- Bitcoin holders shift guard in favor of short-term profit-taking, opposite to current market expectations

- Such a transition may have a significant influence on BTC’s value

Bitcoin’s market sentiment has modified considerably over the previous couple of weeks. In reality, there have been expectations that BTC will keep its bullish momentum from September in October too. Nevertheless, these expectations had been removed from the truth of issues.

In line with information, there’s a rising development that will restrict the cryptocurrency’s capacity to soar to new highs, no less than within the short-term. A current CryptoQuant evaluation underlined the identical, highlighting the modifications in long run holder (LTH) and quick time period holder (STH) dynamics.

In line with the evaluation, LTH’s realized cap lately dropped by $6 billion. This advised that LTHs have been taking revenue. By extension, it additionally implied that they don’t anticipate value to increase into new highs, no less than within the quick time period.

Supply: CryptoQuant

The identical evaluation highlighted a surge in brief time period holder realized cap by roughly the identical quantity ($6 billion). In line with the evaluation, this shift by STHs may imply that they’re accumulating, however with a concentrate on short-term earnings.

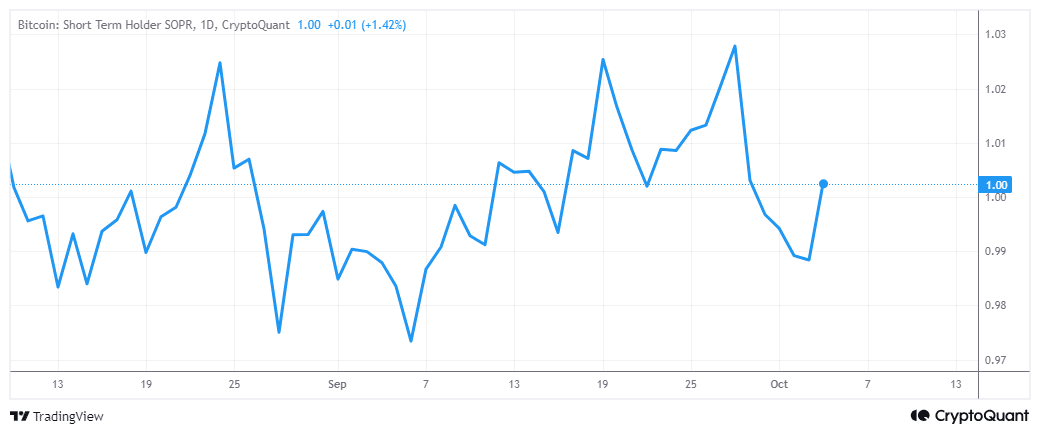

The evaluation aligned with Bitcoin’s newest value motion, which has been characterised by quick time period swings. In different phrases, it may very well be some time earlier than Bitcoin experiences a significant breakout. That is additionally in step with the current observations in BTC’s short-term holder SOPR.

Supply: CryptoQuant

The short-term holder SOPR’s upticks confirmed the shift in favor of quick time period profit-taking. That is traditionally aligned with each prime in shorter-term intervals.

How lengthy will this Bitcoin quick time period focus final?

The shift in favor of quick time period profit-taking is essentially depending on the prevailing market sentiment. This has currently been pushed by market occasions. Proper now, essentially the most vital upcoming occasion that might have a significant influence on Bitcoin is the U.S election cycle.

Uncertainties are inclined to help a short-term focus, which can clarify why traders have shifted to their present quick time period profit-taking method. The U.S election’s end result might also set off a significant response, one which may very well be sufficient to push BTC from its present vary. Be aware that this might both be bullish or bearish, relying on the result.

So far as quick time period expectations are involved, Bitcoin merchants ought to preserve a watch out for liquidations. A brief time period profit-taking method encourages extra leverage, which can in flip result in extra publicity to liquidation occasions.