- Bitcoin Futures order e book stays free.

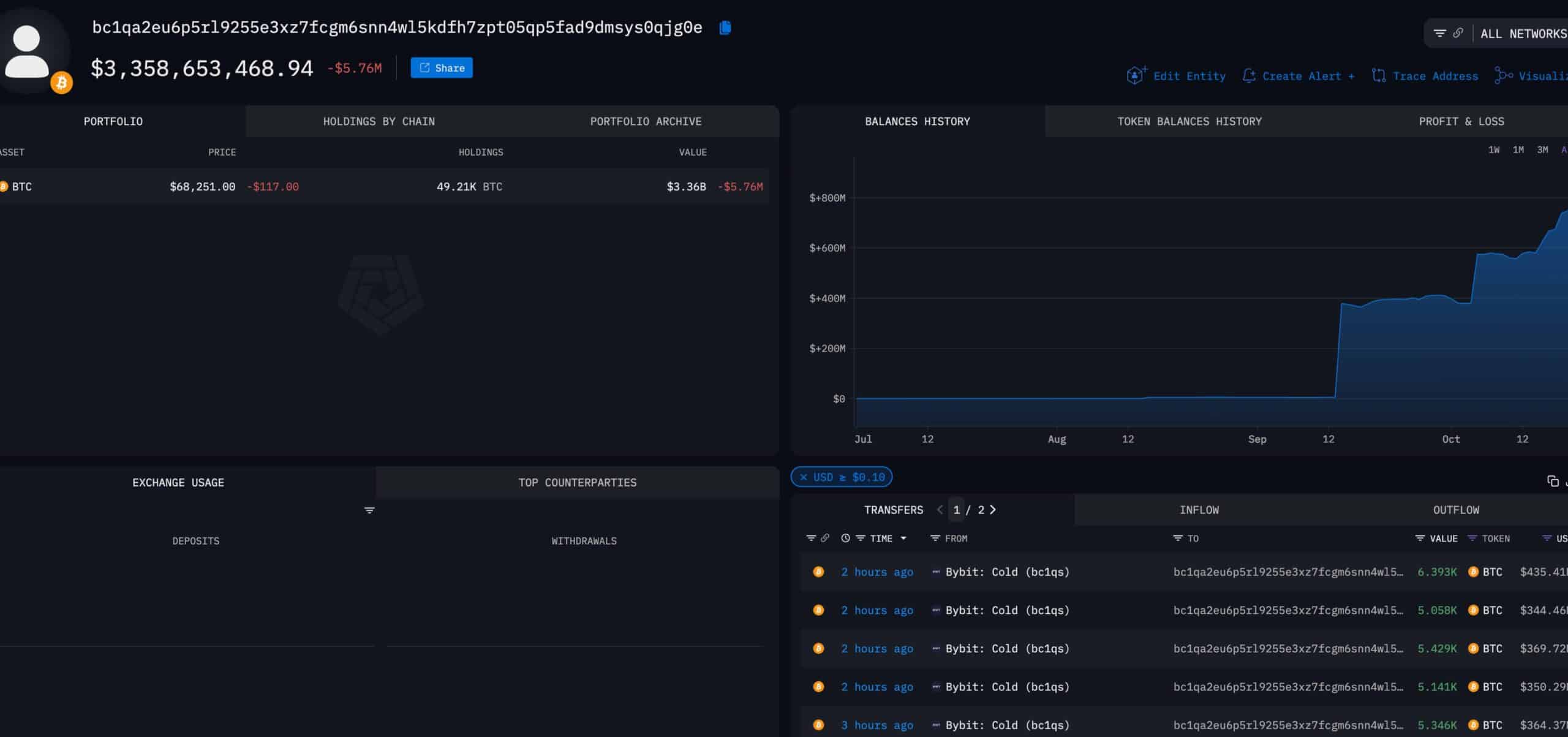

- Bybit strikes $3.3 billion value of BTC to new pockets.

The worth motion of Bitcoin [BTC] is making a dynamic atmosphere as its Futures order e book stays free.

