- Bitcoin’s rainbow chart revealed that BTC was in an accumulation section.

- Metrics prompt that buyers have already began to purchase BTC.

Like most cryptos, Bitcoin [BTC], being the chief of the pack, turned bullish in the course of the previous 24 hours as effectively. Subsequently, let’s assess just a few key metrics of BTC to know whether or not this nonetheless is the suitable time for buyers to purchase BTC.

Do you have to purchase Bitcoin?

CoinMarketCap’s information revealed that BTC’s value elevated marginally over the past 24 hours. At press time, it was buying and selling at $61,107 with a market capitalization of over $1.20 trillion.

IntoTheBlock, an analytics and metrics supplier, lately posted a tweet highlighting a key metric.

The tweet talked about BTC’s MVRV ratio and talked about that at any time when the metric goes under 1, it opens a chance for buyers to build up.

Likewise, when the MVRV ratio goes above 3, it turns into an excellent alternative for buyers to promote. At press time, BTC’s MVRV ratio had a price of 1.93.

This meant that Bitcoin buyers ought to prepare as a shopping for alternative may seem quickly.

Supply: IntoTheBlock

Root, a well-liked crypto analyst, posted a tweet mentioning one more vital BTC metric. The tweet used BTC’s on-chain worth map, which identified that BTC was pretty valued.

Subsequently, this additionally prompt that buyers may take into account stockpiling.

AMBCrypto then checked Bitcoin’s Rainbow Chart to see what that metric needed to counsel. As per our evaluation, BTC’s value was within the “accumulate” stage, additional indicating that it’s the proper time to build up.

Supply: Blockchaincenter

A take a look at what buyers are as much as

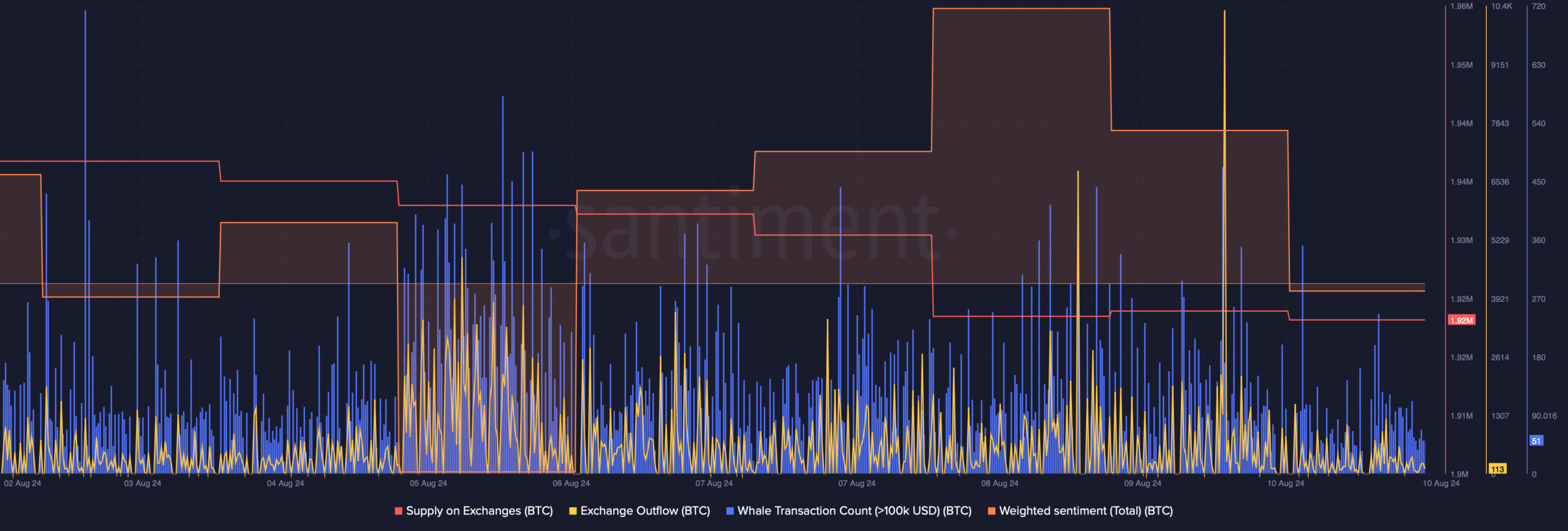

AMBCrypto then checked BTC’s on-chain information to seek out out whether or not buyers have began to build up. As per our evaluation of Santiment’s charts, Bitcoin’s provide on exchanges dropped, which means that purchasing stress elevated.

The truth that buyers had been stockpiling BTC was additional confirmed by the substantial spike in its change outflow on the ninth of August.

