- Bitcoin drew nearer to a provide crunch and a serious rally as trade reserves dipped decrease.

- A CryptoQuant analyst highlighted why BTC’s reserves and rising stablecoin provide pointed to an upcoming main rally.

Bitcoin [BTC] holders have been anticipating a serious bullish outburst in 2024. However with the yr approaching the tail finish, many have been left questioning if the bull run has been cancelled.

Earlier than the heights of expectations dip into the valley of despair, there are nonetheless indicators signaling that Bitcoin bulls should still present up.

Based on CryptoQuant analyst Tarek, the subsequent main Bitcoin bullish transfer is quickly drawing close to.

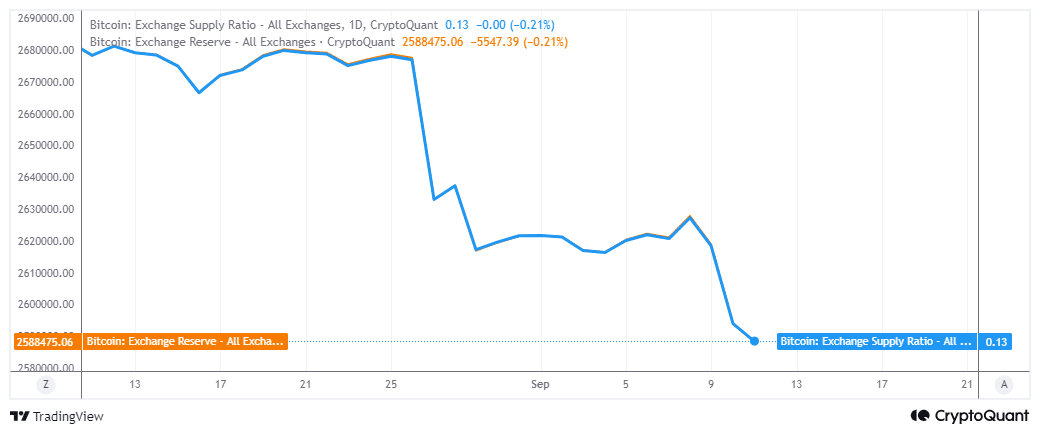

The analyst highlighted the declining Bitcoin trade reserves as the primary main signal. This decline accelerated within the final three days, after beforehand registering an uptick between the 4th and the eighth of September.

Supply: CryptoQuant

Trade reserves dropped by 39,356 BTC (value roughly $2.28 billion) in the course of the three-day interval. This will additionally clarify why Bitcoin bulls lately demonstrated energy in bouncing again from latest native lows.

It additionally coincided with a resurgence of demand from ETFs.

Stablecoin reserves lately reached new highs

The declining reserves underscore the tightening Bitcoin provide. Decrease costs noticed lately supplied a big period of time for patrons, particularly whales, to build up at decrease costs.

The analyst additionally identified rising stablecoin reserves as one other signal pointing to the opportunity of a rally.

Supply: CryptoQuant

The ERC20 whole stablecoin marketcap on exchanges lately reached a brand new ATH above $25.5 billion, in keeping with CryptoQuant.

The analyst famous that the quickly rising stablecoin marketcap is an indication that the market demand for stablecoins is excessive. This tends to occur as buyers put together to maneuver liquidity into crypto.

The mix of declining Bitcoin reserves and rising stablecoin reserves factors to the chance {that a} main rally is on the way in which.

Bitcoin has additionally demonstrated energy above $50,000. A sign that any dip under that degree could be seen as a heavy low cost.

The above observations are additionally consistent with the Bitcoin halving timeline. This occasion has traditionally been adopted by a serious rally, months after the halving.

The truth that institutional demand is now extra current than ever might set Bitcoin up for one more sturdy bullish transfer.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

What does all of it imply for worth motion? Bitcoin might quickly push into new worth discovery areas. Some authorities within the funding panorama, comparable to Cathie Wooden, anticipate costs to push above $200,000.

Subsequently, a extra modest expectation could be above $90,000 probably earlier than the tip of the yr and even increased in 2025.