Latest information from the Bitcoin liquidation heatmap confirmed heightened exercise, suggesting potential liquidations that would set off value actions.

This creates a playground for giant gamers to affect value actions within the zone between $67.5K and $69.5K, signaling volatility.

With Futures positions competing in these zones, Bitcoin’s value may see speedy swings up or down with comparatively small quantities of capital.

Supply: Coinglass

A key help stage at $63K could also be examined if Bitcoin fails to carry above its key Fibonacci retracement stage. Nevertheless, long-term holders might discover reassurance in robust help from the 180 and 120-day shifting averages.

With practically 49,000 BTC moved from Bybit’s chilly storage to a brand new pockets, some traders are paying shut consideration to those vital transfers.

Such large-scale transactions may sign market shifts, and the Bybit group’s inside motion of belongings ought to be rigorously monitored, particularly with liquidations in play.

Supply: Arkham

BTC native prime and sentiment

By way of value forecasts, Bitcoin is approaching resistance at $70K, with CME Futures barely above present costs.

Market contributors are keenly watching whether or not BTC can break via this resistance or face rejection.

Bulls might want to defend the $68K help stage, as sustaining this value is essential for stopping a extra vital drop.

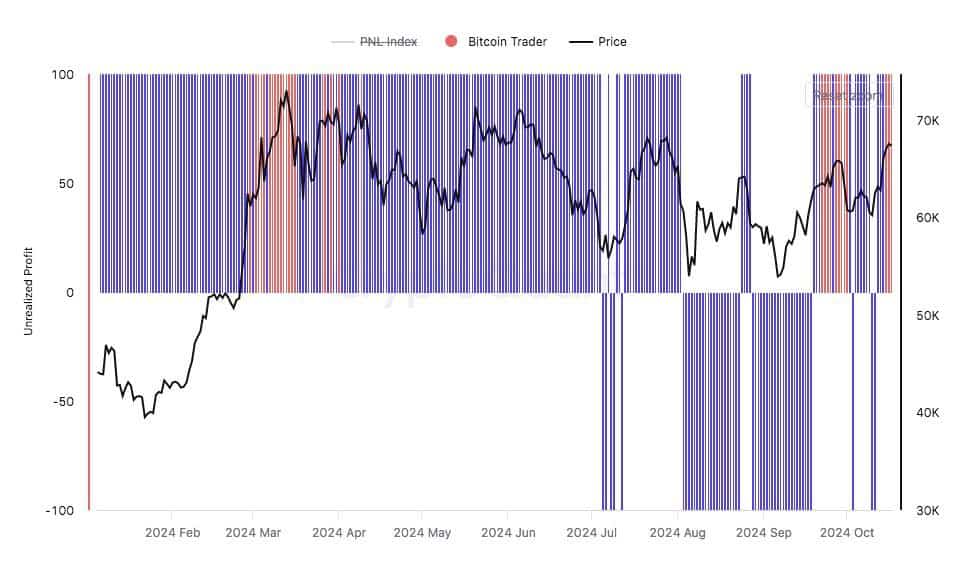

Traditionally, when unrealized income rise sharply, as they at the moment have (exceeding $7 billion), merchants are inclined to money in, which may ramp up promoting strain and set off a neighborhood prime earlier than a pullback.

Supply: CryptoQuant

Moreover, sentiment surrounding Bitcoin has turned extra constructive after a interval of pessimism. There was a noticeable shift in direction of bullish sentiment on social media.

Shopping for throughout concern and promoting throughout euphoria has traditionally been worthwhile for merchants. This pattern boosts confidence for these looking for to capitalize on present market dynamics.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

As Bitcoin strikes via its swing value vary and key resistance ranges, merchants should keep alert for shifts. Volatility is probably going within the coming weeks, with massive gamers influencing the market via strategic trades.

The important thing query is whether or not Bitcoin will break larger or face a short-term correction earlier than its subsequent rally. Worth swings are anticipated inside the two main liquidation zones, creating alternatives for each Futures and spot merchants.