- Promoting sentiment has been dominant amongst U.S traders

- Market indicators hinted at a sustained worth drop within the brief time period

Bitcoin [BTC] has been on a rollercoaster trip for a few weeks now. This was greatest evidenced by BTC efficiently crossing $64k, earlier than dropping beneath $60k inside only a few days.

Whereas the coin’s volatility has remained excessive, institutional traders are contemplating stockpiling the cryptocurrency. Will this assist BTC flip bullish in September?

Are institutional traders accumulating Bitcoin?

Bitcoin witnessed a +9% worth correction final month. On the time of writing, it was buying and selling at $58,184.19 with a market capitalization of over $1.13 trillion.

Within the meantime, Vivek, a well-liked crypto influencer, not too long ago shared a tweet highlighting an fascinating growth. In keeping with his evaluation, the variety of BTC balances on new addresses with greater than 1k BTC elevated sharply over the past a number of months. This clearly prompt that institutional traders have been displaying confidence in BTC. It additionally means they count on the king coin’s worth to surge within the coming weeks or months.

Since a brand new month is already upon us, AMBCrypto took a more in-depth take a look at Bitcoin’s state. This, in an try and see whether or not institutional traders’ confidence in BTC would repay this month.

Supply: X

How BTC’s September may appear like

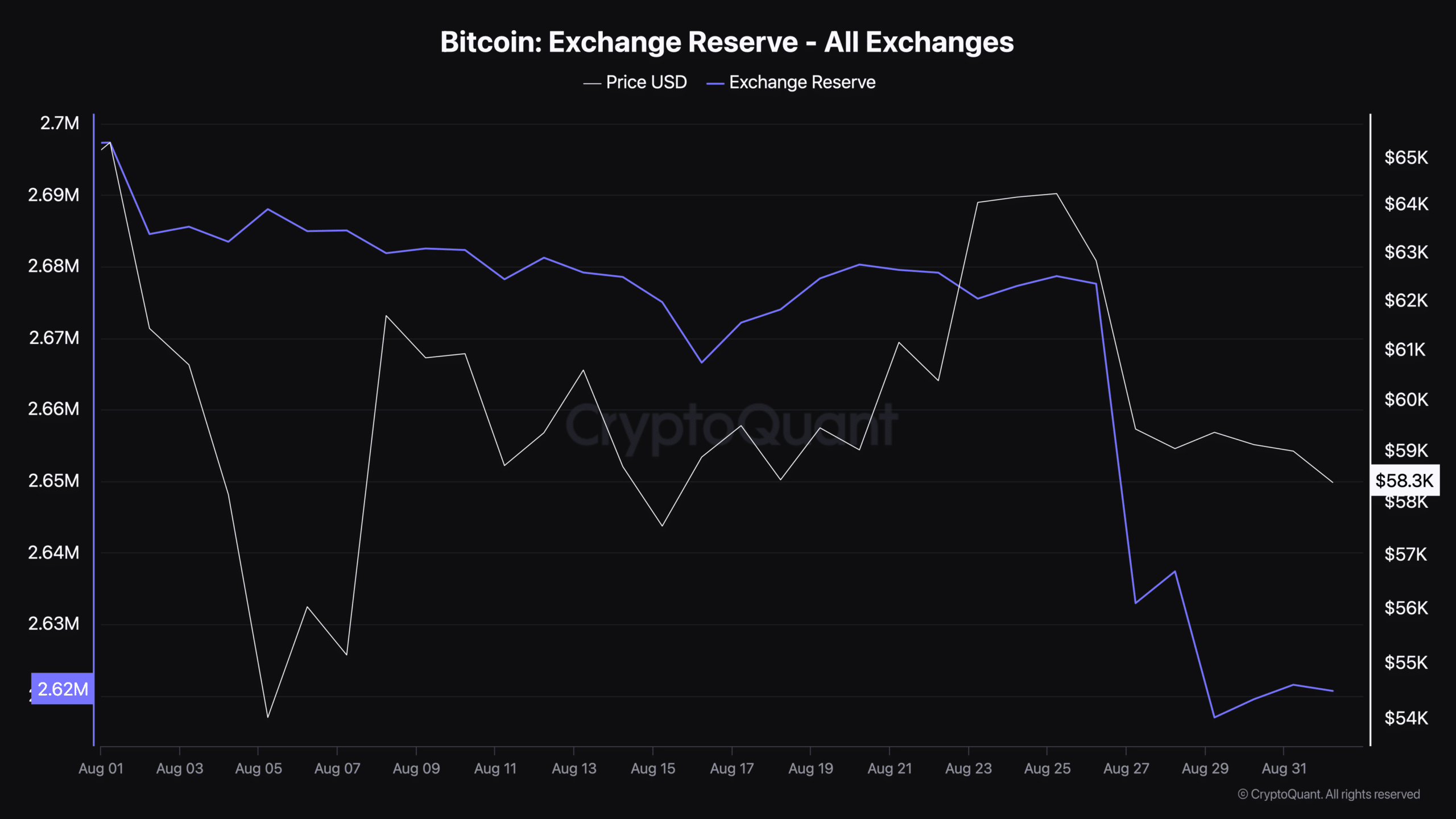

AMBCrypto’s evaluation of CryptoQuant’s information revealed that BTC’s trade reserves dropped sharply on 27 August. This clearly prompt that purchasing stress on the coin was excessive, which regularly leads to worth hikes.

