent week is essential for BTC

For these unfamiliar, a Bitcoin ETF is a product that exposes traders to the worth motion of the monetary instrument. Nevertheless, this doesn’t imply that traders would personal BTC instantly.

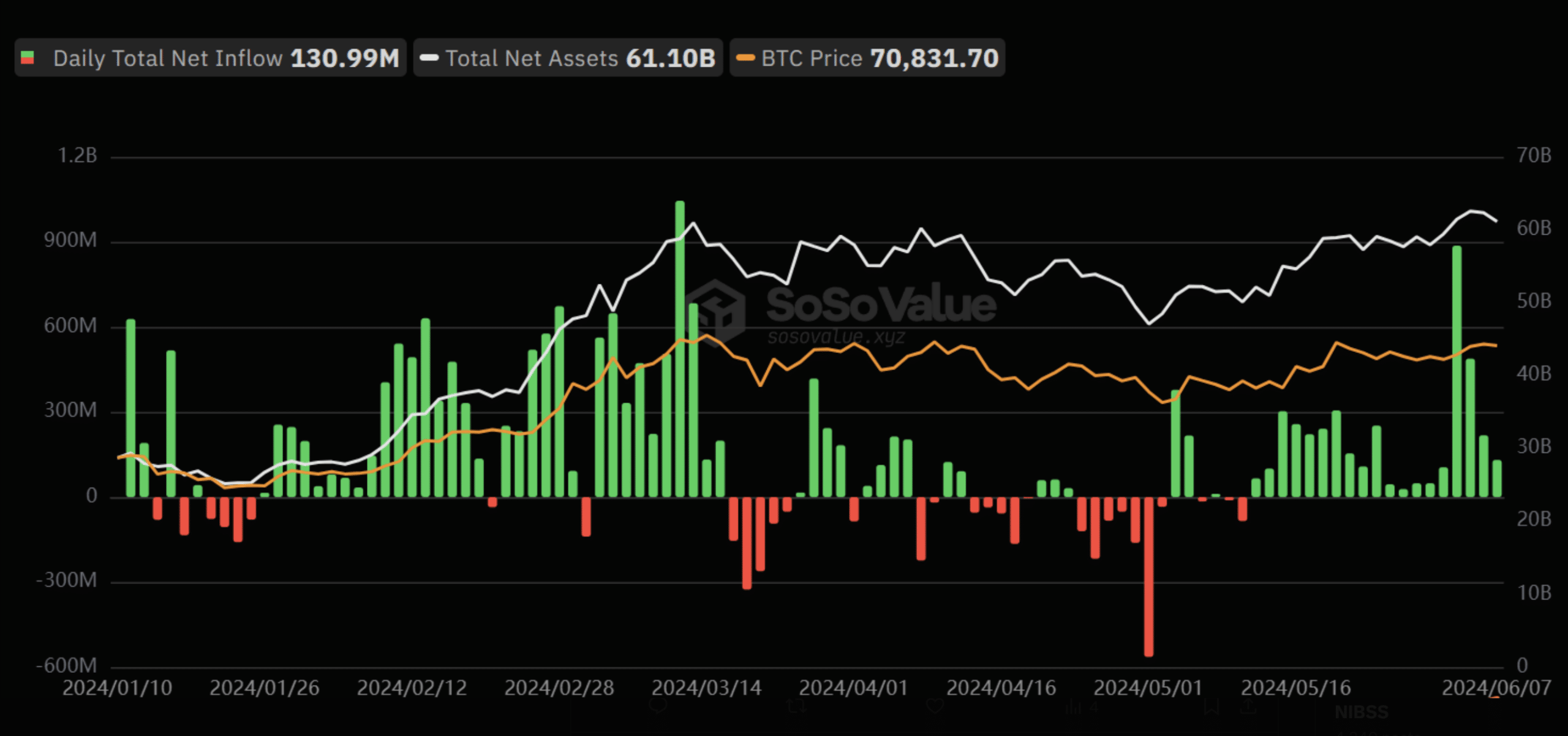

In line with crypto funding monitoring instruments, the full internet inflows on 7 June had been $131 million. Giving particulars of the breakdown, reporter Colin Wu famous,

“On June 7, the total net inflow of Bitcoin spot ETFs was $131 million. Grayscale ETF GBTC had a single-day outflow of $36.3411 million, and BlackRock ETF IBIT had a single-day inflow of $168 million. The total net asset value of Bitcoin spot ETFs is $61.104 billion.”

Supply: Soso Worth

Whereas the inflows had been a bit decrease than earlier days, the truth that it was larger than the outflows instructed that BTC may evade a big correction. If by Monday the inflows are larger, Bitcoin’s worth may revisit $71,000. If not, the worth may swing sideways.

Nevertheless, one different factor that may have an effect on Bitcoin within the coming week is the FOMC assembly. FOMC stands for Federal Open Market Committee. The committee is answerable for figuring out the financial coverage in the USA.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

The assembly normally spurs volatility available in the market, and is due for 12 June. If the company cuts rates of interest, BTC may see a surge in worth amid excessive volatility. Nevertheless, a better fee may contribute to a different decline within the crypto’s worth.