Moreover, the highest gamers had been additionally actively studying BTC because the whale transaction rely elevated.

Nevertheless, regardless of buyers shopping for BTC, its weighted sentiment dropped and went into the damaging one. This meant that bearish sentiment across the coin elevated.

Supply: Santiment

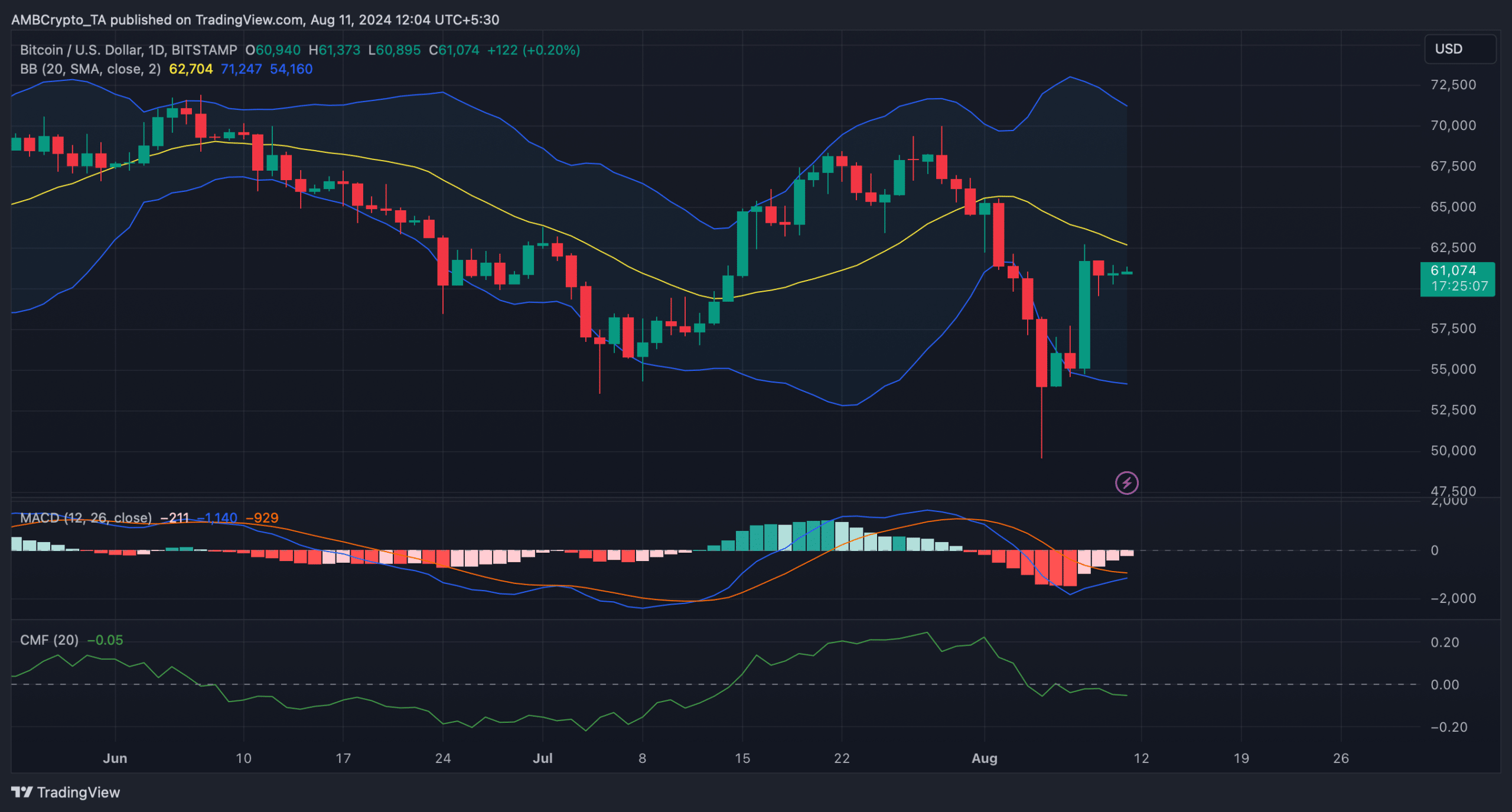

We then deliberate to take a look at BTC’s every day chart to see whether or not the drop in weighted sentiment may lead to a value decline within the coming days.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

As per our evaluation, BTC’s Chaikin Cash Circulate (CMF) registered a pointy downtick, hinting at a bearish take over.

At press time, BTC was testing its 20-day Easy Transferring Common (SMA) as prompt by the Bollinger Bands. Notably, the MACD displayed the potential for a bullish crossover, which may permit BTC to efficiently go above the 20-day SMA.

Supply: TradingView