Supply: CryptoQuant

Nonetheless, not every thing appeared to be within the coin’s favor. For instance, the Coinbase premium turned inexperienced, that means that promoting sentiment was robust amongst U.S traders. On prime of that, the Funds premium was additionally pink. This indicated that traders in funds and trusts, together with Grayscale, have comparatively weak shopping for sentiment.

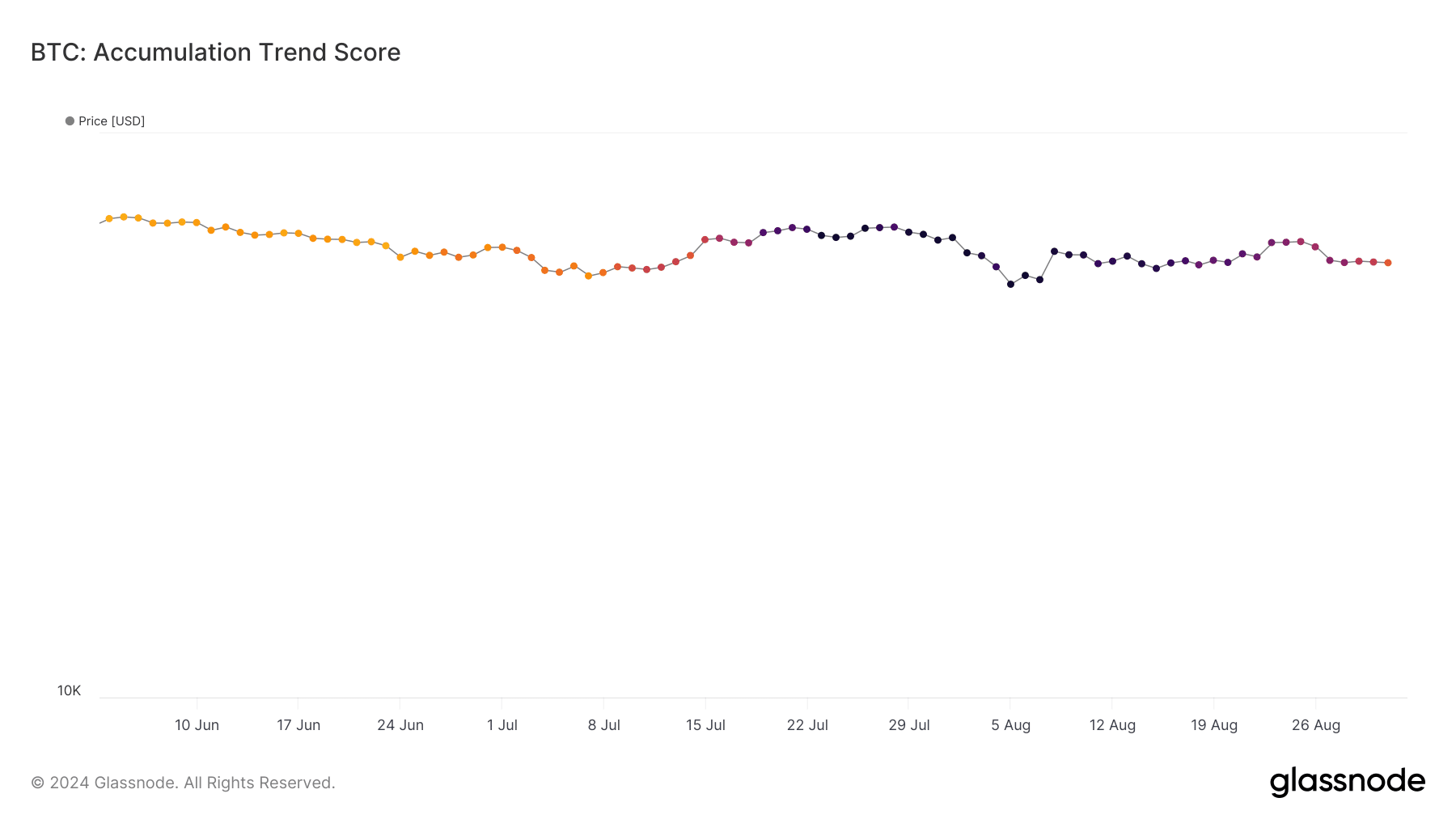

Aside from this, AMBCrypto’s evaluation of Glassnode’s information revealed that at press time, Bitcoin’s accumulation development rating had a worth of 0.35. For starters, the buildup development rating is an indicator that displays the relative measurement of entities which might be actively accumulating cash on-chain when it comes to their BTC holdings.

A quantity nearer to 0 signifies the reluctance of traders to build up. Then again, a worth nearer to 1 hints at a hike in shopping for stress. Since at press time the worth was near 0, it appeared that purchasing stress was diminishing.

Supply: Glassnode

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

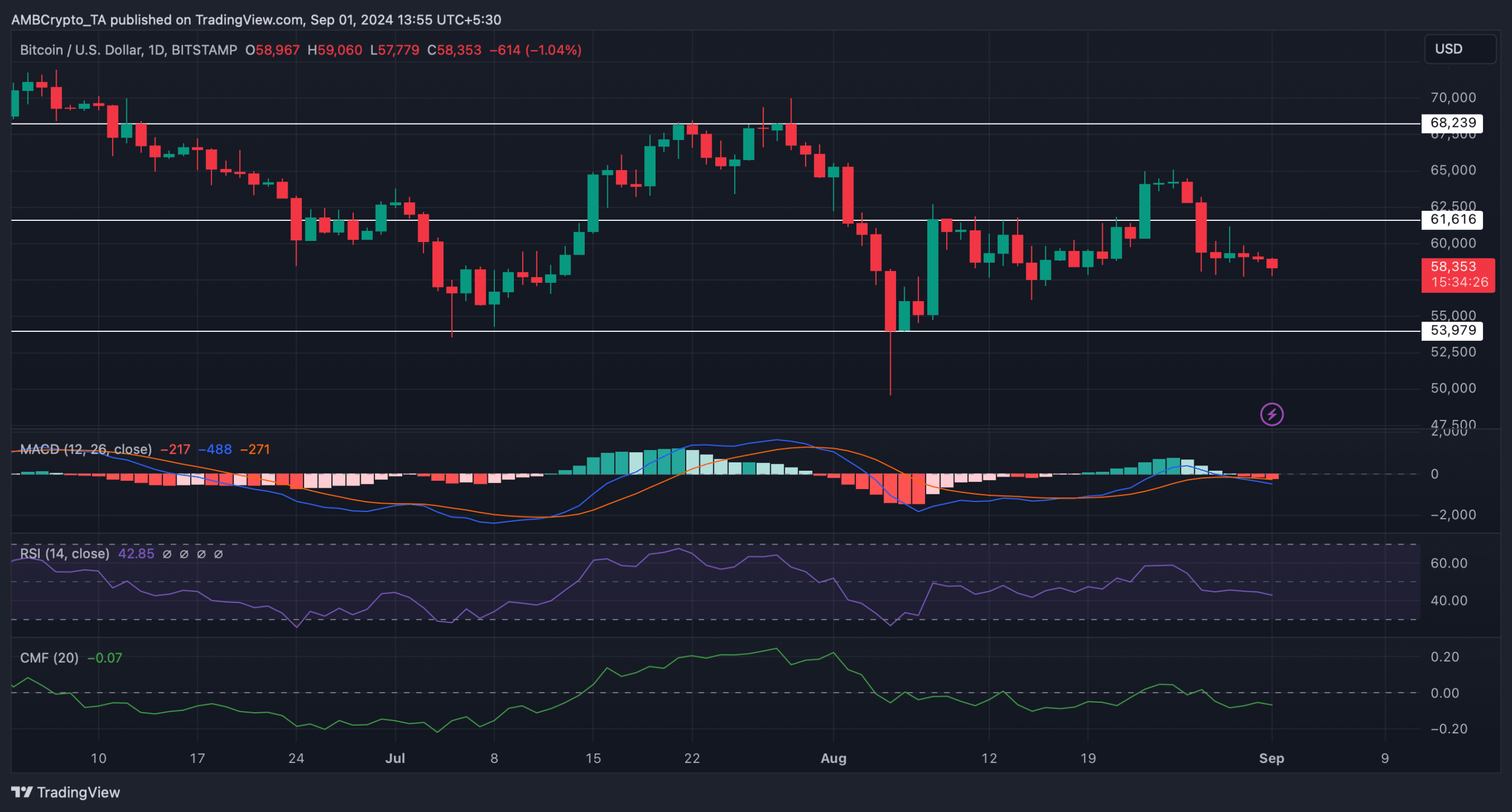

Lastly, AMBCrypto analyzed BTC’s every day chart to raised perceive what to anticipate from it in September.

The technical indicator MACD displayed a bearish crossover. Each its Chaikin Cash Movement (CMF) and Relative Energy Index (RSI) registered downticks too. Collectively, these indicators prompt that traders may need to attend longer in September to see Bitcoin flip bullish.

Supply: TradingView